EUR/USD PRICE FORECAST:

Your Free Guide to the EURO for the Rest of Q3 Below

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: USD/JPY, EUR/JPY Update: A Temporary Pause Before Bullish Continuation?

EUR/USD put in impressive gains early in the US session before a return of Dollar strength saw the pair surrender the 1.0900 handle once more to trade at 1.0872 at the time of writing.

US DATA

US data this afternoon showed that initial jobless claims declined by only 11k and came in at 239k following a revised print of 250k last week. The Philly Manufacturing Business Outlook smashed estimates following on from yesterday’s positive retail sales data but failed to arrest the Dollar’s slide. Massive improvements in general activity, new orders and shipments were all positive for the first time since May 2022. Expectation for the next 6 months however were a bit underwhelming as most of the future indexes declined. A rare positive in the fight against inflation came as firms expect lower increases in prices compared to the previous quarter.

As the US session wore on it seems any positive change to sentiment faded away as the Dollar roared back while risk assets faltered. EURUSD remains slightly positive for the day but the constant shift in sentiment continues to provide a modicum of support to the US dollar each time the Euro appears ready for a rebound.

The DXY for its part remains below the long-term descending trendline which is key as we head toward the weekend with the Jackson Hole Symposium kicking off next week as well. Could the Fed spring a surprise at Jackson Hole which did not disappoint last year and could get markets out of its August malaise.

Dollar Index (DXY) Daily Chart – August 17, 2023

Source: TradingView

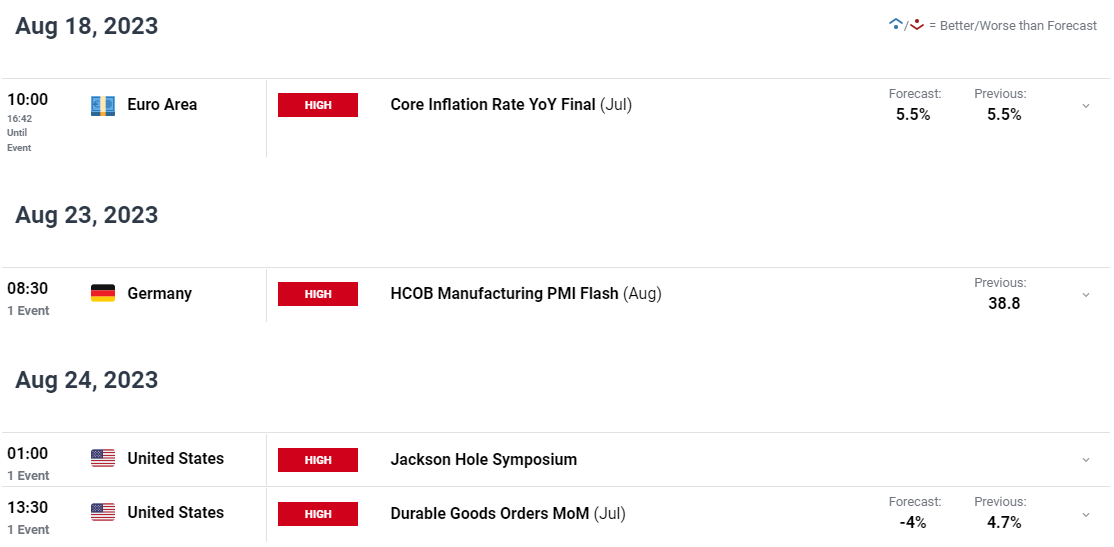

RISK EVENTS AHEAD

From a risk event perspective there isn’t a lot on the horizon for the US over the next week or so in the lead up to the Jackson Hole Symposium. Some mid-tier data early next week is the highlight with focus shifting to the Euro Area instead.

Tomorrow brings the Euro Area inflation final number which may stoke volatility should there be a significant change from the preliminary number. However, should the print come in as expected EURUSD could be driven by overall sentiment heading into next week.

For all market-moving economic releases and events, see the DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL OUTLOOK AND FINAL THOUGHTS

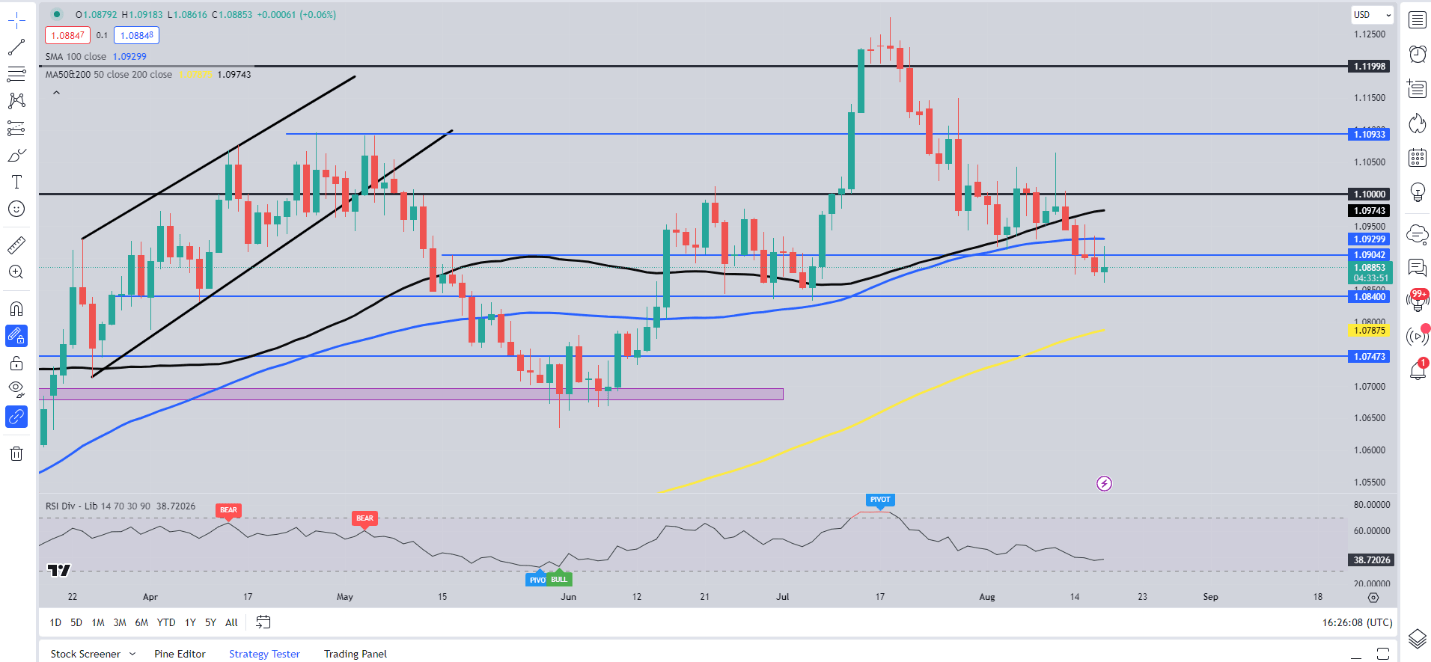

Looking at EURUSD from a technical perspective and the attempted bounce today failed to take out the previous four hour swing high as the pair continues to print lower highs and lower lows.

Looking at the daily timeframe and we can see on the chart below we have had 3 consecutive days of an attempted recovery being met by selling pressure with the 100-day MA likely to serve as a key area of resistance with a break higher facing another challenge in the form of the 50—day MA resting at the 1.0974 handle.

Looking at the RSI (14) and we are approaching oversold territory with another leg to the downside likely to be met by some form of buying pressure. Immediate downside support rests at the 1.0840 handle before the 200-day MA becomes an area of focus around the 1.0787 handle.

EUR/USD Daily Chart – August 17, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently Net-Long on EURUSD, with 59% of traders currently holding LONG positions.

To Get the Full IG Client Sentiment Breakdown as well as Tips, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 3% | -6% | -1% |

| Weekly | 18% | -21% | -1% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda