Download Demo:

Abiroid_Scanner_GMMA_Trend_Demo_v2.2.zip- 2.2

Note: Demo only works for 3 pairs.

Important Links:

Available for purchase here:

https://www.mql5.com/en/market/product/38747

Get the free GMMA Arrows Indicator which works on a single Symbol/Timeframe here:

https://www.mql5.com/en/market/product/42908

You can read more about GMMA (Guppy System of Trading) here:

https://abiroid.com/indicators/guppy-arrows-indicator

Read Common Scanner Settings described here:

https://www.mql5.com/en/blogs/post/747456

About Scanner Strategy:

How GMMA Lines are calculated:

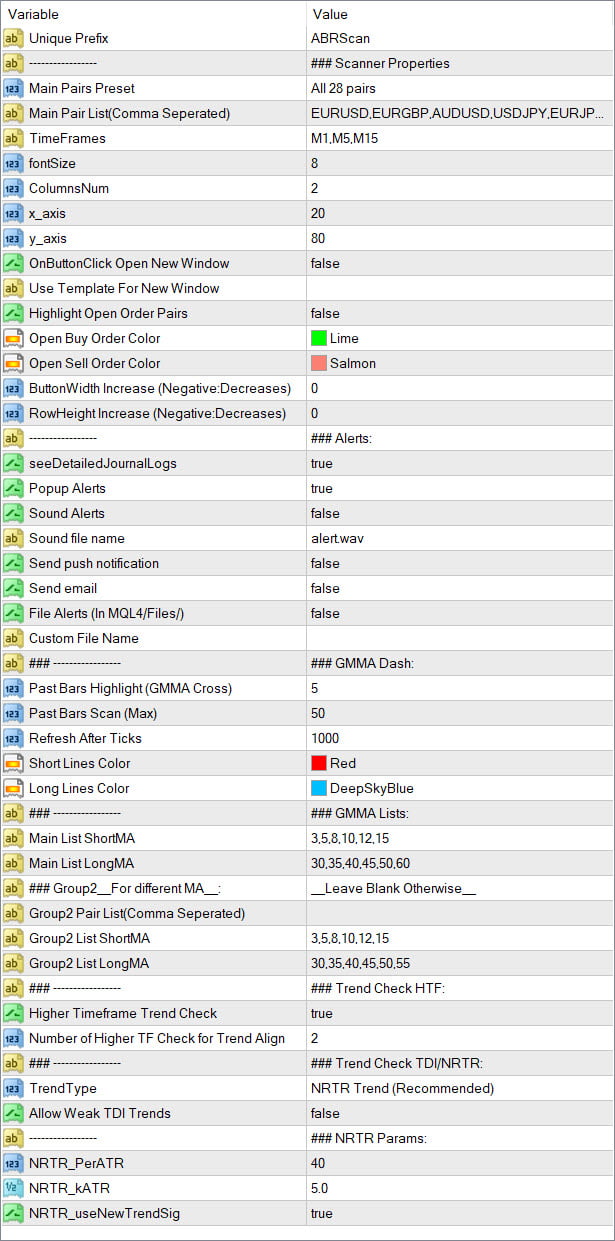

Main List ShortMA is used to calculated Short MA lines by default and Main List LongMA is used for Long MA lines.

But for some pairs, you might need different MA periods. So you can use Group2 Pair List for adding comma separated list of those pairs.

And specify the comma separated Short and Long MA lists for Group2.

The Checks:

1- Current TF GMMA Cross and Trend (Mandatory Check.. G-Up/G-Down)

Check for GMMA Cross. When short GMMA lines cross long GMMA lines upwards, the trend is Bullish shown by G-Up.

When short GMMA lines cross long GMMA lines downwards, the trend is Bearish shown by G-Dn (G-Down).

The number in brackets are how many bars back the cross happened.

Past Bars Scan (Max): Number of total past bars to scan for a cross

Past Bars Scan (Highlight): Default: 5. So, if number of bars is 5 or less and all conditions meet (2 or 3 optional if true), highlight that block (Red for Bearish and Green for Bullish).

2- HTF GMMA Trend Check (Optional.. slanting arrow)

If Higher Timeframe Trend Check is true and “Number of HTF Check Trend Align” is 2. Then check 2 HTF for GMMA Trend alignment.

3- TDI or NRTR Trend Check (Optional.. diamond)

From Trend drop-down select:

- NRTR: Use this NRTR indicator to detect if trend is Up/Down:

- TDI: Use this TDI indicator to detect Trend Up/Down. TDI is a bit heavy and CPU intensive. So if you are using all 28-pairs, then I would recommend not using it. As it might give memory issues and you might get Array Out of Range errors.

Indicator Settings:

NRTR Params:

Modify kATR value to make NRTR SR Lines closer or further apart.

If NRTR Thick Red Line is above price, it means trend is downwards. If blue NRTR Thick line is below price, it means trend is Upwards.

TDI:

If using TDI, you can specify Allow Weak TDI Trends true/false. If false, it will only use the strong TDI Trends. If true, it will also use the weak trends.

Best trading type:

Default settings are the best for M15+ and higher timeframes. And they are good for longer term trend based trading. GMMA is not good for short term scalping. If you are looking for scalping tools, try something like reversal based trading.