Indicator available here for free:

https://www.mql5.com/en/market/product/119515/

Similar to logic used in: Golden MA MTF TT

Overview

“Golden MA” indicator for OB/OS levels. It’s based on High/Lows of higher timeframe (HTF) previous bar. Only useful in swing trading or scalping.

Best for at least M15+. For lower timeframes you’ll need to change StartPips to lower value to get consistent lines. Because lower timeframes will have smaller pip distances.

Features

- Define Higher Timeframes for Current Timeframe:

- Use a comma-separated list to define the higher timeframe for the current chart timeframe.

- Example: M1=H1,M5=H4,M15=D1,M30=W1,H1=W1,H4=MN1,D1=MN1,W1=MN1

- Available Price Types:

- OCLH: Open, Close, Low, High average.

- MEDIANco: Median of Close and Open.

- MEDIANhl: Median of High and Low.

- TYPICAL: Typical price (High + Low + Close) / 3.

- WEIGHTEDo: Weighted price with emphasis on Open.

- WEIGHTEDc: Weighted price with emphasis on Close.

- Get Levels values in Buffers

- Max Past Bars:

- Specify the maximum number of past bars to calculate levels for.

- Helps control the indicator’s computational load.

- Refresh After Given Number of Ticks:

- Set the number of ticks after which the indicator should refresh.

- DrawLevels On/Off:

- Toggle to draw the calculated levels on the chart.

- Can be turned off if only buffer values are needed for EAs, reducing chart clutter.

- Draw End Of Period:

- Draw vertical lines at the end of each higher timeframe period.

- Helps visualize the start and end of higher timeframe bars, aiding in multi-timeframe analysis.

Best Trades:

Indicator default settings are best for H1. For smaller timeframes like M5,M15 you will need to make StartPips a lot smaller. Because smaller timeframes will have smaller point distances.

So to draw the lines more appropriately. Use crosshairs tool to figure out the best distances.

Volatility should be good. Usually for pairs which have market open.

Wait for price to cross Mid Line. And then during next few bars, price should cross the Buy or Sell Start Line. A strong volume candle is preferrable. (get attached VolumeCandles to detect good volumes)

Make sure that price hasn’t gone too far in breakout bar and crossed multiple levels. Because really long bars might then have a retracement or enter a range. So be careful:

Always trade in direction of overall higher timeframe trend.

If scalping, wait for price to cross Buy/Stop End levels. And then place a trailing stop. Definitely close by Warning OB/OS or at max by Danger OB/OS.

Place a stop loss near Mid line. And Keep take profits at least 1.5-2 times Stop Loss. If price is moving well, keep shifting your Take Profit. If price seems like it is ranging, then close trade early. And never be too greedy 🙂

Example:

Here, start trade near the Sell Start Level (red line) shown with arrow. Stop loss above Mid Line (orange) or above the previous high.

Then around the part where price starts to slow down and formed a pin-bar, it would be good to take at least some TP.

And Trailing stop could continue further. Keeping this much TP will ensure that even if you have some losing trades, you will still have more Profits overall.

Input Parameters

- Prefix : Prefix for object names used by the indicator.

- ChartPeriodStr : String to define higher timeframes for the current timeframe.

- PriceType : Type of price to use for calculations (enumerated type).

- MaxPastBars : Maximum number of past bars to calculate.

- RefreshAfterTicks : Number of ticks after which the indicator should refresh.

- StartPips : Number of pips to start level calculations.

- InnerPips : Inner pips for additional levels.

- DrawLevels : Boolean to toggle the drawing of levels on the chart.

- BeginningEndOfPeriod : Boolean to draw vertical lines at the start and end of higher timeframe periods.

- CenterColor : Color for the center level line.

- BullStartColor : Color for the start of bullish levels.

- BearStartColor : Color for the start of bearish levels.

- HighColor : Color for high levels.

- LowColor : Color for low levels.

- CenterSize : Width of the center level line.

- HighLowSize : Width of the high and low level lines.

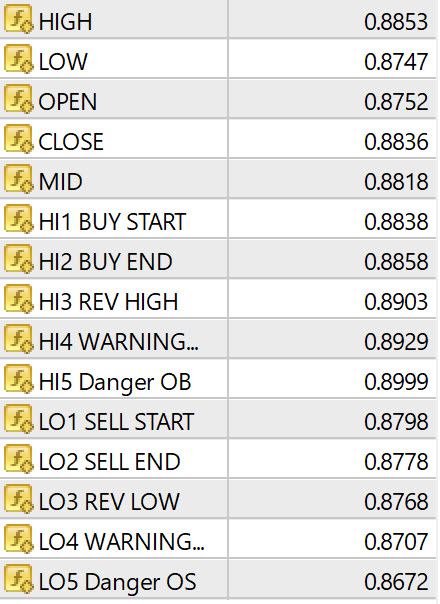

Buffer Values

The indicator uses multiple buffers to store calculated values:

- HIGH[] : High prices.

- LOW[] : Low prices.

- OPEN[] : Open prices.

- CLOSE[] : Close prices.

- MID[] : Calculated median prices based on the selected PriceType .

- HI1[] to HI5[] : Various high levels indicating overbought conditions.

- LO1[] to LO5[] : Various low levels indicating oversold conditions.

Overbought/Oversold Levels:

The indicator defines various levels to identify potential market conditions:

- HI1 BUY START: Indicates the starting point of a potential buying opportunity.

- HI2 BUY END: Marks the end point of the buying opportunity.

- HI3 REV HIGH: Represents a high reversal point.

- HI4 WARNING OB: Signals a warning that the market is approaching overbought conditions.

- HI5 DANGER OB: Indicates a dangerous overbought condition, suggesting high caution or potential for reversal.

Price Types Calculations:

The Golden MA Indicator offers various price calculation methods. Here’s how each price type is calculated:

- OCLH: Average of Open, Close, Low, and High prices.Calculation: (OPEN+CLOSE+LOW+HIGH)/4(OPEN + CLOSE + LOW + HIGH) / 4(OPEN+CLOSE+LOW+HIGH)/4

- MEDIANco: Average of Close and Open prices.Calculation: (CLOSE+OPEN)/2(CLOSE + OPEN) / 2(CLOSE+OPEN)/2

- MEDIANhl: Average of High and Low prices.Calculation: (HIGH+LOW)/2(HIGH + LOW) / 2(HIGH+LOW)/2

- TYPICAL: Average of High, Low, and Close prices.Calculation: (HIGH+LOW+CLOSE)/3(HIGH + LOW + CLOSE) / 3(HIGH+LOW+CLOSE)/3

- WEIGHTEDo: Weighted average giving more weight to the Open price.Calculation: (HIGH+LOW+2×OPEN)/4(HIGH + LOW + 2 xOPEN) / 4(HIGH+LOW+2×OPEN)/4

- WEIGHTEDc: Weighted average giving more weight to the Close price.Calculation: (HIGH+LOW+2×CLOSE)/4(HIGH + LOW + 2 xCLOSE) / 4(HIGH+LOW+2×CLOSE)/4

Final Notes:

This indicator does not perform well for a slow sideways ranging market. So be careful. Better to use forex core pairs.

Ideal times to trade will be good volatility markets. Be careful during news events. And careful when market it choppy or whipsawing.