A significant upward revision in the final read for US first-quarter gross domestic product (GDP) data (2.0% versus 1.4% forecast) adds to the list of positive economic surprises in the US lately, with economic resilience aiding to calm some nerves around recession concerns, at least for now. That paved the way for some catch-up performance in riskier small-cap stocks overnight, with the Russell 2000 outperforming its counterparts to close 1.2% higher.

Banking stocks also stole the limelight, with all 23 lenders acing the Federal Reserve’s (Fed) annual stress test by proving their resilience in weathering a severe recession scenario. The results provided a positive lead-up to their earnings releases in a few weeks’ time, which saw renewed market traction on the prospects of a potentially higher shareholder payout.

Thus far, the Financial Select Sector SPDR Fund has not fully recovered from its pre-SVB levels, with the index trading within a rising wedge pattern in its aftermath. The Relative Strength Index (RSI) has managed to hold above the 50 level, which kept the near-term bias to the upside. The next test for buyers will be at the 33.70-33.90 level, which marked a resistance confluence zone, particularly from its 200-day moving average (MA) and upper wedge trendline resistance. Overcoming this level may pave the way towards the 35.00 level next.

Source: IG charts

Treasury yields jumped as rate expectations saw a hawkish recalibration in the aftermath of a brighter US economic profile. The two-year yields surged close to 15 basis-points (bp) to a new three-month high, while the 10-year also saw a similar move to retest its recent June high, keeping a lid on the rate-sensitive Nasdaq.

The day ahead will leave all eyes on the US core PCE price index release later today. Being the Fed’s preferred gauge of inflation, the inflation data has not seen much progress since the start of the year, in contrast with the US Consumer Price Index (CPI). Another set of stubborn inflation read could reinforce a high-for-longer rate outlook and push back against rate-cut prospects, further validated by indications of a stronger US economy lately.

Asia Open

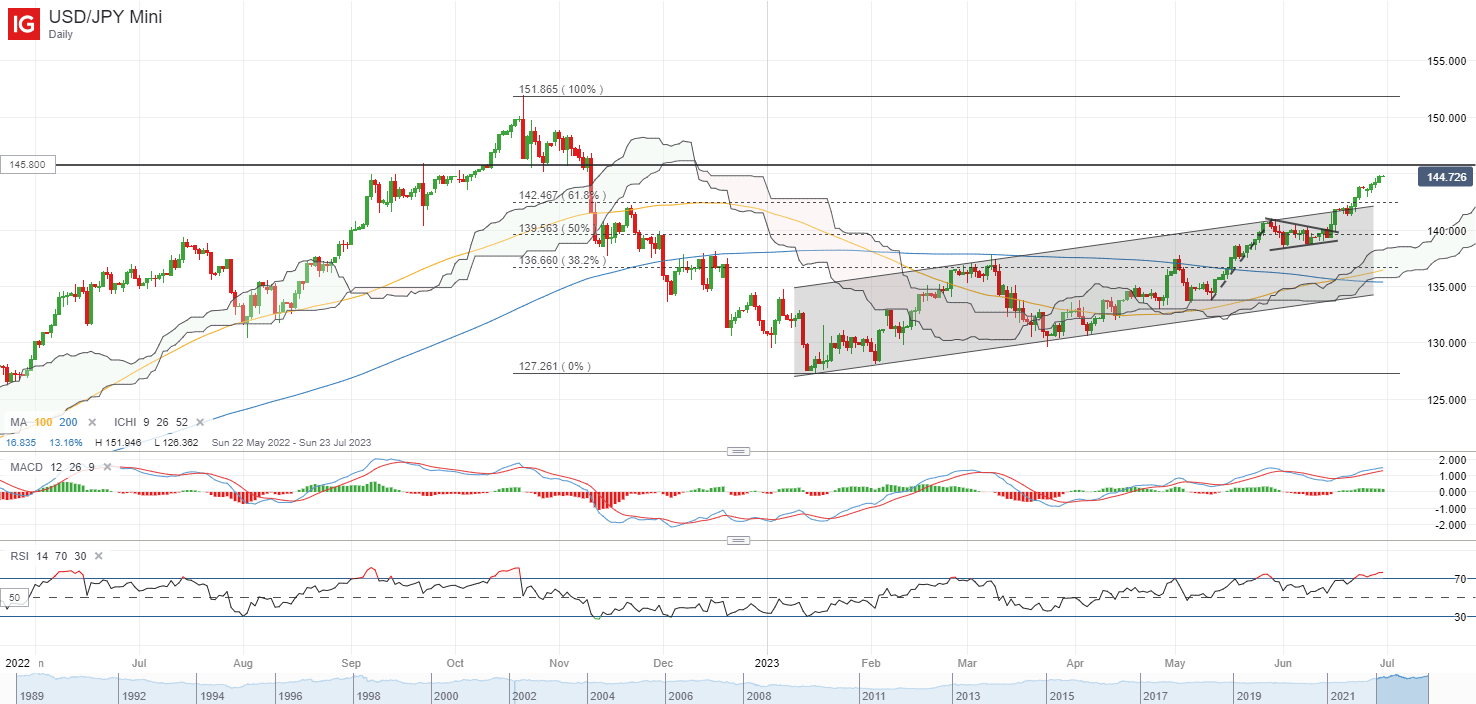

Asian stocks look set for a downbeat open, with Nikkei -0.69%, ASX -0.38% and KOSPI +0.14% at the time of writing. Despite recent jawboning of currency intervention from Japanese authorities, doubts largely remain for any follow-through action as the USD/JPY continues to edge higher over the past week, alongside US dollar strength. The pair is just 0.5% away from the 145.80 level, where a softer round of yen-buying (US$19.7 billion) was conducted in September 2022, which failed to provide much conviction for markets at that time.

This morning, Tokyo’s softer-than-expected core CPI (3.2% versus 3.3% forecast) will likely reinforce the Fed-BoJ policy divergence once more and add to the downward pressure for the JPY. We may see further ramp-up of intervention talks by Japanese authorities ahead, but unless they translate to concrete action, it may seem difficult to stem the increase in the pair. Even in the event of an intervention, the 2022 attempts suggest that the amount of yen-buying matters.

The USD/JPY will face a key test of resistance at the 145.80 level, as caution may intensify on the prospects of intervention while technical conditions trend in overbought territory. But given the higher-highs-higher-lows since the start of the year anchoring an upward trend in place, any sell-off could still be looked upon as a retracement, which leave the 142.50 level on watch for immediate support.

Source: IG charts

Ahead, China’s NBS PMI figures will be on the radar. A more subdued reading in the June PMI figures remains the broad consensus (49 versus previous 48.8), which could likely reinforce views that more needs to be done. A sustained turnaround in the data will be warranted to provide greater conviction that the worst is over.

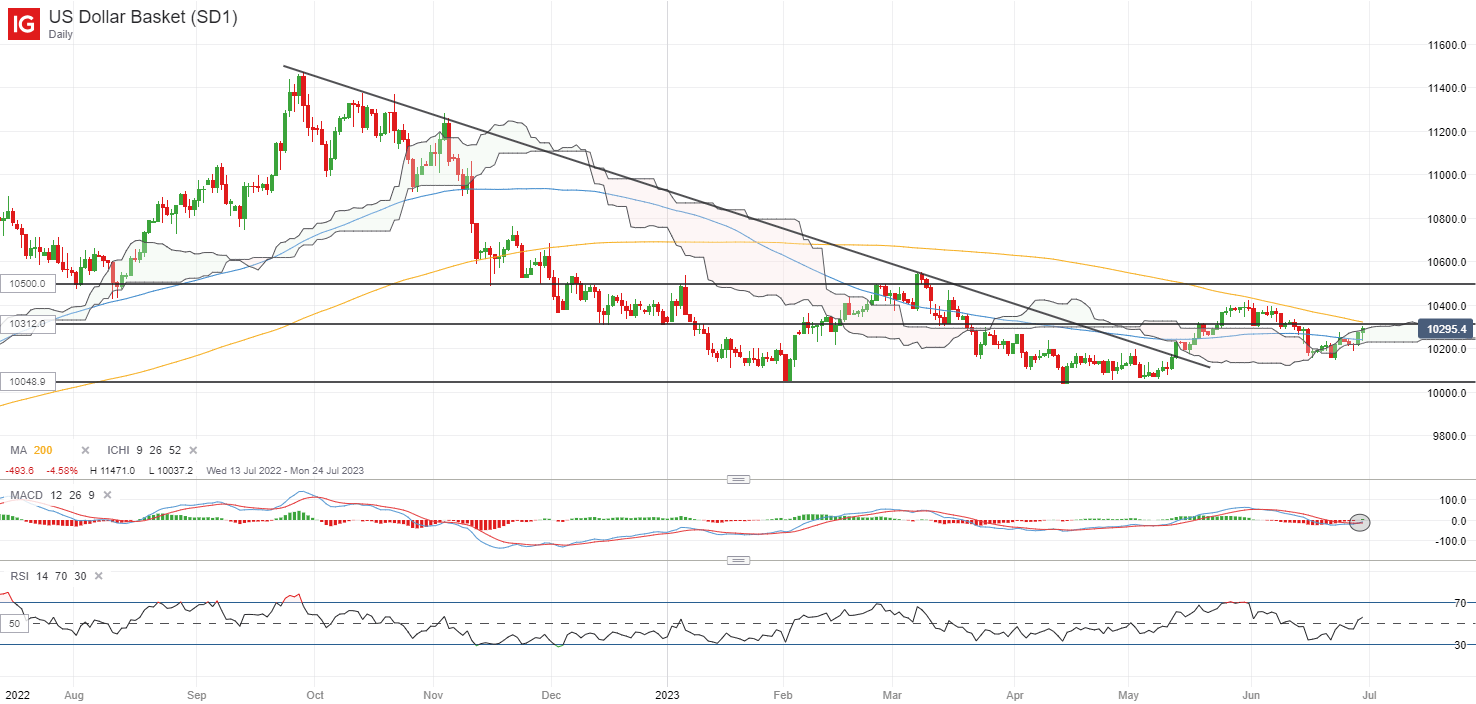

On the watchlist: US dollar on watch ahead of US core PCE price index release

The US dollar has been edging higher in the lead-up to the US PCE price index release today, tapping on some resilience in Treasury yields lately as positive economic surprises this week point to a high-for-longer rate outlook. Its 100-day MA has been reclaimed overnight, after being supported off its Ichimoku cloud on the daily chart. Buyers are also seeking to take greater control, with a bullish crossover on MACD and a move in RSI back above the 50 level, but validation will have to be sought from a more persistent set of inflation readings to further support US dollar strength.

The 103.12 level may serve as immediate resistance to overcome ahead, with a move above this level potentially paving the way to retest the 105.00 level next. On the other hand, failure to reclaim the level could leave its 2023 year-to-date lows on watch at the 100.50 level.

Source: IG charts

Thursday: DJIA +0.80%; S&P 500 +0.45%; Nasdaq -0.02%, DAX -0.01%, FTSE -0.38%