EUR/GBP and GBP/NZD Outlooks

Recommended by Nick Cawley

Get Your Free GBP Forecast

Sterling pairs have been quiet of late after the recent BoE meeting. On Friday the latest UK GDP figures are released, while next week heavyweight employment, inflation, and retail sales data will need to be closely followed.

GBP/NZD continues to grind higher and is touching highs last seen back in March 2020. The pair have moved higher since February this year on diverging central bank policy and while one technical indicator (CCI) suggests that the pair are overbought, the short- and medium-term term outlook remains positive.

Looking at the daily chart, GBP/NZD continues to print a series of higher lows and higher highs, while the 20- and 50-day moving averages are seen propping up the move higher. A 50-day/200-day golden cross made in late March has added to the positive sentiment in the pair. Any pullback in the pair should be relatively minor with a block of recent highs and lows in July acting as a support zone. With little in the way of resistance, the pair may continue to nudge higher.

GBP/NZD Daily Price Chart – August 9, 2023

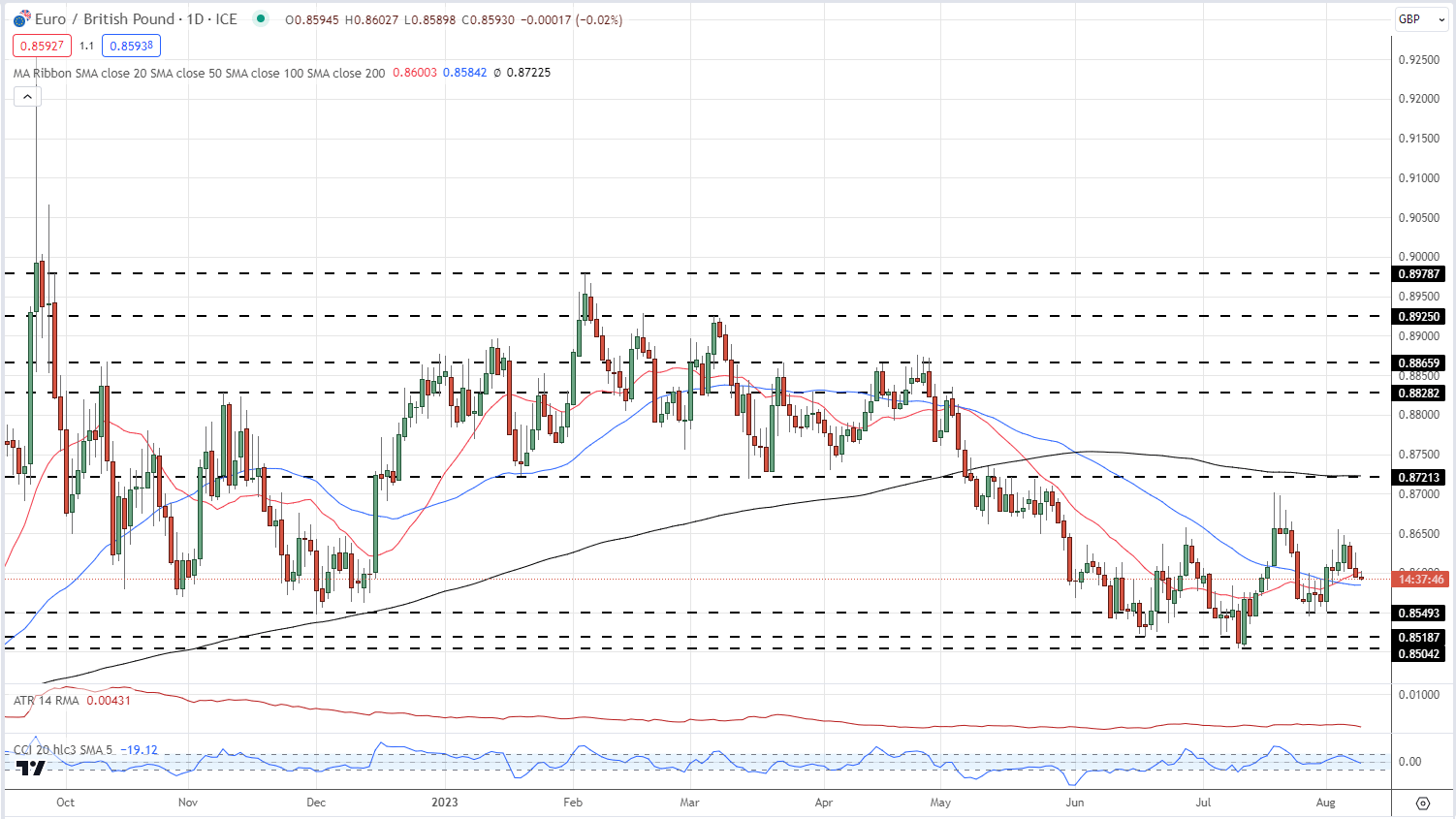

In contrast to GBP/NZD, another British Pound pair, EUR/GBP, remains locked in a range with little reason at the moment to attempt a breakout. The range between 0.8504 and 0.8721 has held for nearly three months, while the pair have started to narrow this range recently. Resistance at 0.8721, originally formed off a prior level of support, is strengthened by the 200-day simple moving average that currently sits just above at 0.8722. The daily charts outlook is not helped by the recent 20-day and 50-day crossover, while the CCI indicator shows that the pair is neither overbought nor oversold. The current range is likely to persist unless a fundamental driver appears.

Learn More About Range Trading by Downloading the Range Trading Guide Below

Recommended by Nick Cawley

The Fundamentals of Range Trading

EUR/GBP Daily Price Chart – August 9, 2023

Retail trader data shows 59.44% of traders are net-long with the ratio of traders long to short at 1.47 to 1.

For a More Detailed Look at Daily and Weekly Changes in EUR/GBP and What it Means for Sentiment, Download the Free IG Client Sentiment Guide

| Change in | Longs | Shorts | OI |

| Daily | 0% | 1% | 1% |

| Weekly | -10% | 19% | -1% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.