Gold (XAU/USD) Price, Charts and Analysis:

- Gold prices remain stuck with the prospect that global interest rates have further to rise.

- This week’s FOMC minutes still have markets looking for a US increase this month.

- Against that backdrop, non-yielding assets will struggle.

Recommended by David Cottle

Download the New Q3 Forecast Guide for Gold by the DFX Team

Gold prices won back a little lost ground on Thursday, but the market remains beleaguered by a strong belief that global interest rates have further to rise, including most importantly those in the United States.

Higher interest rates weigh against non-yielding assets like gold. Investors are much more easily tempted by better returns in other markets when yields go up. However, it is important not to overstate this. Gold is widely perceived as a hedge against the very inflation which those higher interest rates are imposed to fight, and notably remains at quite elevated levels despite central banks’ long scramble to raise borrowing costs.

The US Federal Reserve paused its own version of that scramble in June, ostensibly to assess the effects of more than a year of rate increases. However, guided by the Fed itself, the markets think rates will continue to rise in the US and that they could well do so as soon as this month. Futures markets put the likelihood of a move at over 80%.Wednesday’s release of minutes from June’s rate-setting conclave did nothing to alter their view. Fed rate-setters meet again on July 25 and 26.

However, markets will be looking at every crumb of US economic data for a steer as to how likely that July move is. They’ll get a big one on Friday in the form of official employment numbers, with earnings levels especially in focus for a market now obsessed with inflation.

Thursday offers a taster in the form of the Automated Data Processing employment numbers for June.

If the numbers do nothing to lessen rate-hike expectations, gold will continue to struggle for near-term gains, even if continued conflict in Ukraine and huge uncertainties over global growth are likely to keep its ’haven asset’ status in supportive focus.

Naturally those expectations have supported the greenback against its global rivals, which also makes Dollar-denominated gold and gold derivative products more expensive for non-US investors. The Chinese Yuan, for example, is now close to eight-month lows against the US unit.

Recommended by David Cottle

Check Out the Latest Top Trade Opportunities by the DFX Team

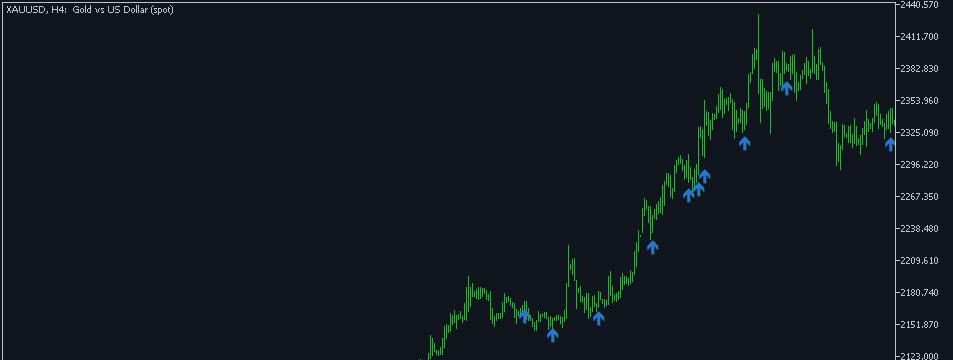

Gold Technical Analysis

Gold Daily Chart

Chart Compiled Using TradingView

Gold prices have been meandering lower since making their recent significant highs above $2000/ounce in early May of this year. It’s worth noting however that the price got very close to its all-time, 2020 peak at that point, and for all the fundamental headwinds facing it, hasn’t retraced very far since.

In the near term thee’s a clear downtrend in place, even if its hold on the market seems to be waning a little as prices bump along the first Fibonacci retracement of their rise up to May’s top from the lows of last November.

That retracement comes in at $1902.92 and there seems to be a clear reluctance to push prices much below that level. However, to break the downtrend bulls are going to have to establish themselves above immediate support at the $1925-$1935 area, and they don’t seem able to get that done. If gold gets a fundamental whacking from the US jobless data then that retracement level could fnaly give way, putting focus perhaps on the 1800-1840 region where prices bounced back in late February.

Sentiment towards gold looks quite bullish according to IG’s own client survey, perhaps suggesting that prices might have suffered enough for now. Fully 72% of traders are bullish at current levels.

Foundational Trading Knowledge

DailyFX Education Walkthrough

Recommended by David Cottle

—By David Cottle for DailyFX