Hi Traders,

Many of you asked for Quant Analyzer Portfolio Results, so I am uploading it here and everybody can analyze them, and make good decisions based on them.

The EA: https://www.mql5.com/en/market/product/122633?source=Site+Profile+Seller

Our website: https://nomadforexrobots.com/

I want to highlight the incredible value of using Quant Analyzer reports for assessing the risk and overall performance of our Expert Advisors (EAs). These reports are not just another tool; they are essential for making informed trading decisions and optimizing our strategies. Here’s why they’re so crucial:

1. Comprehensive Risk Assessment

Quant Analyzer reports provide a detailed view of the risk associated with each EA. They offer insights into critical metrics such as Maximum Drawdown and Value at Risk (VaR). These metrics help us understand how much risk we’re taking and what potential losses could look like in adverse conditions. By analyzing this data, we can better manage our risk exposure and adjust our strategies to protect our capital.

2. In-Depth Performance Metrics

The reports break down performance metrics in a way that goes beyond simple profit and loss. We get detailed information on win/loss ratios, trade frequency, and profit distributions. This level of detail helps us assess not just how much our EA is making, but also how consistent and reliable its performance is. It’s essential for identifying strengths and weaknesses in our trading strategies.

3. Historical Performance Analysis

One of the standout features of Quant Analyzer is its ability to analyze historical performance. By reviewing how our EA has performed in various market conditions over time, we gain valuable insights into its potential future performance. This historical perspective helps us determine if the EA’s success is sustainable or if it depends on specific market conditions that might change.

4. Robust Scenario and Stress Testing

Quant Analyzer allows us to simulate different market scenarios and stress-test our EAs. This means we can see how our strategies might perform under extreme conditions, which is crucial for understanding their robustness. Stress testing helps us prepare for potential market shocks and ensures that our EAs are capable of handling unexpected volatility.

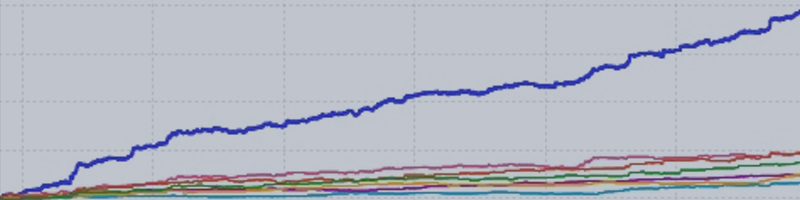

5. Visual Insights

The reports come with powerful visualization tools, including charts and graphs. These visual aids make complex data more accessible and easier to interpret. By reviewing equity curves, drawdown charts, and other visual metrics, we can quickly identify trends and areas that need attention.

6. Informed Decision-Making

Overall, Quant Analyzer reports support more informed decision-making. They provide the data and insights we need to refine our trading strategies, manage risk more effectively, and improve our overall approach. Instead of relying solely on intuition, we can base our decisions on empirical evidence and comprehensive analysis.