Nikkei (Japan 225) Analysis

- Nikkei ends first half of the year narrowly behind the Nasdaq as foreign investors pile in

- Yen Depreciation and a US data-led hit to risk appetite sees the Nikkei trade lower

- Possible double top forming for the Nikkei, signalling potential for extended selling

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Find out how the yen is forecasted to fare in Q3

Nikkei Ends 1H in Second Place, Narrowly Behind the High-Flying Nasdaq

The Nikkei has been one of the top performing equity indices in the world during the first half of 2023, bested only by the high-flying, tech heavy Nasdaq. In fact, the Nikkei ended 1H having risen 27.8%, only a little less than the Nasdaq at 29.86%.

Performance of Major Indices Year-to-Date

Source: FT, Bloomberg prepared by Richard Snow

The stellar performance is said to be due to a number of tailwinds that are forcing asset managers to rethink their views on Japanese stocks. Continued monetary support from the unchanging BoJ Governor Mr Ueda creates an environment with sufficient access to credit and the depreciating Japanese yen improves company profitability. The added benefit of continuing yen depreciation is that it renders Japanese stocks cheaper to buy for foreign buyers who have really piled into the local equity market.

A recent Bank of America report revealed that inflows into Japanese stocks over the past 5 weeks reached $8.9 billion. Over the same time period, inflows into US large cap funds amounted to $12.9 billion – the most in nearly 8 months as investors look to squeeze every last ounce of juice out of the equity rally.

Nikkei Technical Levels to Consider

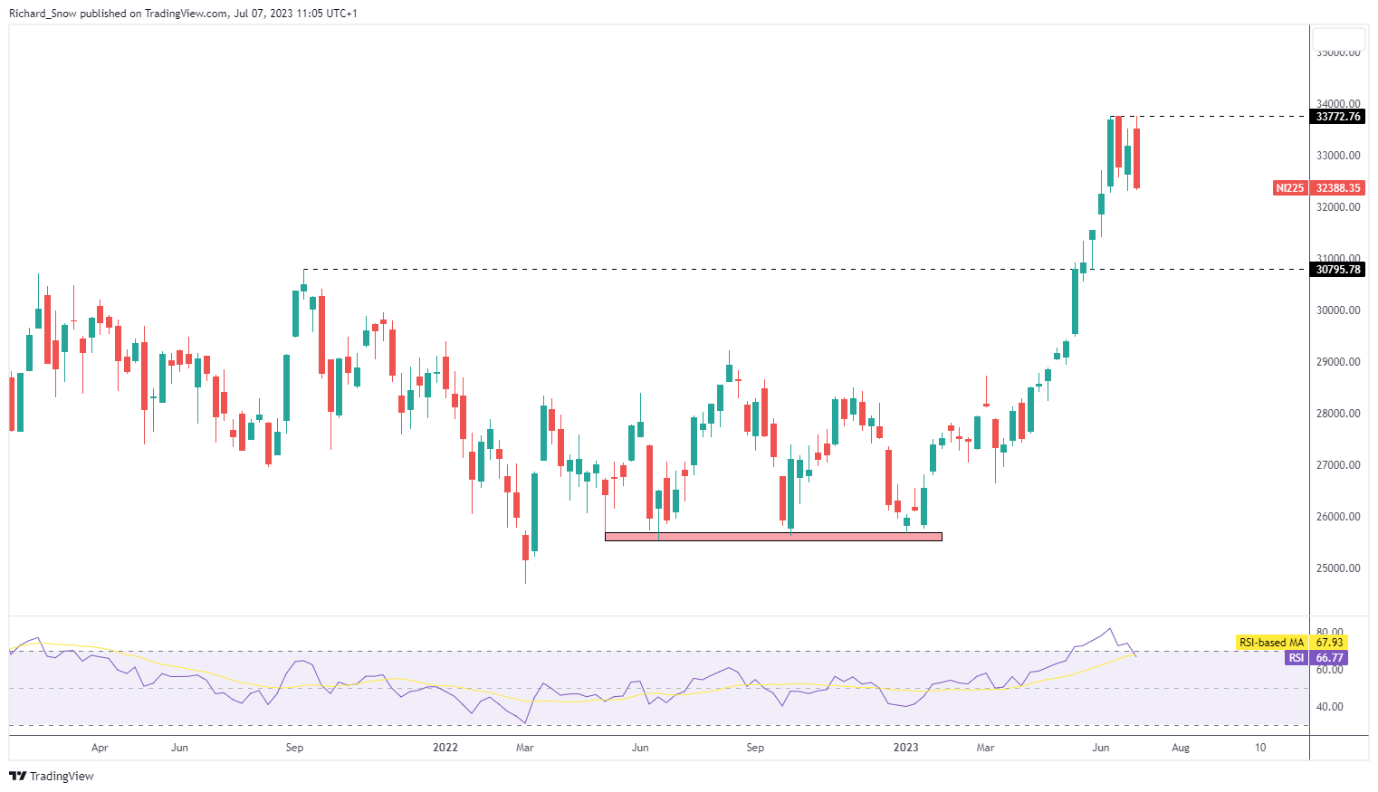

The Nikkei has risen exponentially this year as can be seen via the weekly chart. Bullish momentum was halted at the well-defined level of 33,772 – which failed to see even the slightest move higher. Since the retest of 33,772, the index has sold off, ending an extended period when the index oscillated in and out of overbought territory.

Nikkei Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

The new quarter brings with it a whole lot of opportunities

A stronger yen, elevated on news of broad participation in this year’s wage increases – suggesting future policy normalisation – appears to have weighed on Nikkei bulls. At the same time, a string of impressive US economic data (upward GDP revision, improved services PMI and yesterday’s blowout ADP employment data) suggests no let up in the Fed’s hawkish persistence.

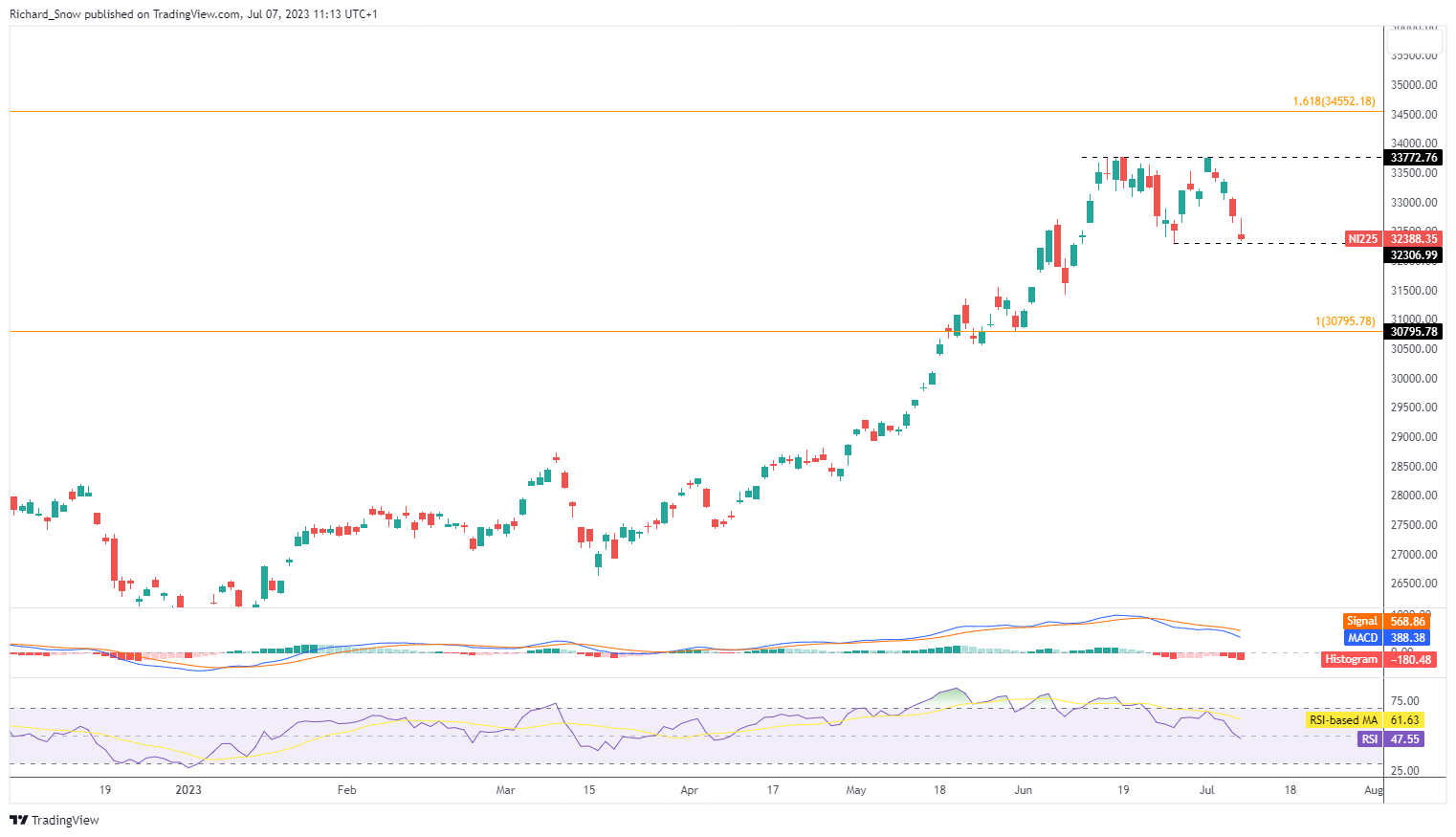

The daily chart helps to zoom in on more recent price direction and levels of interest if we are to see an extended sell off. Naturally, the recent swing low of 32,307 provides the litmus test for a bearish continuation as the MACD indicator suggests momentum remains on the side of sellers.

The emergence of what appears to be a double top, suggests that further downside is possible. With the index closing the week lower, after initially rising during intra-day trading on Friday, our focus turns to US NFP data as this can influence risk sentiment at the start of next week.

Nikkei Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX