EUR/USD Analysis

Recommended by Richard Snow

How to Trade EUR/USD

German Inflation Steadies in July but the Job is Far from Done

German inflation met expectations, rising 6.2% year-on-year as forecasted, with a month-on-month rise of 0.3%. The data comes after the EU experienced a second successive month where core inflation printed at 5.5% and headline inflation eased from 5.5% to 5.3%.

Customize and filter live economic data via our DailyFX economic calendar

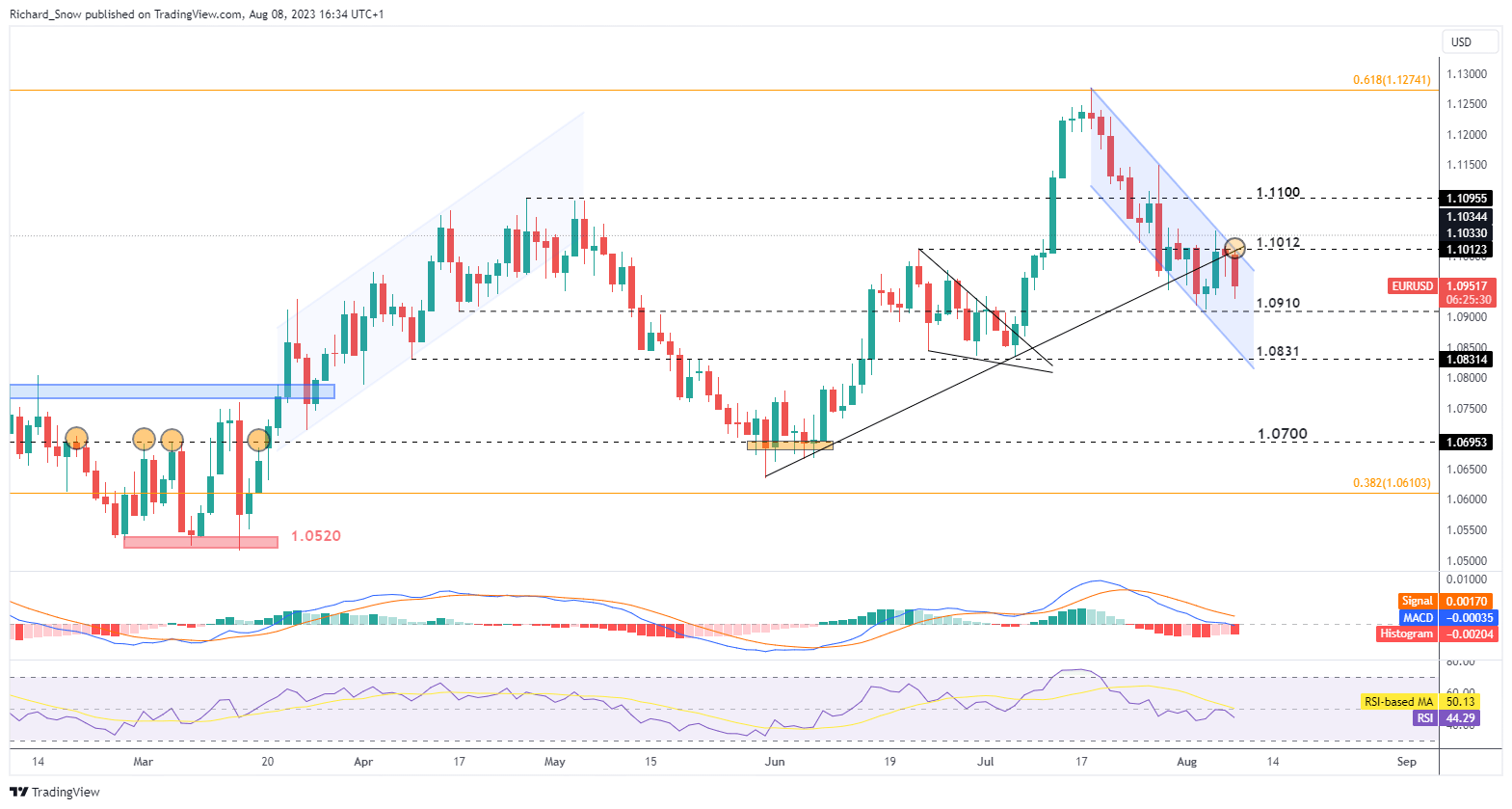

EUR/USD continues to trade within the descending channel, which emerges within a larger long-term uptrend (weekly chart). At the end of last week, price action traded and closed below trendline support – hinting at an extended selloff. However, with the Fed and ECB at or nearing peak rates and experiencing mixed progress on inflation, the pair has seen shorter-term swings up and down.

Such directional uncertainly complicates the trading outlook but today’s price action could be telling for the pair’s future path. Often after a close below a trendline it can be prudent to await a retest and rejection of the trendline, this time acting as resistance. Today’s price action witnessed an open around the confluence zone at the intersection of the prior trendline support (now resistance) and 1.1012 – the June high of this year. Thus far, selling has ensued as the dollar caught a bid. Such USD price action is rather unexpected seeing as treasury yields have fallen and market implied rate hike odds hardly moved.

Nevertheless, if the selloff is due to extend, 1.0910 remains the next level of support, followed by 1.0831. Resistance appears at 1.1012 followed by the psychological level of 1.1100. The MACD suggests momentum remains to the downside.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

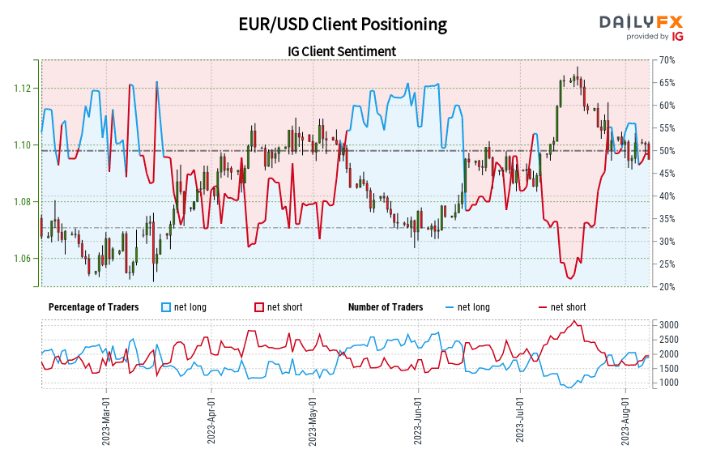

IG Client Sentiment Diverges – Offering Little Contrarian Value

The IG client sentiment indicator is great for taking a contrarian view to retail positioning during strong trending markets. The EUR/USD choppy descent and recent positioning doesn’t reflect a strong trending market while positioning around 50% offers very little too.

The broader trend, viewed on a weekly chart, helps to reveal that the pair trades lower within a broader uptrend – resulting in a rather challenging landscape for trend traders.

EUR/USD IG Client Sentiment Positioning

Source: IG, DailyFX, prepared by Richard Snow

EUR/USD:Retail trader data shows 52.04% of traders are net-long with the ratio of traders long to short at 1.09 to 1.We typically take a contrarian view to crowd sentiment, but positioning is no longer at extreme levels, rendering the effectiveness of the contrarian indicator less helpful.

For more on the IG client sentiment indicator and how to use it, read out guide by clicking on the banner below:

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX