1. How to Choose the Right EA

Choosing a quality EA (Expert Advisor) is crucial to your success in forex trading. Here are the detailed criteria to consider when selecting an EA:

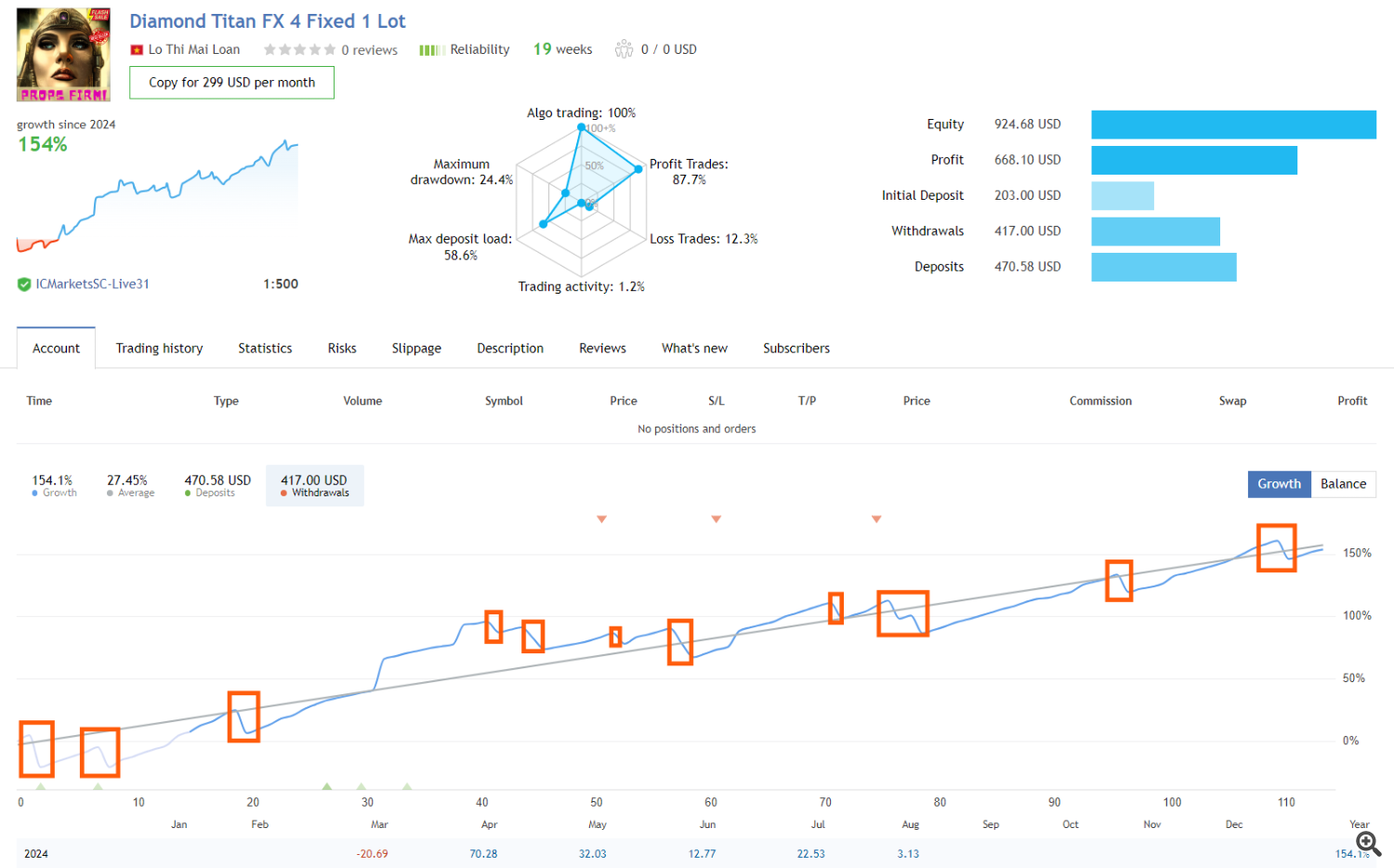

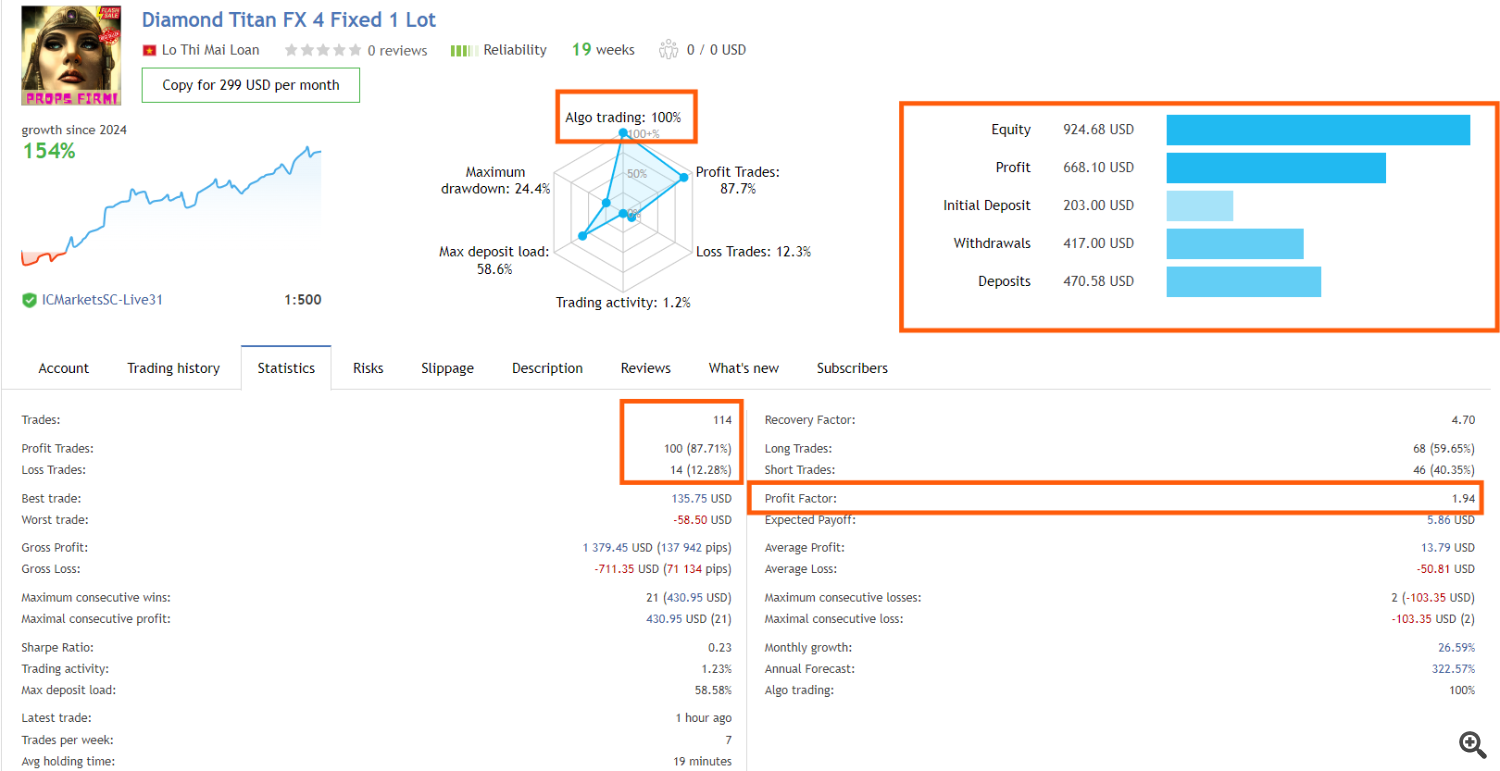

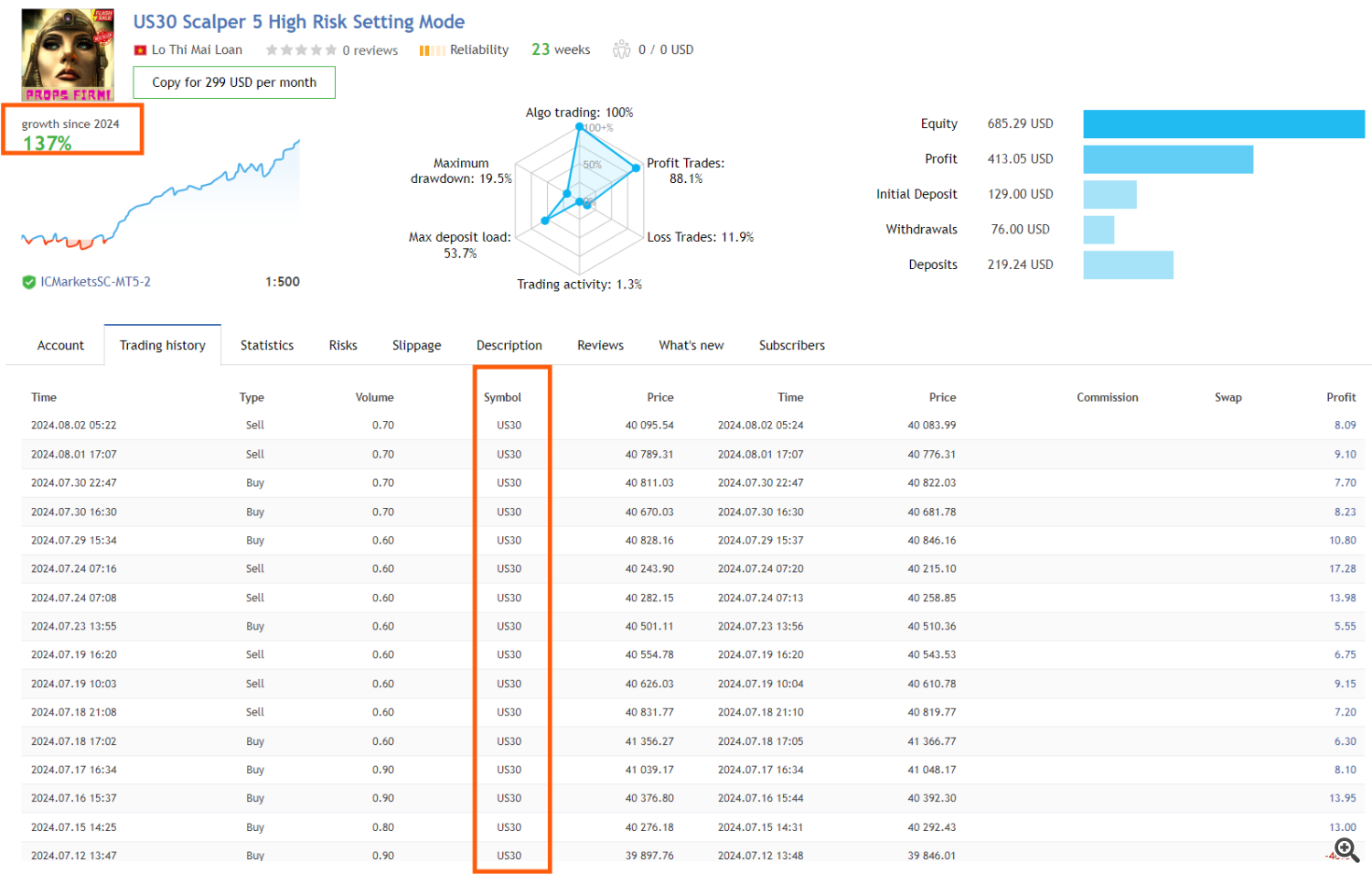

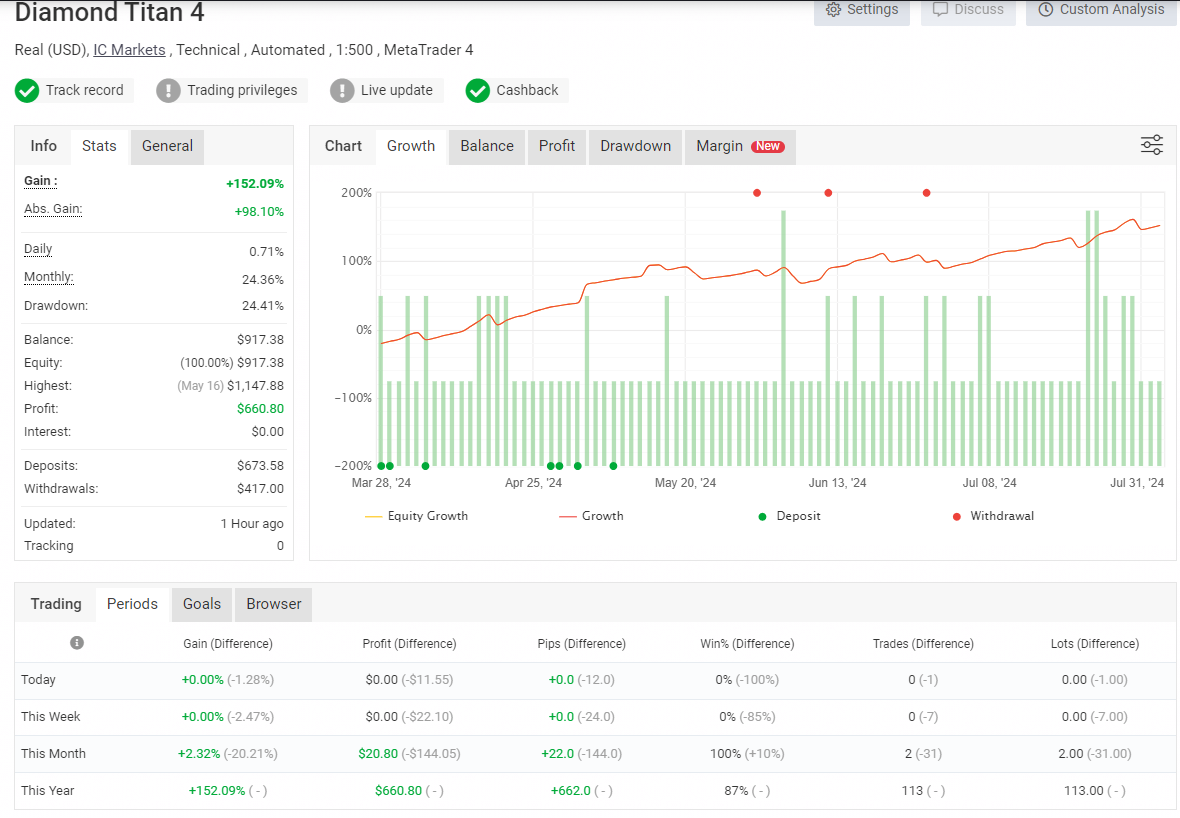

