Euro Vs US Dollar, Australian Dollar, New Zealand Dollar – Outlook:

- EUR/USD rose a bit after US rating downgrade.

- However, growth differentials remain in favour of USD, limiting EUR/USD’s rise for now.

- What is the outlook and the key levels to watch in key Euro crosses?

Recommended by Manish Jaradi

How to Trade EUR/USD

The euro appears to be slightly supported after Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating to AA+ from AAA. Still, monetary policy and growth differentials suggest the single currency is unlikely to benefit much from Wednesday’s early lift, at least in the near term.

Both central banks, the US Federal Reserve, and the European Central Bank are in wait-and-watch mode with regard to further tightening, leaving very little monetary policy advantage from a relative perspective. From an absolute perspective, higher US rates clearly stand out. However, growth differentials appear to be in favour of the US, arguing for a softer EUR/USD. The US Economic Surprise Index is at its highest level since 2021, while the Euro area Economic Surprise Index is at its lowest level since 2020.

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Consolidation could continue

EUR/USD’s recent softness could extend a bit further given the stiff hurdle on the 200-week moving average. As highlighted in the previous update, the near-term bias appears to be of consolidation within a broadly constructive outlook. Only a fall below 1.0500-1.0600, including the early-2023 lows, would pose a threat to the broader uptrend. See “US Dollar Slips After Fed Rate Hike: What Has Changed for EUR/USD, GBP/USD, USD/JPY?”, published July 27.

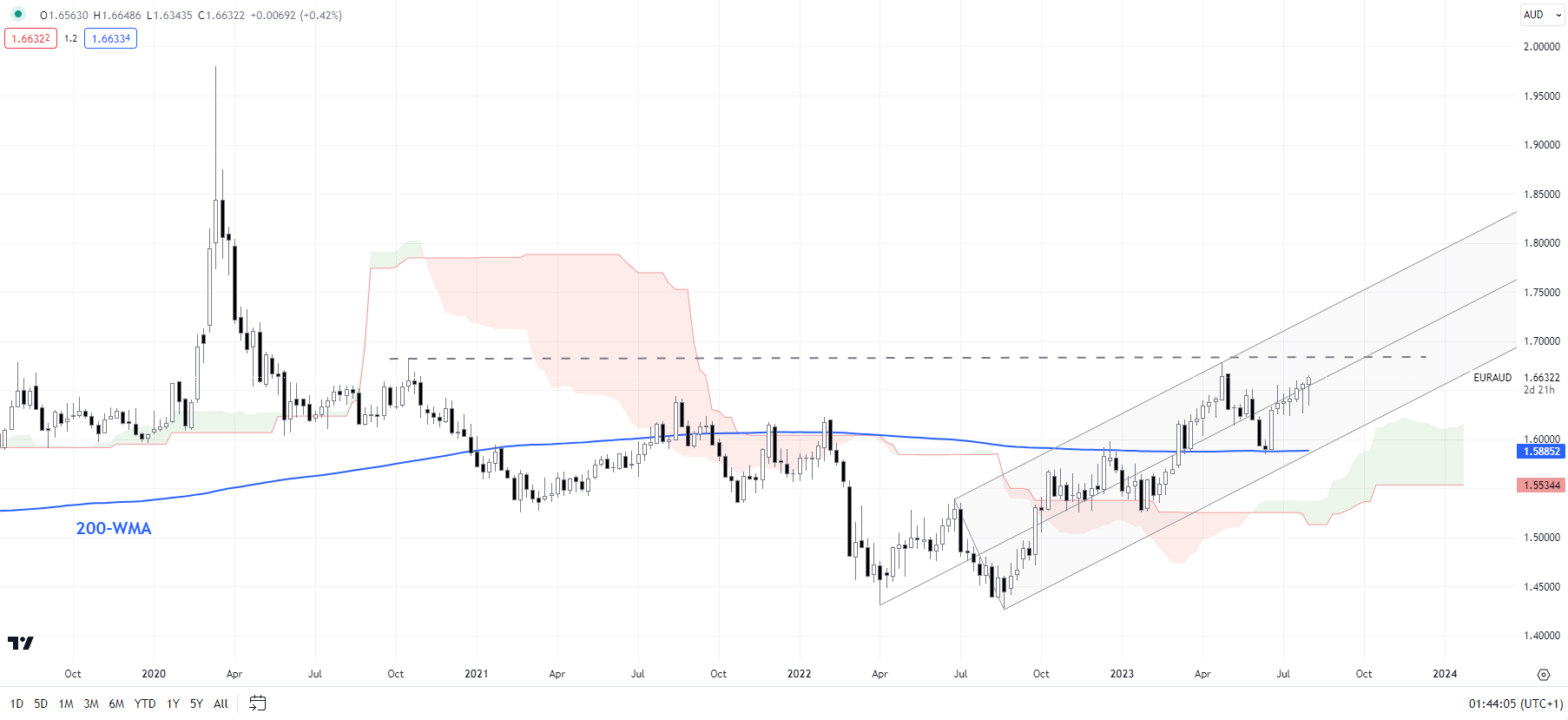

EUR/AUD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/AUD: Broader bullish trend reaffirmed

