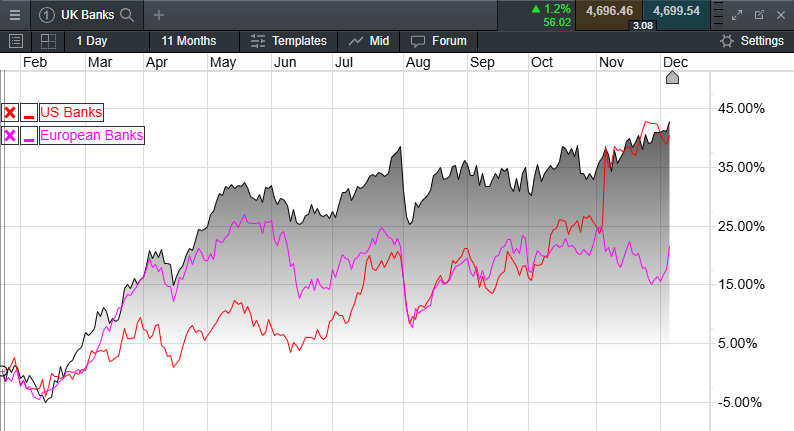

In 2023 European banks managed to outperform their US and UK peers by quite some distance while US and UK banks underperformed, although the rebound seen in the European banking sector in 2023 needs to be set in the context of years of underperformance by banks across Europe as a result of the turmoil of the sovereign debt crisis at the beginning of the last decade.

This year we’ve seen a much better performance from both UK and US banks after 2 years of trading sideways over concerns over tighter regulation and rising interest rates.

European banks saw a much stronger rebound as their balance sheets started to reap the benefits of positive interest rates after a decade of negative rates affected their ability to generate meaningful returns.

This year we’ve seen both UK and US banks reassert their dominance over their European peers with some strong gains across the board, with US banks getting a further lift in November in the aftermath of Donald Trump’s win in the US election.

UK banks also benefited from a strong start to the year from the UK economy, with the likes of Barclays, NatWest and Standard Chartered helping drive the FTSE100 to new record highs.

The performance of the UK economy also showed how poor the likes of the Bank of England, as well as the OBR are when it comes to their predictive capabilities, given that at the start of 2023 the BOE was predicting a 2-year UK recession.

If one thing has been learnt from the events of the last few years is that any economic prediction from many of these economic bodies is that while spreadsheets are good at predicting many things, economic performance doesn’t tend to be one of them.

Sometimes you have to get out and about, away from your economic models, and live in the real world as well, and no economic model that I know of survives first contact with the vagaries of human behaviour.

Comparison: UK, US, and EU banking basket

Source: CMC Markets

The US banking sector this year has also shrugged off the concerns of 2023 about the mid-tier banking sector in the wake of the collapse of Silicon Valley Bank due to a combination of exposure to rising interest rates due to over exposure in US long dated treasury bonds, and an over concentration of customer deposits in the tech sector, which was heavily exposed to sharp rises in interest rates.

The various measures taken by the FDIC, Federal Reserve and the big US banks in 2023 appear to have served to stabilise this key part of the US economy.

Residual concerns still remain about the wider sector’s exposure to commercial real estate, but now that the Fed has started to cut rates, the pressure along with a resilient US economy has seen these concerns ease, and this has been reflected in a broader rally in US banks.

UK banking shrugs off headwinds

Here in the UK, the stand out performers have been NatWest and Barclays along with Standard Chartered, while Lloyds and HSBC have again underperformed.

When looked at on a longer time line this underperformance is even more noteworthy even from pre-Covid times, a fact that is more startling given that both banks are more profitable now than they were in 2019.

The underperformance of Lloyds is more surprising perhaps given that the bank is more resilient and profitable than at any time since the financial crisis.

As for NatWest the wheels did temporarily come off at the end of 2023 in a manner that was entirely self-inflicted with questions being asked over its governance after previous CEO Alison Rose was forced to step down for leaking personal information about the account of Nigel Farage to a BBC journalist.

From a reputational standpoint this proved to be hugely damaging, along with revelations of unprofessionalism amongst its staff it would appear that new CEO Paul Thwaite has managed to draw a line under the fallout from his predecessor’s departure.

This process of a clean slate was completed in April this year with the retirement of previous Chairman Howard Davies, who was also tainted by the debanking scandal, and who was replaced by Richard Haythornwaite.

UK banks performance YTD

Source: CMC Markets

On an individual basis none of the banks are doing significantly better than they were in 2023, as increased competition, as well as pressure on margins prompts revenues and profits to slip back. There is a feeling however that, despite the weaknesses in the UK economy, they are more resilient to economic shocks than at any time since the financial crisis.

NatWest Group

When NatWest reported in Q3, profits from continuing operations rose strongly to £1.24bn, an increase of 30% over the same period a year ago, although on a year-to-date basis profits are on a par to the same period in 2023.

The improvement seen in the previous 2 quarters despite the prospect of lower rates appears to show that despite pressure on NIM that the bank is just about holding on to its deposit base, with a small increase of £2.2bn between Q2 and Q3, while its loan book also grew over the quarter rising to £427.4bn, with net interest margin at 2.11% year to date.

The addition of the £2.3bn Metro Bank loan book which NatWest agreed to buy in July, and completed on 30th September helped with respect to the loan book growth, with the mortgage transfers forecast to complete by the end of Q2 2025.

The bank also raised its guidance for full year total income to £14.4bn.

Barclays

Coming off the back of 2 disappointing years in 2022 and 2023, the Barclays share price has seen a renaissance in 2024 having put behind the turmoil of Jes Staley’s departure, and then the investigation over some of its trading products in the US, at a time when current CEO Venkat oversaw the banks risk environment, which saw the bank incur a multi-million US dollar hit.

This year has seen the bank post some really strong gains, pushing above its 2022 as well as its 2017 peaks and return to levels last seen in 2015.

The catalyst for the latest surge in the share price to 9-year highs, was the bank’s Q3 numbers which saw attributable profits jump by 23% to £1.57bn, well above the £1.27bn reported in the same quarter in 2023. Q3 revenue was also better, coming in at £6.5bn, a 5% increase on last year.

The bank also upgraded its target for net interest income to come in above £11bn for the full year, with a strong performance from its UK bank helping to boost margins as well as revenue growth.

The outperformance was helped in some part by the £600m acquisition of the Tesco Bank retail banking business in February, while its investment banking division also saw a strong quarter, as income there rose 6% to £2.85bn.

Digging a little deeper into the numbers did show that while the UK business saw profits increase by 7%, the deposits base saw a decline to £236.3bn, while loans and advances also fell from £204.9bn in Q3 last year to £199.3bn.

What was particularly noteworthy was the drop off in lending balances for personal and business banking, while Barclaycard saw an increase of £1bn, a particularly worrying development given the high rates of interest that type of borrowing attracts.

Lloyds Banking Group

While it still looks like we could see a positive year for Lloyds Banking Group shares it could and should have been a lot better, but for concerns over the banks’ exposure to the car finance sector, which prompted a sharp fall in the share price in late October.

When you have the likes of Barclays and NatWest performing so well it does seem odd that Lloyds continues to struggle, however while the uncertainty over payments of commissions to third parties remains it probably pays to be cautious.

The high court ruling in October which found against FirstRand Bank and Close Brothers stipulating that it was unlawful for lenders to pay hidden discretionary commissions to car dealers without the knowledge of the borrower has stirred up a hornet’s nest of concerns over possible large scale compensation payments, with some numbers being bandied about being as high as £3bn.

Given that Lloyds Black Horse Finance division is one of the biggest lenders to the UK car industry with loans totalling up to £16bn, concerns are rising as to what this ruling might do to that business if the appeal to the ruling fails.

The hope is that the appeal to the Supreme Court will clarify what is covered, and what isn’t, and bring this whole sorry episode to a conclusion.

On the actual underlying business itself the bank is performing reasonably well. Q3 statutory profits after tax fell to £1.3bn, due to lower margins from a year ago, prompting a modest decline in net income to £4.34bn, from £4.5bn, although the profit number was still the best quarter since the same quarter last year.

Over the 9 months operating costs rose by £338m, to just shy of £7bn, and were £50m above the same quarter a year ago at £2.29bn.

As far as the UK business is concerned, unlike Barclays, Lloyds saw growth in both loans and deposits, with a £4.6bn increase in both underlying loans and advances to customers over the quarter to £457bn, while loans and deposits also rose by £1bn to £475.7bn.

While on the face of it these numbers look good, unlike Barclays, Lloyds doesn’t have a big investment banking arm which means its fortunes are inextricably linked to the health or otherwise of the UK economy.

With consumer confidence and business confidence undergoing a sharp fall in the last few weeks the journey into year-end could be a bumpy one for Lloyds given its close affiliation to the fortunes of the UK economy, as well as the current uncertainty around the car financing industry. These are the headwinds we need to be aware of as we head into 2025.

HSBC

The movement in the HSBC share price this year has been an exercise in steady as she goes when compared to its peers but it is still positive, nonetheless.

When the Anglo-Chinese bank, and Europe’s largest financial institution reported in Q3 pre-tax profit increased by 10% to $8.5bn, helped by 5% increase in quarterly revenue to $17bn.

Management also announced a further $3bn share buyback bringing the total this year to $9bn, along with an interim dividend of 10c a share.

Of all the major banks HSBCs net interest margin is on the low side slipping from 1.7% to 1.5% with the bank announcing plans to cut costs further in the wake of the retirement of previous CEO Noel Quinn in the summer.

Talk of cost savings of $300m along with a plan to restructure the bank into eastern and western divisions could also be a precursor to some form of split if the political situation deteriorates between China and the rest of the world.

For several years now HSBC management has come under pressure from activist investor Ping An, to become more efficient, as well as looking to focus on its domestic markets. The bank’s relationship with the Chinese government has also come under scrutiny in the wake of the treatment of some of its account holders in the wake of the pro-democracy protesters in Hong Kong.

While incumbent CEO George Elhedery was at pains to insist that the new structure was in no way to a precursor to a split of the bank, it does appear that the building blocks are being put into place if the pressure to do so becomes too much and HSBC is unable to straddle the competing strands of its relationship with the Chinese government, and its western markets.

Given the balancing act HSBC has to perform between its two major regions, the reality is it does make most of its money in Asia, with $16bn in profits so far this year, while the UK bank has seen a return over the last 9 months of $5.56bn, out of a total of $30bn year to date.

This could mean that when push comes to shove, we could well get a split, with this year’s announcement potentially laying out a foundation towards such a scenario playing out in the not-too-distant future.

Banks resilience to face a key test in 2025

The last 12 months have seen well overdue gains for the UK banking sector as Barclays and NatWest leading the sector high, also helped by the continued turnaround by Standard Chartered.

Lloyds shares have once again underperformed but might have the potential to rebound if the concerns over Black Horse Finance go away.

Looking ahead to 2025, the main challenges for the sector will be the risk of a slowing economy as businesses look to adapt to the higher costs brought about by the recent budget.

The last 12 months saw concern over householders having to pay more on their mortgages as their fixed rate deals expire not play out as expected, however the fiscal drag from that could well continue to weigh on the economy as more and more deals come up for roll-over.

Mercifully we have seen gilt yields come down somewhat from their peaks in November, however they are still high relative to yields elsewhere and given current rates of inflation the Bank of England is unlikely to be cutting rates aggressively with the next cut potentially coming in February.

This means that while we have seen the top in the current interest rate that doesn’t mean that budgets won’t feel the squeeze when these deals rollover and are refinanced at higher rates in 2025.

In data released in the summer by the Bank of England it was reported that mortgage arrears were at their highest levels in 8 years, even though they remain well below the peak of 3.64% seen in the aftermath of the 2008 financial crisis. These numbers appeared to have flattened out over the summer due to the resilience of the UK economy, although we have seen a slowdown since then.