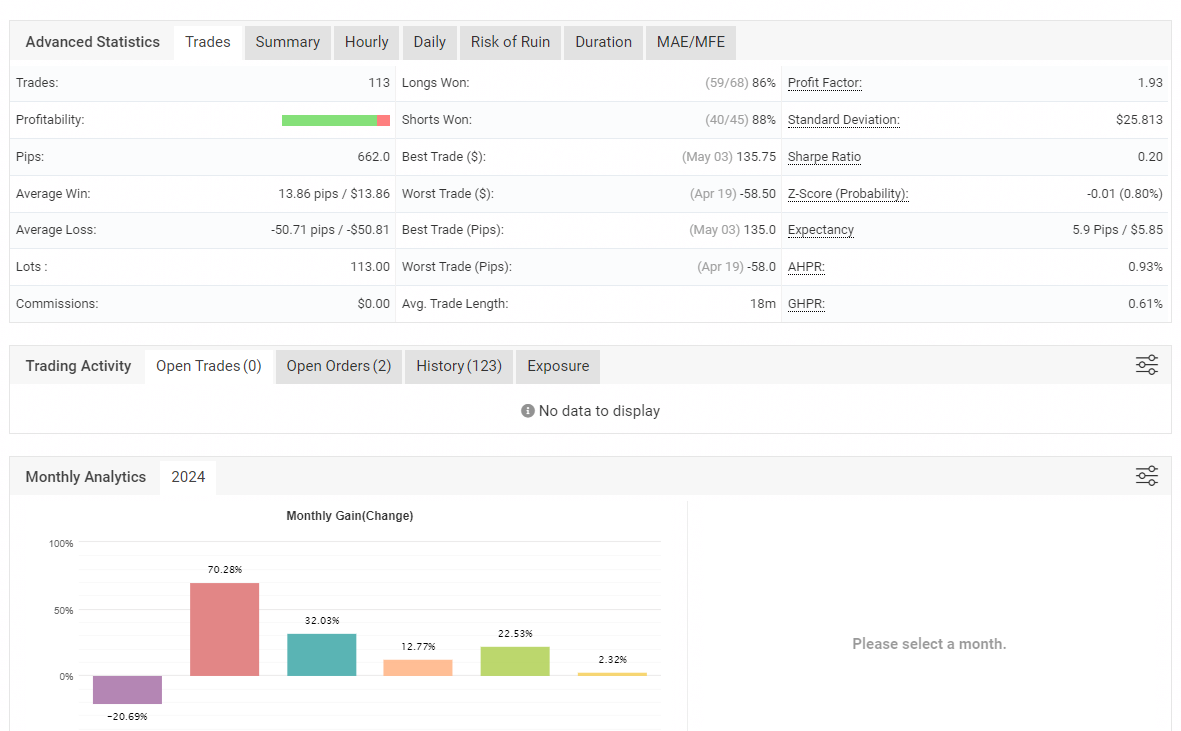

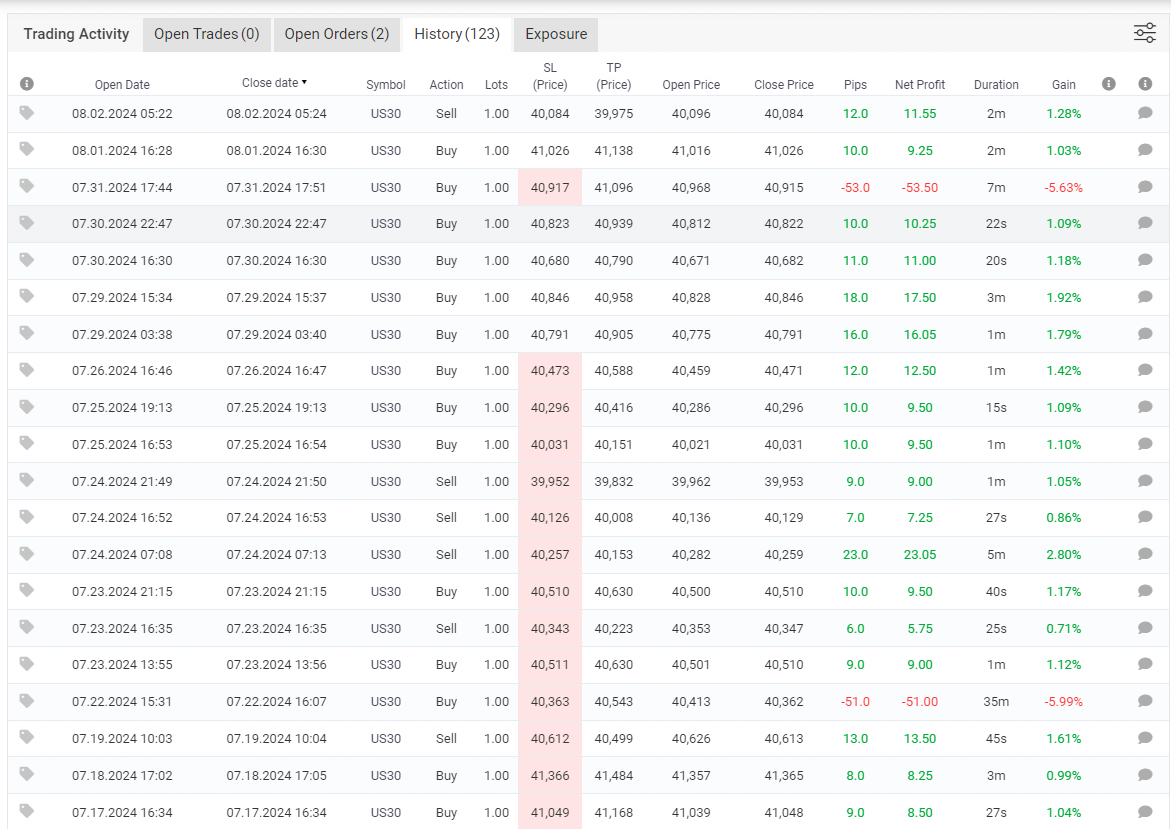

– Clear and Transparent Live Signals (NOT DEMO): The first important criterion is that the EA must have clear and transparent live signals. A transparent live signal provides detailed information about the trades executed, including