US Dollar, Canadian Dollar, Mexican Peso Vs Japanese Yen – Price Action:

- USD/JPY retreats, but approaches a strong floor.

- CAD/JPY rally may have run its course for now.

- High chance that a broader consolidation in MXN/JPY may have started.

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The Japanese yen looks set this week to shed some of its gains against some of its peers, but cracks are starting to emerge in the Japanese currency’s broader downtrend that could limit any weakness.

USD fell broadly after the US economy added the fewest jobs in more than two years, lowering the hurdle for the Fed to raise interest rates later this month. Still, the rate futures market continues to show a high chance of a 25 basis points rate hike at the July 25-26 FOMC meeting. However, if US CPI slows more than expected (data due next week), it could lead to a setback in rate hike odds, capping USD/JPY.

Moreover, the threat of intervention by Japanese authorities could keep USD/JPY’s upside in check. For more on intervention, see “Japanese Yen on Intervention Watch: USD/JPY, EUR/JPY, GBP/JPY Price Setups”, published June 26.

JPY has also been supported by the surge in Japanese workers’ wages bringing the Bank of Japan closer to the end of its ultra-easy monetary policy. For more details see “Japanese Yen Aided by Jump in Japan Wages: USD/JPY, EUR/JPY, AUD/JPY Price Setups”, published July 7.

USD/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

USD/JPY: Approaches a fairly strong floor

On technical charts, USD/JPY has fallen below quite strong converged support on the 89-period moving average and the lower edge of the Ichimoku cloud on the 4-hourly charts (the support triggered a rebound in USD/JPY last month). The break confirms that cracks have started to emerge in USD/JPY’s rally. For now, the pair could be supported around the 200-period moving average on the 4-hourly chart (at about 141.50). However, any rebound could be capped, raising the risk of an extended consolidation in USD/JPY.

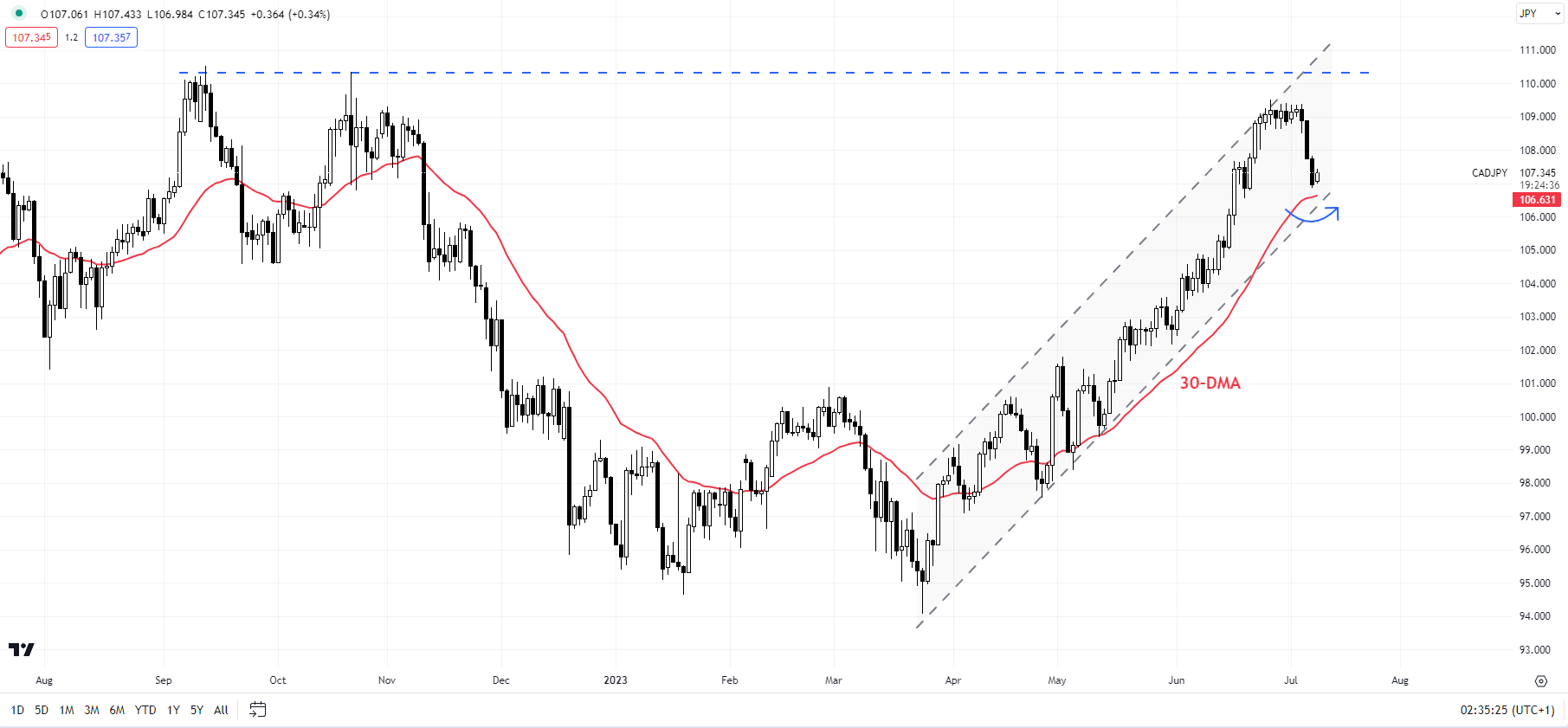

CAD/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

CAD/JPY: Rally may have run its course for now

CAD/JPY appears to have succumbed to the tough converged hurdle at the 2022 highs, coinciding with the upper edge of a rising channel since March. However, the cross has quite a strong cushion on the 30-day moving average, near the lower edge of the channel, pointing to a minor rebound (see chart).

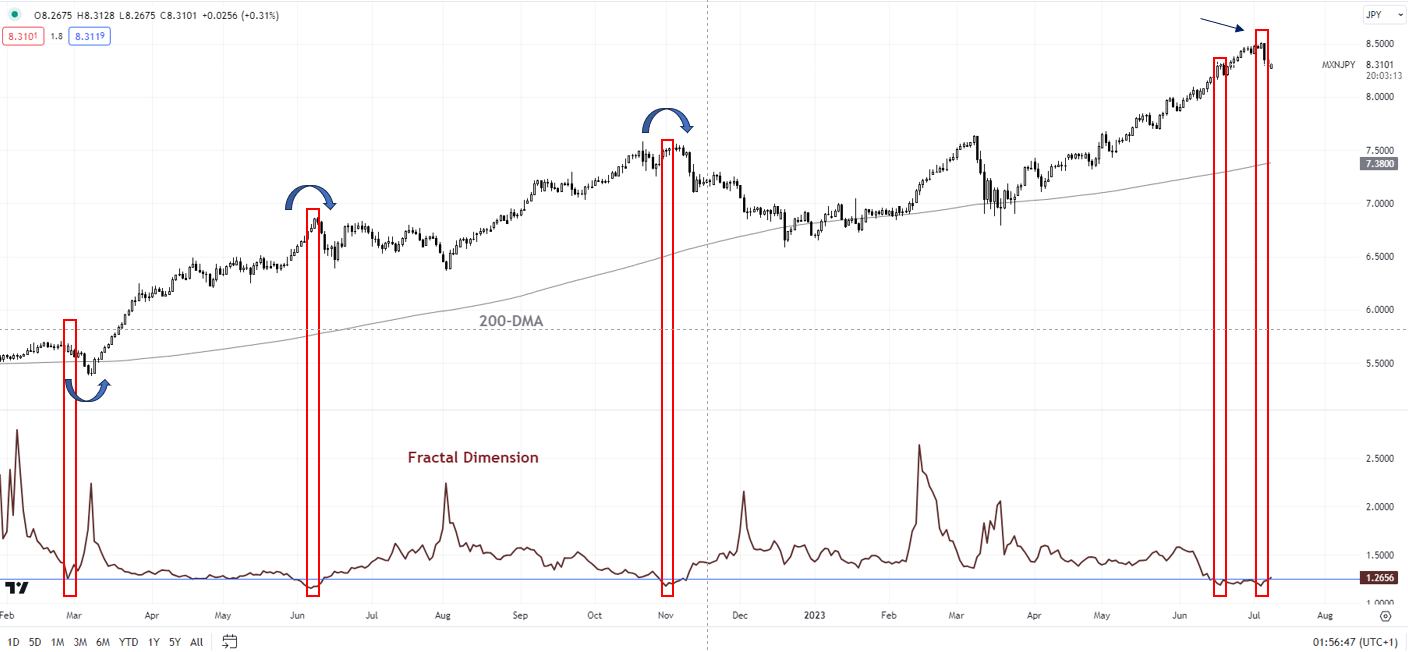

MXN/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

MXN/JPY: Consolidation may have started

MXN/JPY looks highly overbought while it has run into major resistance at the 2014 high of 8.72. Interestingly, market diversity, as measured by fractal dimensions, appears to be low as MXN/JPY has hit a multi-month high. Fractal dimensions measure the distribution of diversity. When the measure hits the lower bound, typically 1.25-1.30 depending on the market, it indicates extremely low diversity as market participants bet in the same direction, raising the odds of a price reversal. For MXN/JPY, the 65-day fractal dimension fell below the threshold of 1.25, raising a red flag. (See chart.)

Recommended by Manish Jaradi

Get Your Free Gold Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish