By Karen Brettell

NEW YORK (Reuters) -The U.S. dollar dropped to a four-month low on Friday after a weaker-than-expected employment report for July raised expectations that the Federal Reserve will cut interest rates by 50 basis points in September as the economy sours.

Employers added 114,000 jobs, below expectations for an increase of 175,000. The unemployment rate rose to 4.3%, above economists expectations that it would be unchanged on the month at 4.1%.

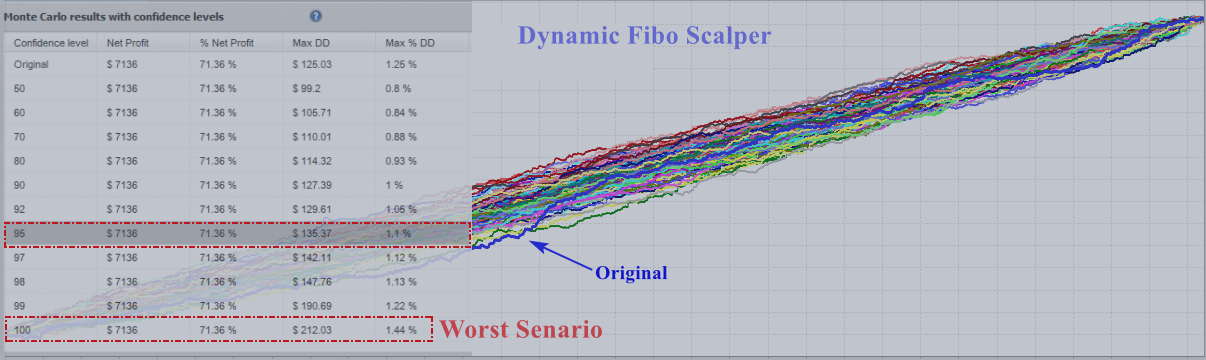

Traders are now pricing in a 71% probability that the Fed will cut rates by 50 basis points in September, up from 31% before the data was released and from 22% on Thursday, according to the CME Group’s (NASDAQ:) FedWatch Tool.

A cut of at least 25 basis points is fully priced in for September and 116 basis points of easing is now expected by year-end.

“This is what a growth scare looks like. The market is now realizing that the economy is indeed slowing,” said Wasif Latif, president and chief investment officer at Sarmaya Partners in Princeton, New Jersey.

The was last down 1.1% at 103.21 and got as low as 103.12, the lowest since March 14. It is the largest one-day percentage drop since November.

Treasury yields also tumbled, with interest rate sensitive two-year yields dropping as low as 3.845%, the lowest since May 2023, and benchmark 10-year yields reaching a low of 3.79% for the first time since Dec. 27.

The U.S. Labor Department said that Hurricane Beryl, which made landfall in Texas on July 8, had “no discernible effect” on the jobs data, discounting one theory that may have explained the weakness.

“There’s no silver lining anywhere as far as I can tell. They say they didn’t have any kind of hurricane effects, and if they did, it’s not enough to offset the degree of softness that we’re seeing,” said Steve Englander, head of global G10 FX research at Standard Chartered (OTC:)’s New York Branch.

Some economists, however, were not convinced that Beryl had no impact, and saw some spots of brightness in Friday’s jobs data.

The Fed kept interest rates unchanged at the conclusion of its two-day meeting on Wednesday and Fed Chair Jerome Powell said that interest rates could be cut as soon as September if the U.S. economy follows its expected path.

Chicago Fed President Austan Goolsbee said on Friday the U.S. central bank should move in a “steady” way, a mild pushback against the market pricing for rate cuts.

Softer jobs data, a weak manufacturing report and some disappointing corporate outlooks in recent days have increased fears that the economy is worsening at a faster pace.

But despite Friday’s weak jobs report, Englander notes that “most of the other indicators are not consistent with a really sharp slowdown at the moment… Everything is soft, but nothing is catastrophically soft.”

New economic releases will now be even more closely watched for confirmation on whether the growth outlook is as bad as feared.

The greenback weakened 1.84% to 146.62 Japanese yen and got as low as 146.42, the lowest since Feb. 2.

The yen has gained since hitting a 38-year low of 161.96 against the dollar on July 3, boosted by interventions by Japanese authorities and traders unwinding carry trades in which they were short the yen and long U.S. dollar assets.

It got an extra lift on Wednesday when the Bank of Japan hiked rates to 0.25%, the highest since 2008.

The Japanese yen and Swiss franc were also boosted by safe haven demand amid the stocks selloff and geopolitical concerns.

The funeral of Hamas leader Ismail Haniyeh took place in Qatar on Friday following his assassination two days ago in Iran’s capital Tehran, which investors worry may lead to a widening conflict in the Middle East.

The dollar weakened 1.58% to 0.859 Swiss franc

The euro gained 1.12% to $1.0912 and reached $1.0927, the highest since July 18.

Sterling strengthened 0.53% to $1.2807, bouncing back from a one-month low after the Bank of England on Thursday cut interest rates from a 16-year high.

In cryptocurrencies, bitcoin fell 2.74% to $62,878.