parameters such as trade time, currency pair, trade volume, profit, and loss. Specifically, this signal should have at least 100 trades to ensure the EA’s representativeness and reliability.

– Complete Win and Loss Records: An EA with a 100% win rate is often unreliable because it can hide potential risks. It’s crucial to have a balance between winning and losing trades, which helps accurately assess the EA’s recovery ability and actual performance. You should consider the win/loss ratio, maximum drawdown, and average profit ratio.

– Other Criteria: Besides the two main criteria above, you should also consider other factors such as:

- EA’s Operating Time: How long has the EA been operating in the market? An EA with a long and stable operating time is more reliable.

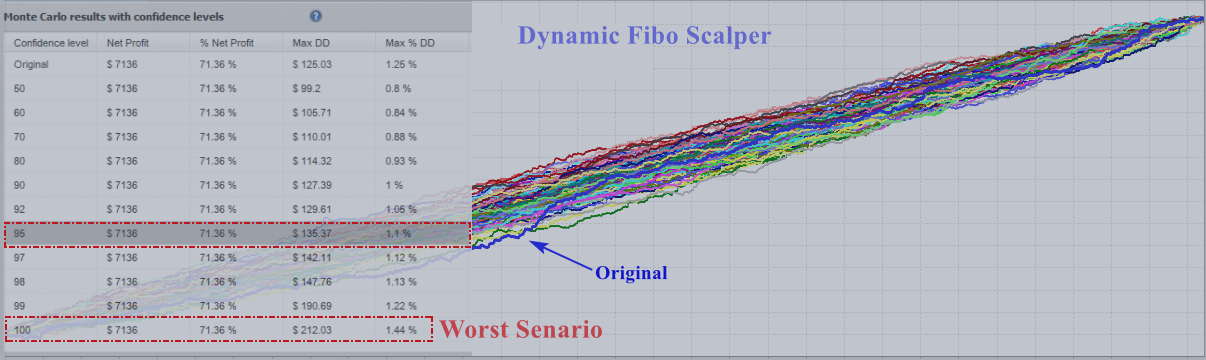

- Drawdown Level: Drawdown is the reduction of an account from its peak to its lowest point over a period. A good EA should have a low drawdown to minimize risk.

- Trading Strategy: Understanding the trading strategy used by the EA is very important. Popular strategies include scalping, day trading, swing trading, and trend following.

Illustrative images of the live signal and the EA’s trade history will make it easier for you to choose. For example, you can use websites like MQL5 to review trade signals and evaluate EAs.

2. Choosing Pairs Based on Preference or Profit?

Many traders prefer trading specific currency pairs, such as XAU/USD (gold), because of high volatility and significant profit potential. However, selecting currency pairs should not only be based on personal preference but also on the EA’s ability to generate profit.

- Personal Preference: Although personal preference can influence pair selection, the most important thing is that the EA must be capable of generating consistent profit. If an EA can generate steady profit across multiple currency pairs, then the choice of pair becomes less significant.

- Focusing on Few Pairs: It is advisable to focus on 1-2 currency pairs to understand their behavior and characteristics. This helps optimize trading strategies and manage risk more effectively.

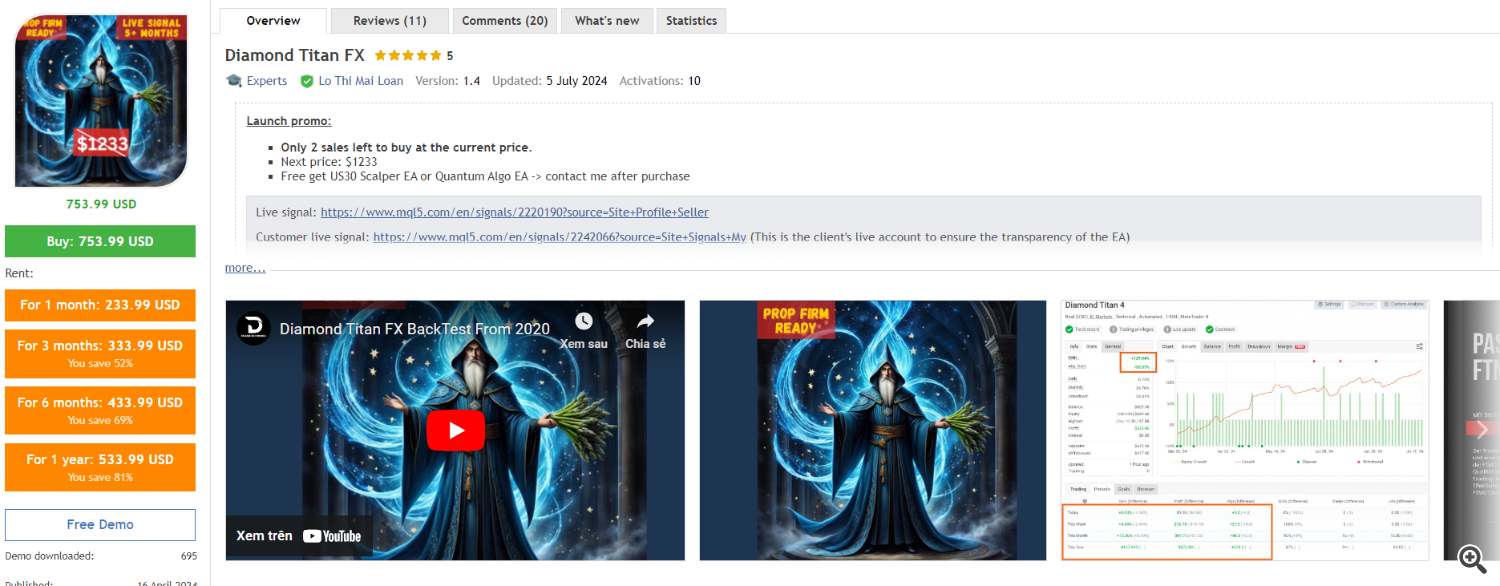

3. Choosing Sellers with a Good Track Record and Clear EA Signals

A reputable seller is crucial to ensure you are using a quality EA. Here are the criteria to consider:

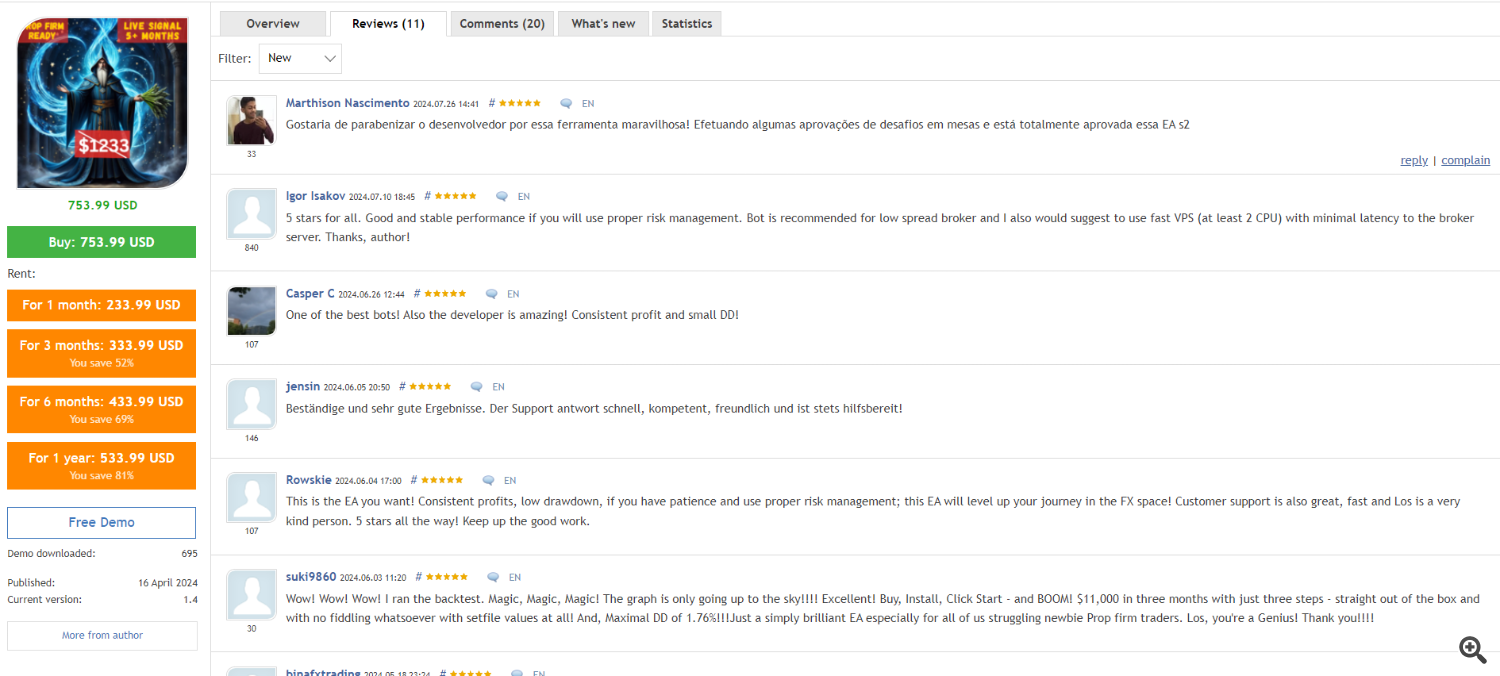

– Good Reputation: The seller must have a good reputation in the trading community and receive many positive feedbacks from users. You can check the seller’s reputation through reviews on websites like MQL5, Myfxbook, or trading forums.

– Clear EA Signals: Choose sellers with many transparent EA signals, allowing you to easily track and evaluate the performance of different EAs. A reliable seller will provide complete information about the trades executed, including detailed trade history and results.

– Customer Support: The seller should also have good customer support services to help you resolve technical issues and provide necessary information about the EA.

Illustrative images of reputable sellers and EA signals will give you a clearer view of your options. You can find reputable sellers on websites specializing in EAs and trading signals.

4. Introduction to Diamond Titan EA FX

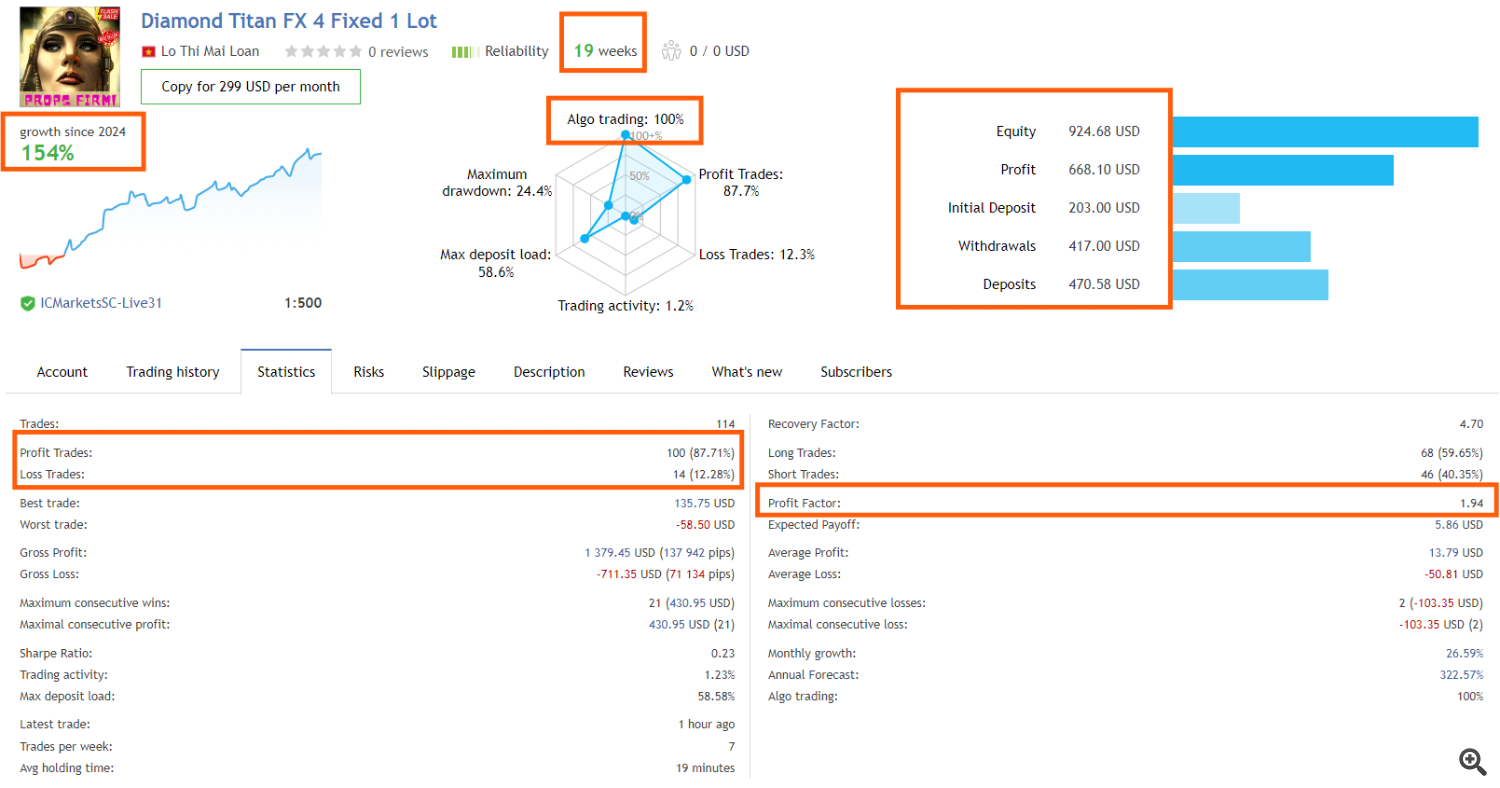

Diamond Titan FX EA is one of the most reliable EAs available today, with the following outstanding features:

– Safety and Good Risk Management: This EA values safety and does not place too much risk in a single trade. Therefore, although it may experience drawdowns, the account is unlikely to be wiped out because it always has a clear stop loss (SL).

– No Martingale or Grid Strategies: Diamond Titan EA does not use high-risk strategies like Martingale or Grid, protecting your account from significant losses. Martingale is a strategy that increases trade volume after each loss to recover losses, while Grid involves opening multiple orders at different price levels. Both strategies carry high risks and can lead to account wipeout.

– Diverse Trading Strategies: Diamond Titan EA uses diverse trading strategies, including scalping and swing trading, to maximize market opportunities. Scalping is a short-term strategy aiming for small profits from minor price movements, while swing trading is a medium-term strategy targeting profits from larger price swings.

Illustrative images of Diamond Titan EA’s trades will give you a clear view of the EA’s performance and operation. You can review detailed trade reports and performance charts to accurately assess the effectiveness of Diamond Titan EA.

5. Other Notes When Using EA

– Testing Before Use: Before using any EA, thoroughly test it using a demo account. This helps you understand how the EA operates and adjust settings to match your trading style.

– Regular Updates: EAs need to be updated regularly to adapt to market changes. Ensure that you are using the latest version of the EA and follow updates from the developer.

– Risk Management: Always manage risks carefully by using stop loss and take profit. Never invest all your capital in a single trade and always keep a reserve portion in your account.

– Monitoring Performance: Continuously monitor the EA’s performance and make necessary adjustments. If the EA does not achieve the expected results, consider the influencing factors and change the strategy if needed.