🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕

⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐

Exp – AI Sniper. Automatic Smart Expert Advisor for Metatrader.

💎 Exp – AI Sniper MT4: https://www.mql5.com/en/market/product/118167

💎 Exp – AI Sniper MT5: https://www.mql5.com/en/market/product/118127

🌐↔️↔️↔️ FULL GUIDE for Exp – AI Sniper: https://expforex.com/aisniper/

▶️Youtube: https://www.youtube.com/watch?v=TdFK770JeHw

⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐⭐

🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕🆕

Our team is thrilled to introduce Trading Robot, the cutting-edge Smart Trading Expert Advisor for the MetaTrader terminal.

AI Sniper is an intelligent, self-optimizing trading robot designed for both MT4 and MT5 terminals. It leverages a smart algorithm and advanced trading strategies to maximize your trading potential.

With 15 years of experience in trading exchanges and the stock market, we have developed innovative strategy management features, additional intelligent functions, and a user-friendly graphical interface.

Every function within AI Sniper is backed by an optimized program code and rigorous testing.

Its advanced computational intelligence identifies the best entry and exit points for trades through meticulous technical analysis and thousands of mathematical calculations at each price movement step.

Whether the trend is bearish or bullish, AI Sniper accurately analyzes signals to execute precise BUY or SELL trades.

Vision. Mission. Strategy. Success is deeply embedded in our commitment to empowering traders with the best tools.

Multiple trading strategy functions are collected in a unique trading robot. AI Sniper!

Our goal is your success.

Download. Test. And experience the transformative power of AI Sniper for yourself.

Visit our website at expforex.com to get started and take advantage of our free offer today.

Thank you for your time, and we look forward to supporting your journey to trading success.

The EA obtains data on these parameters from a currency pair specification, the current prices, and other factors that are a part of our strategy.

Description

AI Sniper Expert Advisor: A New Benchmark in Automated Trading

MetaTrader users and forex traders meet the AI Sniper Expert Advisor, the next evolution in automated trading software. Built upon the robust foundation of the renowned TickSniper, AI Sniper elevates your trading strategy with advanced features and enhanced performance, ensuring you stay ahead in the competitive world of forex trading.

Key Features and Enhancements:

- Enhanced Algorithmic Precision: AI Sniper leverages cutting-edge AI and machine learning algorithms to refine trading signals. The system dynamically adapts to market conditions, making it more accurate and reliable compared to its predecessor, TickSniper. This results in improved trade entry and exit points, maximizing profit potential while minimizing risks.

- Real-Time Market Analysis: Utilizing sophisticated data analytics, AI Sniper continuously monitors and analyzes market trends in real-time. This allows for quick adjustments to trading strategies, ensuring that the advisor capitalizes on emerging opportunities and mitigates potential losses effectively.

- Customizable Trading Parameters: AI Sniper offers extensive customization options, enabling traders to tailor the advisor to their specific trading style and risk tolerance. Whether you prefer aggressive, moderate, or conservative trading, AI Sniper can be fine-tuned to meet your individual needs.

- Improved Risk Management: One of AI Sniper‘s standout features is its enhanced risk management module. The advisor incorporates advanced stop-loss and take-profit mechanisms, along with intelligent position sizing and capital allocation strategies. This comprehensive approach ensures that your investments are protected, even in volatile market conditions.

- User-Friendly Interface: Despite its advanced capabilities, AI Sniper maintains a user-friendly interface that is easy to navigate. Both novice and experienced traders will appreciate the intuitive design, which simplifies the setup and monitoring processes.

- Backtesting and Optimization: AI Sniper includes robust backtesting and optimization tools, allowing traders to test their strategies against historical data. This feature helps in refining and optimizing trading approaches before deploying them in live market conditions, providing an additional layer of confidence and security.

- Continuous Updates and Support: The development team behind AI Sniper is committed to providing ongoing updates and enhancements, ensuring the advisor remains at the forefront of technological advancements in trading. Comprehensive customer support is also available to assist users with any queries or issues.

Why Choose AI Sniper?

AI Sniper represents a significant upgrade from TickSniper. It incorporates the latest advancements in AI and machine learning to deliver a superior trading experience. Its ability to adapt to changing market conditions, combined with its robust risk management and customizable features, makes it an invaluable tool for traders seeking consistent profitability and reduced risks.

By choosing AI Sniper, you are investing in a powerful, intelligent trading advisor that not only enhances your trading strategy but also provides the peace of mind that comes with knowing your investments are in capable hands.

Conclusion

The AI Sniper Expert Advisor is more than just an upgrade; it is a revolution in automated trading. Its blend of advanced technology, user-centric design, and comprehensive support makes it a must-have for any serious trader. Experience the future of trading with AI Sniper and take your trading performance to new heights.

Recommended Broker.

Principle of Operation

The AI Sniper Expert Advisor operates on a sophisticated framework that combines advanced artificial intelligence (AI) algorithms, real-time data analysis, and adaptive trading strategies. Here’s how it fundamentally works:

- Data Collection and Preprocessing:

- Market Data Aggregation: AI Sniper continuously collects a vast array of market data, including price movements, trading volumes, economic indicators, and relevant news events.

- Data Cleaning: The collected data undergoes preprocessing to filter out noise and inaccuracies, ensuring high-quality inputs for analysis.

- Real-Time Analysis:

- AI and Machine Learning Algorithms: The core of AI Sniper‘s operation involves sophisticated AI and machine learning models that analyze the preprocessed data. These algorithms are trained to identify patterns, trends, and anomalies that signal potential trading opportunities.

- Technical Indicators: The advisor evaluates multiple technical indicators (such as moving averages,…..) and price action signals to enhance the accuracy of its predictions.

- Signal Generation:

- Trading Signals: Based on real-time analysis, AI Sniper generates precise trading signals. These signals indicate optimal entry and exit points for trades, aiming to maximize profit while minimizing risk.

- Adaptability: The signal generation process is dynamic, allowing AI Sniper to adapt to changing market conditions and refine its strategies accordingly.

- Risk Management:

- Stop-Loss Orders: AI Sniper sets stop-loss orders to limit potential losses by closing trades that move unfavorably beyond a set threshold.

- Take-Profit Orders: It defines take-profit levels to lock in gains once a target is achieved.

- Position Sizing: The advisor calculates the appropriate position size for each trade, considering the trader’s risk tolerance and account size.

- Diversification: AI Sniper employs capital allocation strategies to ensure a balanced distribution of investments, avoiding overexposure in any single trade or market condition.

- Execution of Trades:

- Automated Trading: Upon validating a trading signal, AI Sniper executes the trade automatically. The system ensures swift and accurate execution, capitalizing on real-time market opportunities.

- Monitoring and Adjustment: The advisor continuously monitors open positions, making real-time adjustments as necessary to optimize outcomes.

- Continuous Learning and Adaptation:

- Machine Learning: AI Sniper uses machine learning to learn from past trades, continuously improving its algorithms and strategies.

- Performance Feedback Loop: This continuous feedback loop ensures that AI Sniper evolves over time, becoming more efficient and effective in its trading decisions.

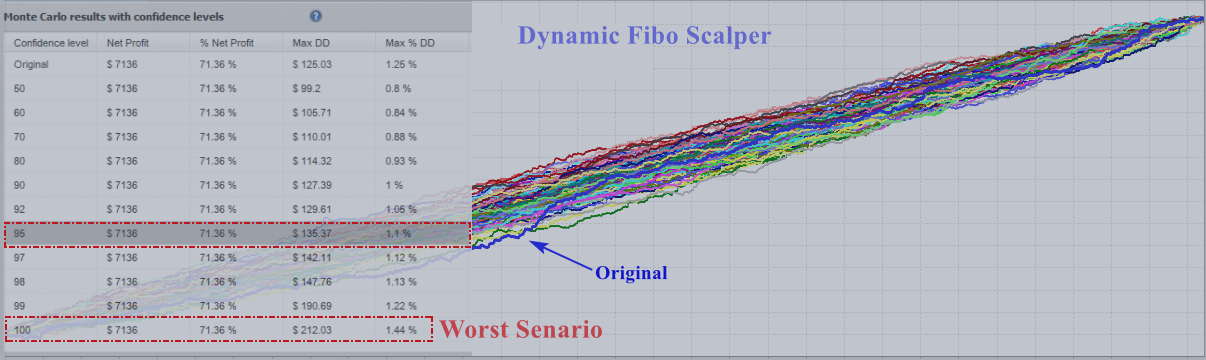

- Backtesting and Optimization:

- Historical Data Testing: Traders can use AI Sniper‘s backtesting tools to evaluate strategies against historical data, providing insights into potential performance.

- Strategy Optimization: Based on backtesting results, traders can fine-tune their strategies, optimizing parameters for better future performance.

Operation

Here’s a step-by-step guide on how AI Sniper operates in a real-world trading environment:

- Installation and Setup:

- Install AI Sniper on the MetaTrader platform.

- Configure the advisor by setting parameters such as risk tolerance, trading style (e.g., aggressive, moderate, conservative), and preferred technical indicators.

- Data Collection and Initialization:

- Upon activation, AI Sniper starts collecting and preprocessing market data in real-time.

- The system initializes by analyzing the initial set of data to understand current market conditions.

- Real-Time Analysis and Signal Generation:

- AI Sniper continuously processes incoming data through its AI and machine learning models.

- It generates trading signals, indicating when to enter or exit trades based on analyzed patterns and trends.

- Trade Execution:

- When a trading signal is validated, AI Sniper automatically executes the trade on the MetaTrader platform.

- The advisor sets up corresponding stop-loss and take-profit orders to manage the trade.

- Monitoring and Adjustment:

- AI Sniper monitors the performance of open trades, adjusting strategies in real-time if necessary to optimize outcomes.

- It ensures that trades are closed at the optimal points, either reaching the take-profit levels or activating the stop-loss orders.

- Continuous Improvement:

- The advisor continuously learns from each trade, updating its models and strategies based on performance feedback.

- It adapts to evolving market conditions, ensuring sustained performance improvement.

- Backtesting and Strategy Optimization:

- Traders can run backtesting sessions using historical market data to test and refine their trading strategies.

- AI Sniper’s optimization tools help adjust parameters, enhancing strategy effectiveness for future trading sessions.

By following these principles and operational steps, AI Sniper offers traders a powerful, intelligent, and adaptive tool that significantly enhances their trading performance while effectively managing risk.

General Recommendations for using a trading robot

To maximize the benefits of the AI Sniper Expert Advisor and ensure a successful trading experience, follow these key recommendations:

- Download the demo version of AI SNIPER or Buy the full version of AI SNIPER

- Understand the System:

- Before using AI Sniper, take the time to understand its features, capabilities, and how it operates. Familiarize yourself with the user interface and the various settings available for customization.

- Customize Settings:

- Adjust the settings of AI Sniper according to your trading style and risk tolerance. Key parameters to customize include:

- Risk Level: Set your desired risk level (aggressive, moderate, or conservative).

- Stop-Loss and Take-Profit Levels: Define your stop-loss and take-profit parameters to align with your trading strategy.

- Position Sizing: Configure the position sizing to match your account size and risk management plan.

- Adjust the settings of AI Sniper according to your trading style and risk tolerance. Key parameters to customize include:

- Use Backtesting:

- Utilize the backtesting feature to test AI Sniper‘s performance against historical market data. This will help you understand how the advisor performs under various market conditions and refine your strategies accordingly.

- Start with a Demo Account:

- Begin by using AI Sniper on a demo account to practice and observe how it operates without risking real money. This allows you to gain confidence in the system and make necessary adjustments to your settings. Check the system on your broker’s server.

- Monitor Performance:

- Monitor AI Sniper‘s performance regularly. Although the system is automated, it is important to monitor its trades and overall performance to ensure it aligns with your expectations and market conditions.

- Keep Software Updated:

- Ensure that you are using the latest version of AI Sniper. The developers regularly release updates and improvements, so keeping your software updated will help you benefit from the latest features and enhancements.

- Diversify Your Portfolio:

- Avoid overexposing your capital to a single trade or market condition. Use AI Sniper as part of a diversified trading strategy to spread risk across different assets and market segments.

- Set Realistic Expectations:

- Understand that no trading system guarantees profits. Set realistic expectations and be prepared for both winning and losing trades. AI Sniper is designed to optimize your trading strategy, but market conditions can be unpredictable.

- Regularly Review and Adjust:

- Periodically review AI Sniper‘s settings and performance. Market conditions can change, and what worked well in the past might need adjustment. Use the insights gained from backtesting and live trading to fine-tune your strategy.

- Educate Yourself:

- Risk Management:

- Always prioritize risk management. Use AI Sniper’s advanced risk management features to protect your capital. Ensure that stop-loss orders are in place and avoid over-leveraging your trades.

- Seek Support When Needed:

- If you encounter any issues or have questions about using AI Sniper, do not hesitate to seek support from the development team or user community. Promptly addressing any concerns can help you make the most of the advisor.

By following these recommendations, you can effectively utilize AI Sniper to enhance your trading strategy, manage risks, and work towards achieving consistent trading success.

Recommendations for Using the New Expert Advisor AI Sniper

Before you buy the Expert Advisor AI Sniper, it is crucial to evaluate its performance and compatibility with your trading environment. Follow these steps and recommendations to ensure you make the most of AI Sniper:

- Download and Test the Demo Version:

- Initial Testing: Download the demo version of AI Sniper and test it on a demo or real account, specifically with the USDJPY currency pair.

- Broker Compatibility: Check the system’s performance on your broker’s server to ensure compatibility and optimal operation.

- Broker Specificity:

- Considerations for Commission and Spread:

- Commission Impact: Be aware that commissions can significantly reduce profits.

- Spread Requirements: The system does not perform well with a zero spread. Use a floating spread for better results.

- Fixed vs. Floating Spread: AI Sniper is tested on a floating spread. It may not work correctly with a fixed spread, affecting its performance.

- Strategy Testing Limitations:

- Strategy Tester Limitations: The Expert Advisor may not work correctly in the strategy tester due to limited quotation history and fixed spreads. Results in the strategy tester may differ from real account performance.

- Operational Mechanics:

- Spread Adjustment: AI Sniper works by adjusting to changes in the spread and the rate of quotation receipt, leading to varied results with different brokers.

- Averaging and StopLoss: The system uses averaging every 75 spreads from the previous position and sets Stop Loss at a distance of 250 spreads.

- Scalper Strategy: Positions can be closed within a range of 1 to 8888888888 points.

- Capital Management:

- Deposit Calculation: Your deposit will be calculated based on tests on your broker’s server to ensure it can withstand the currency pair’s average annual movement.

- Reinvestment and Profit Management: Use reinvestment, timely take profits, and effective money management strategies.

- Risk Awareness:

- Forex Risks: Understand that forex trading involves risks. Learning the basics of forex trading is essential before engaging in live trading.

- Profit and Loss: Recognize that profits are not guaranteed consistently. While you may profit today, there is no assurance of profit in the future due to the unpredictable nature of forex.

- VPS Recommendations:

- Dedicated VPS: If you install AI Sniper on a VPS, it is best to dedicate one VPS to one Expert Advisor without connecting or enabling other terminals. The advisor works on ticks, so there should only be one terminal with one advisor on the VPS.

- Execution Speed: Ensure excellent execution of opening positions with up to 100 ms.

- Recommended VPS: Use the best VPS from MetaQuotes for optimal performance.

Recommended Brokers and Trade Accounts for AI Sniper

To ensure the optimal performance of the AI Sniper Expert Advisor, consider the following recommendations for brokers, trade accounts, and deposit levels based on your risk tolerance:

Recommended brokers

- For MetaTrader 4 (MT4) Terminal: ECN PRO

- For MetaTrader 5 (MT5) Terminal: ECN PRO

Recommended Account Types

- Deposit Over $1,000: PRO Standard or ECN PRO account

- Deposit Under $1,000: PRO Cent account

Deposit Recommendations Based on Risk Levels

- Low Risk

- Recommended Deposit: $1,000

- Lot Size: Minimum lot of 0.01

- Currency Pairs: Trade on three pairs (e.g., EURUSD, USDCHF, USDJPY)

- Leverage: 1:300

- Medium Risk

- Recommended Deposit: $300

- Lot Size: Minimum lot of 0.01

- Currency Pairs: Trade on one pair (e.g., EURUSD)

- Leverage: 1:300

- High Risk

- Recommended Deposit: $100 (Cent Account)

- Lot Size: Minimum lot of 0.01

- Currency Pairs: Trade on one pair (e.g., EURUSD)

- Leverage: 1:300

Additional Recommendations

- Floating Spread: Use a floating spread. Zero spread is prohibited for AI Sniper.

- Leverage: 1:300 or higher is recommended.

- Timeframe: The timeframe does not matter as AI Sniper operates based on tick data.

How to install it?

After reading the article How to buy and install a Market Advisor, our advisor will installed in your Navigator!

To install AI Sniper, follow these steps:

- Download AI Sniper:

- Locate the Downloaded Files:

- Once the download is complete, locate the downloaded files on your computer. The files may be compressed in a ZIP folder.

- Extract the Files:

- If the files are in a ZIP folder, extract them to a location on your computer using file extraction software like WinZip or WinRAR.

- Open MetaTrader Platform:

- Launch your MetaTrader trading platform (either MetaTrader 4 or MetaTrader 5).

- Navigate to the “Navigator” Window:

- In MetaTrader, look for the “Navigator” window. It is typically located on the left side of the platform.

- Locate “Expert Advisors” Section:

- Expand the “Expert Advisors” section in the Navigator window.

- Copy AI Sniper Files:

- Copy the extracted AI Sniper files from your computer’s file explorer.

- Paste into MetaTrader “Experts” Folder:

- In MetaTrader, find the “MQL4” or “MQL5” folder. Within this folder, locate the “Experts” subfolder.

- Paste the copied AI Sniper files into the “Experts” folder.

- Restart MetaTrader Platform:

- Close and restart your MetaTrader platform to ensure that AI Sniper is properly loaded.

- Enable Expert Advisor (EA) and Auto Trading:

- In MetaTrader, ensure that Expert Advisors (EAs) and Auto Trading are enabled. You can do this by checking the options in the platform’s settings or by clicking the respective buttons on the toolbar.

- Drag AI Sniper onto Chart:

- From the Navigator window, locate AI Sniper under the Expert Advisors section.

- Drag and drop AI Sniper onto the chart of the currency pair you wish to trade. Alternatively, you can right-click on the chart, select “Expert Advisors,” and choose AI Sniper from the list.

- Adjust Settings (Optional):

- Once AI Sniper is applied to the chart, you may need to adjust its settings according to your trading preferences. This can include parameters such as risk level, lot size, and currency pairs.

- Monitor AI Sniper:

- After configuring AI Sniper, monitor its performance on the chart. You should see indicators or signals generated by the Expert Advisor.

- Troubleshoot (if Necessary):

- If AI Sniper does not appear to be functioning correctly, double-check the installation steps and ensure that all settings are configured properly. You may also need to consult the user manual or seek assistance from the developer or support team.

What information is displayed in our EAPADPRO

In EAPADPRO (Expert Advisor Panel Pro), you’ll find a comprehensive display of information pertinent to the operation and performance of the AI Sniper Expert Advisor. Here’s a breakdown of the information displayed:

- Ticks / Pips:

- Ticks: Number of ticks that arrived at the terminal for the specified time.

- Pips: Number of points passed for these ticks.

- Sell / Buy: Number of signals in the direction of SELL / BUY.

- Ticks / Logic:

- Ticks: Number of ticks that arrived at the terminal.

- Logic: Number of milliseconds of the algorithm for determining signals.

- TickPrice: The last quote processed by the advisor.

- LastTickTime: The time at which the last quotation arrived.

- Moving Average: Indicator signal direction.

- OpenDistance: Distance to open positions in points.

- OpenTime: Time of opening positions in milliseconds.

- CurrentSpread: Current spread of the selected currency pair.

- AverageSpread: Average spread of the selected currency pair.

- Stoplosspips: Stop-loss in points.

- Takeprofitpips: Take-profit in points.

- Averagerpips: Averaging distance in points.

- TrailingStoppips: Trailing stop point in points.

- Profit / Pips: Current profit in dollars and points.

- DrawDown: Current drawdown in percentage.

- SleepafterSL: Number of seconds left after closing stop-loss.

- SleepafterClose: Number of seconds left after the last close.

- Limiting: Current limit on losses and profits.

- Recommended: The minimum deposit needed for the current currency pair and selected settings, as calculated by the advisor.

- Deals (Buy / Sell): The number of current open positions for buying and selling.

- Average Price (Buy / Sell): The average price of the current open positions for buying and selling.

- Last Price (Buy / Sell): The latest price of the current open positions for buying and selling.

The difference between AI SNIPER – TICKSNIPER

The new AI Sniper and TickSniper are both Expert Advisors (EAs) designed for automated trading on the MetaTrader platform, but they have some key differences:

- Functionality:

- TickSniper: TickSniper is an Expert Advisor that specializes in high-frequency trading, aiming to capitalize on small price movements within the market. It often employs scalping strategies and is designed to execute a high volume of trades based on rapid price changes.

- AI Sniper: AI Sniper, on the other hand, is an improved version of TickSniper that incorporates advanced artificial intelligence (AI) algorithms. While it may still utilize some aspects of high-frequency trading, AI Sniper’s primary focus is on employing AI and machine learning techniques to analyze market data and generate more accurate trading signals. It aims to provide more intelligent and adaptive trading decisions compared to TickSniper.

- Trading Approach:

- TickSniper: TickSniper typically relies on technical indicators and price action patterns to identify short-term trading opportunities. It may execute trades based on rapid changes in price, aiming to profit from small price fluctuations.

- AI Sniper: AI Sniper takes a more sophisticated approach by leveraging AI and machine learning algorithms to analyze market data. It may incorporate a wider range of factors, including fundamental analysis, sentiment analysis, and macroeconomic trends, to make informed trading decisions. AI Sniper aims to adapt to changing market conditions and improve its performance over time through continuous learning.

- Risk Management:

- TickSniper: TickSniper may have basic risk management features such as stop-loss and take-profit orders to mitigate losses and lock in profits. However, its primary focus is on executing trades based on rapid price movements, and risk management may be relatively straightforward.

- AI Sniper: AI Sniper typically offers more advanced risk management capabilities, including dynamic position sizing, adaptive stop-loss, and take-profit levels, and real-time monitoring of trade performance. It may incorporate sophisticated risk management algorithms to minimize drawdowns and optimize risk-adjusted returns.

- Performance and Accuracy:

- TickSniper: TickSniper’s performance and accuracy may vary depending on market conditions, broker execution speed, and the effectiveness of its trading strategies. It may excel in high-volatility environments but may also experience challenges during periods of low liquidity or choppy price action.

- AI Sniper: AI Sniper aims to improve upon TickSniper’s performance and accuracy by incorporating AI and machine learning techniques. It seeks to generate more reliable trading signals by analyzing a broader range of market data and adapting its strategies to evolving market conditions. AI Sniper may provide more consistent and robust performance compared to TickSniper over the long term.

In summary, while both TickSniper and AI Sniper are Expert Advisors designed for automated trading, AI Sniper represents an evolution with enhanced functionality, a more sophisticated trading approach, advanced risk management capabilities, and potentially improved performance and accuracy through the use of AI and machine learning algorithms.

Signal Settings

The signal setting options for AI Sniper determine the trading mode and strategy used by the Expert Advisor. Here’s an explanation of each setting option:

- EASY:

- Mode: Easy mode

- Description: Fewer trades with more accurate signals.

- Timeopen: 3000 milliseconds

- DistanceTickSpread: 7 points

- MEDIUM:

- Mode: The golden circle

- Description: Balanced mode with moderate trading frequency and accuracy.

- Timeopen: 1500 milliseconds

- DistanceTickSpread: 2 points

- HARD:

- Mode: Aggressive method

- Description: More trades with less accuracy, suitable for aggressive trading.

- Timeopen: 1500 milliseconds

- DistanceTickSpread: 1 point

- SlowQuotesBroker:

- Mode: Trading mode for brokers with a weak stream of quotations

- Description: Optimized mode for brokers with slower quote streams.

- Timeopen: 3000 milliseconds

- DistanceTickSpread: 2 points

- CRAZY:

- Mode: Mega Mode

- Description: Highly aggressive trading mode with fast deal executions.

- Timeopen: 3000 milliseconds

- DistanceTickSpread: 1 point

These settings allow users to tailor AI Sniper‘s trading strategy to their preferences and risk tolerance. The choice between easy, medium, hard, slow quotes broker, and crazy modes reflects different levels of trading frequency, accuracy, and aggressiveness, accommodating various market conditions and trader preferences.