EUR/AUD has turned higher from near quite strong support at the mid-July low of 1.6230. From a short-term perspective, the trend is at best sideways. However, from a medium-term perspective, the trend is up given the higher-top-higher-bottom sequence since late 2022. The top end of the range is the April high of 1.6800, while the immediate support is at 1.6230.

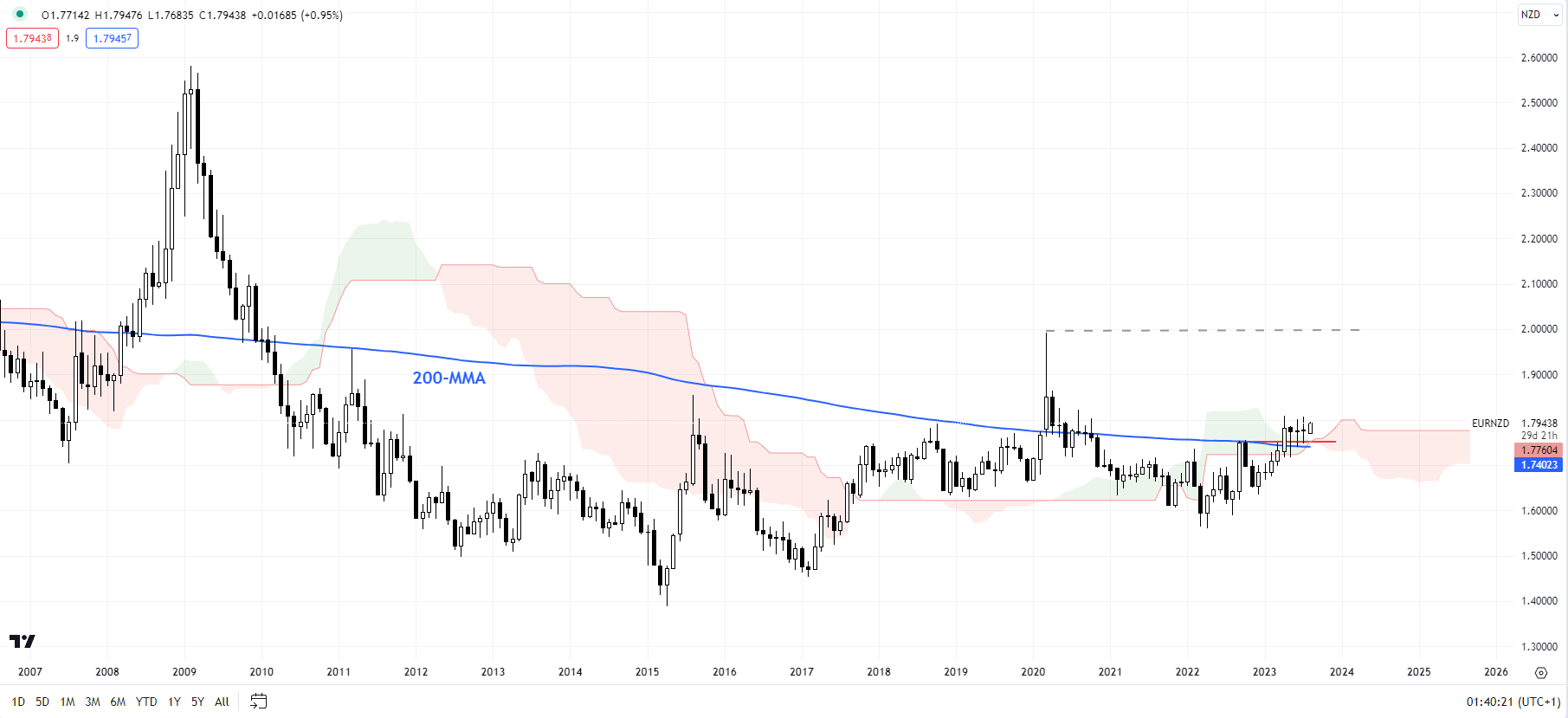

EUR/NZD Monthly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/NZD: Boxed in a range

The price action in recent weeks gives very little sense of direction, being boxed in a 1.7200-1.8100 range. Still, within the choppy range, EUR/NZD continues to hold above the crucial floor on the 89-day moving average. Zooming out, though, on the monthly charts, the break this year above the 2022 high of 1.7500 keeps the broader bullish bias intact.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish