There are many trading strategies. In a single symbol, more than 1000+ trading methods are applied by traders. Each may have their own method and its not important now to discuss if they are successful or not, but we are focusing on the way multiple trading methods are applied on same symbol and how market is reacting based on that.

I will attempt to filter out these based on some valid logics

Before we proceed to decode, we must know following :

1. A symbol which you wish to trade is a fractal and has many timeframes. If you think you may find holy grail in a single timeframe you may be wrong, but with a better risk management you may win, but this winning is only possible when you lose 50% time and win 50% time, and if your risk reward is 1:3 or more you increase winning chances. But I do not support any trading method which relies on a single timeframe, The main reason to neglect such strategies is because Market never follows anything accurately on a single timeframe for long term.

2. Unknown Chart Characteristic : You may be only researching or backtesting a trading method in Candlestick chart but are you aware that Line chart, Renko, Point and Figure and even charts where there is nothing except Grid may be giving more accurate results in your strategy but you are not willing to see those charts?

3. Targets : Most of people believes in calculated targets e.g. 4.236 level of Fibonacci, sometime works sometimes do not work, Are you aware that Targets may be psychological, e.g. If $SOL price is 132.556 people may believe profit booking in 135, what is special in 135 where there is no target? It may be psychological level in multiplication of 5. Are you aware that traders may book profit based on Their risk reward and not the calculated theory? If you do not include this in your study, you may be clueless for lifetime about why your strategy is not performing.

Now we discuss about trading methods

1. Single Timeframe Single Period Fixed Rule methods : For example Applying FIbonacci Retracement on A swing in a single timeframe e.g. 1minute timeframe

These methods are always less rewarding and losing chances are more. They can be highly rewarding if a trader truly understands how a swing is formed based on some calculation which can be coded, but most of people are never able to define the correct property of swing. The indicators such as ZigZag are never giving accurate and true definition of swings. Many attempted earlier to modify ZigZags such as ZigZag based on ATR but still they cant be used to make money consistently and fails.

2. Multi Timeframe Multi Period Variable Methods : For example. Applying Fibonacci on M15 and confirming price action on M1 chart.

M15 : Look at 1.618 level

Now switch to M1 for confirmation in 1.618, you find the level has a breakout so no need to sell

These can be categorized in Multi period too for e.g. Watching 55 EMA in M15 chart while watching 20 EMA on M1 chart and making correlation on these two timeframes to see if strategy performing better than single timeframe single period methods.

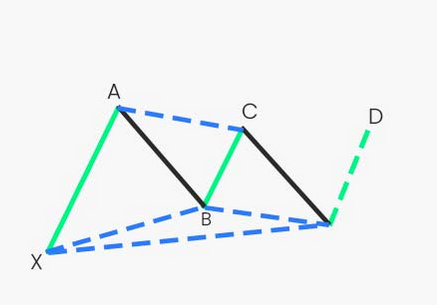

3. Points based trading methods : In this method, usually traders believe that the more points verified the better the accuracy. In earlier example of fiboncci retracements, we were using 2 points verification method, In another example where we are verifying M15 activity on M1 chart we are using 3 points verification method. If we use Fibonacci expansion we use 3 points verification method because in this tool there are 3 anchors. Same way Harmonic patterns are multi point verification of a structure in chart. For example Gartley pattern verifies XABCD point before taking a trading decision.

In Elliot waves there are ABCDEF waves before making a trading decision. In Wyckoff accumulation and distribution theory, there are many points which ends in Upthrust before making a trading decision. Have you wondered if trading was so easy why these people given a complex theory to verify such points. Its because trading is all about patience and waiting for your entries patiently after more than 4+ points of verificaion. So I avoid single timeframe and single period methods.