Euro Vs US Dollar, British Pound – Outlook:

- EUR/USD is holding above vital support ahead of Euro area inflation and US PCE price index data.

- Expectations for the Euro area economy are running low, while that of US economy appear optimistic.

- What is the outlook and the key levels to watch in key Euro crosses?

Recommended by Manish Jaradi

How to Trade EUR/USD

The euro is attempting to recover some lost ground against its peers ahead of Euro area inflation data and US core PCE price index data due Thursday.

The price data comes in at a time when downside surprises in Euro area macro data have narrowed recently, with the Economic Surprise Index turning up meaningfully this month. In contrast, US economic data have been less overwhelming than in the recent past, supporting EUR/USD to some extent for now.

Economic Surprise Index – Euro Area and US

Chart Created by Manish Jaradi Using TradingView

However, last week’s PMI data, especially the sharp drop in services PMI, raises the risk that activity in the Euro area could contract again in the current quarter after expanding in Q2. The deterioration in outlook is a sign that the tightening in financial conditions is spilling over fast across the economy, providing room for the ECB to leave interest rates unchanged at its September meeting. The key question remains to what extent the negatives are already in EUR’s price. Moreover, consensus US economic growth expectations appear to be optimistic, leaving scope for disappointment.

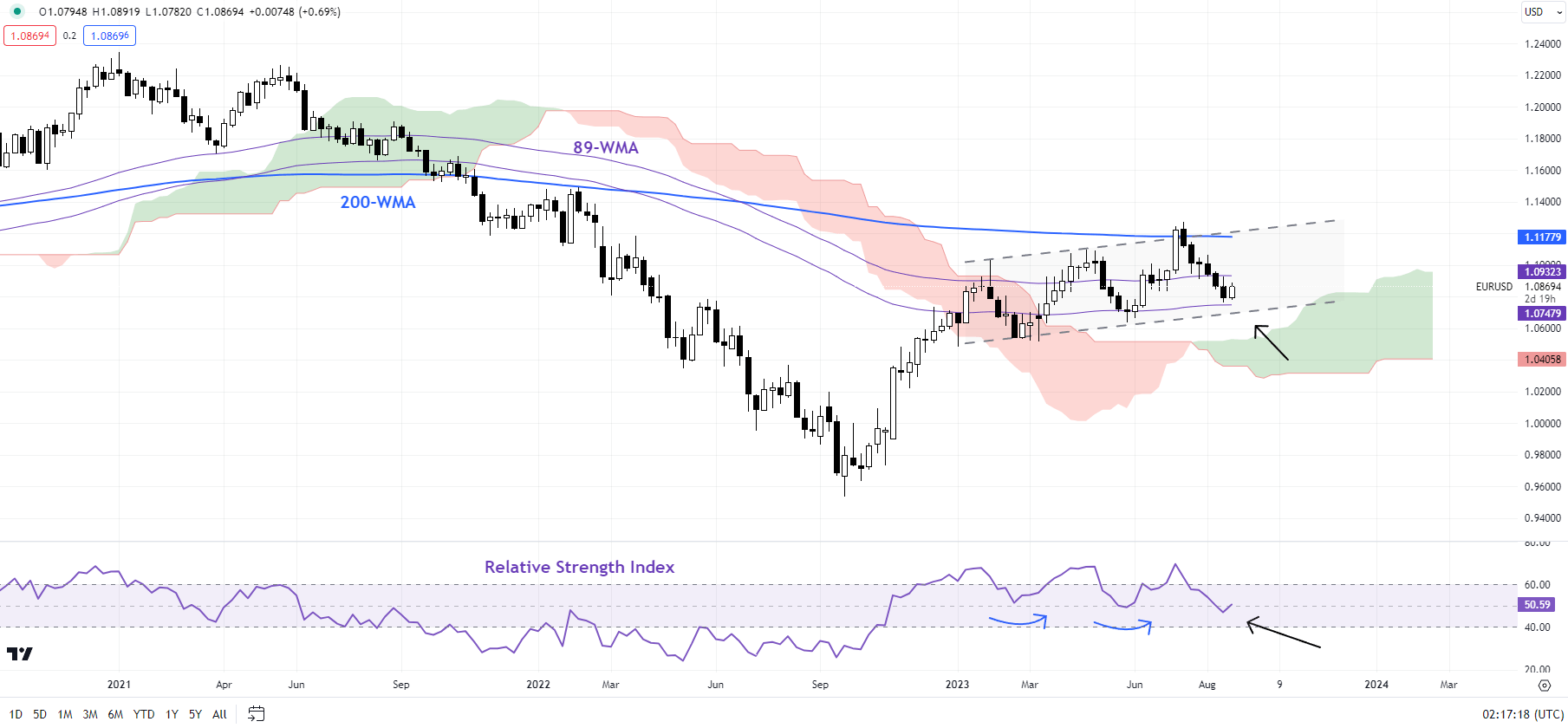

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Recommended by Manish Jaradi

Traits of Successful Traders

In this regard, the key focus is on Euro area inflation data due Thursday: Core inflation likely eased to 5.3% on-year in August from 5.5% previously. Meanwhile, the US core PCE price index is expected to have rebounded slightly to 4.2% on-year in July from 4.1% in June. If the data meet expectations, EUR/USD’s rebound could struggle to gain traction. On the other hand, a lower-than-expected US core PCE figure coupled with a smaller-than-expected drop in Euro area inflation could be a bonus for EUR/USD.

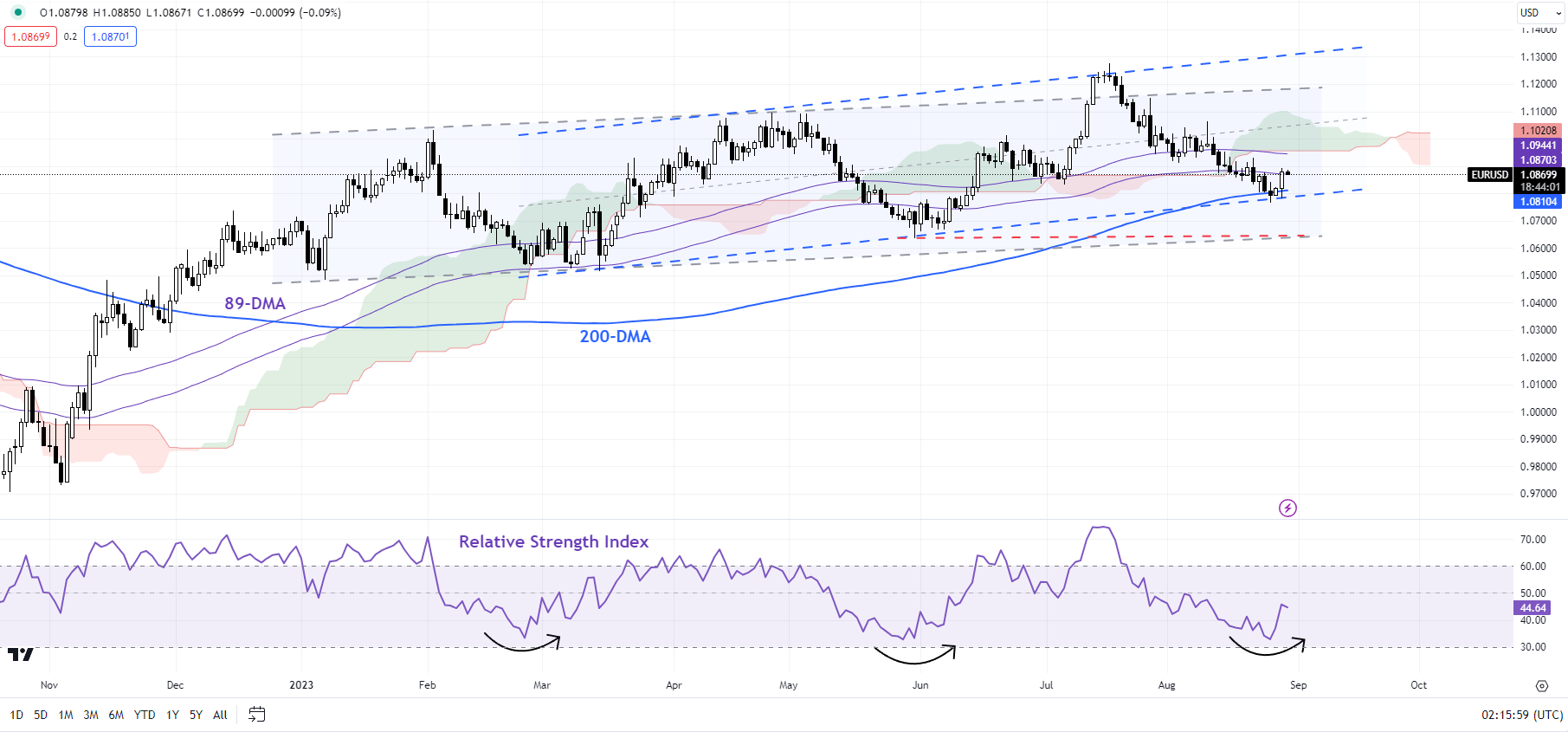

EUR/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Holding above key support

On technical charts, EUR/USD is holding above the 200-day moving average, coinciding with the lower edge of a slightly upward-sloping channel since early 2023. The 14-day Relative Strength Index has fallen to levels that were previously associated with a rebound in EUR/USD (see the daily chart).

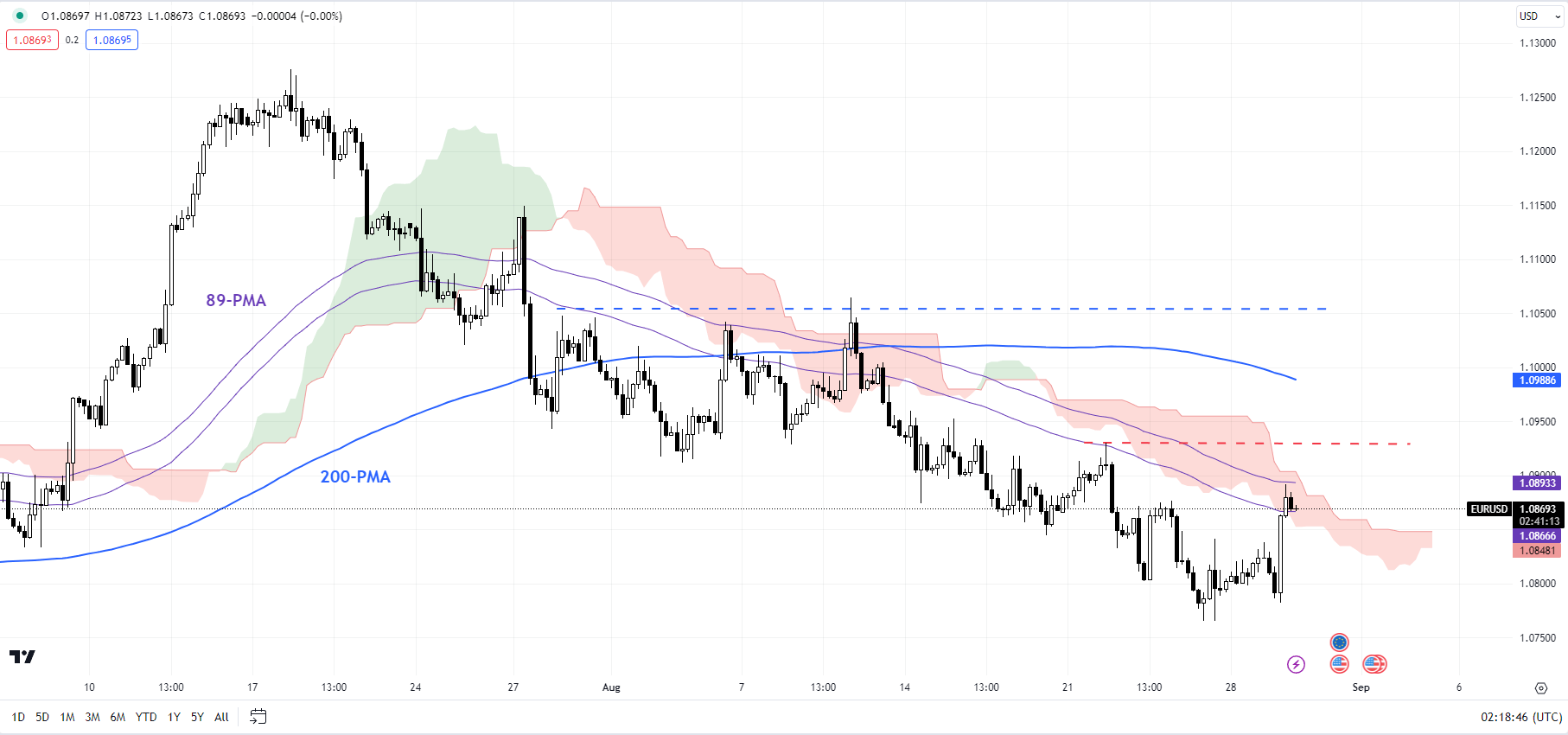

EUR/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Still, there is plenty of resistance for the pair to clear before the short-term outlook turns constructive again. The immediate hurdle is at last week’s high of 1.0930, followed by a stronger barrier at the early-August high of 1.1065. Zooming out, the retreat since last month hasn’t yet reversed EUR/USD’s broader uptrend – a break below 1.0500-1.0600 area is needed to pose a threat to the multi-month uptrend.

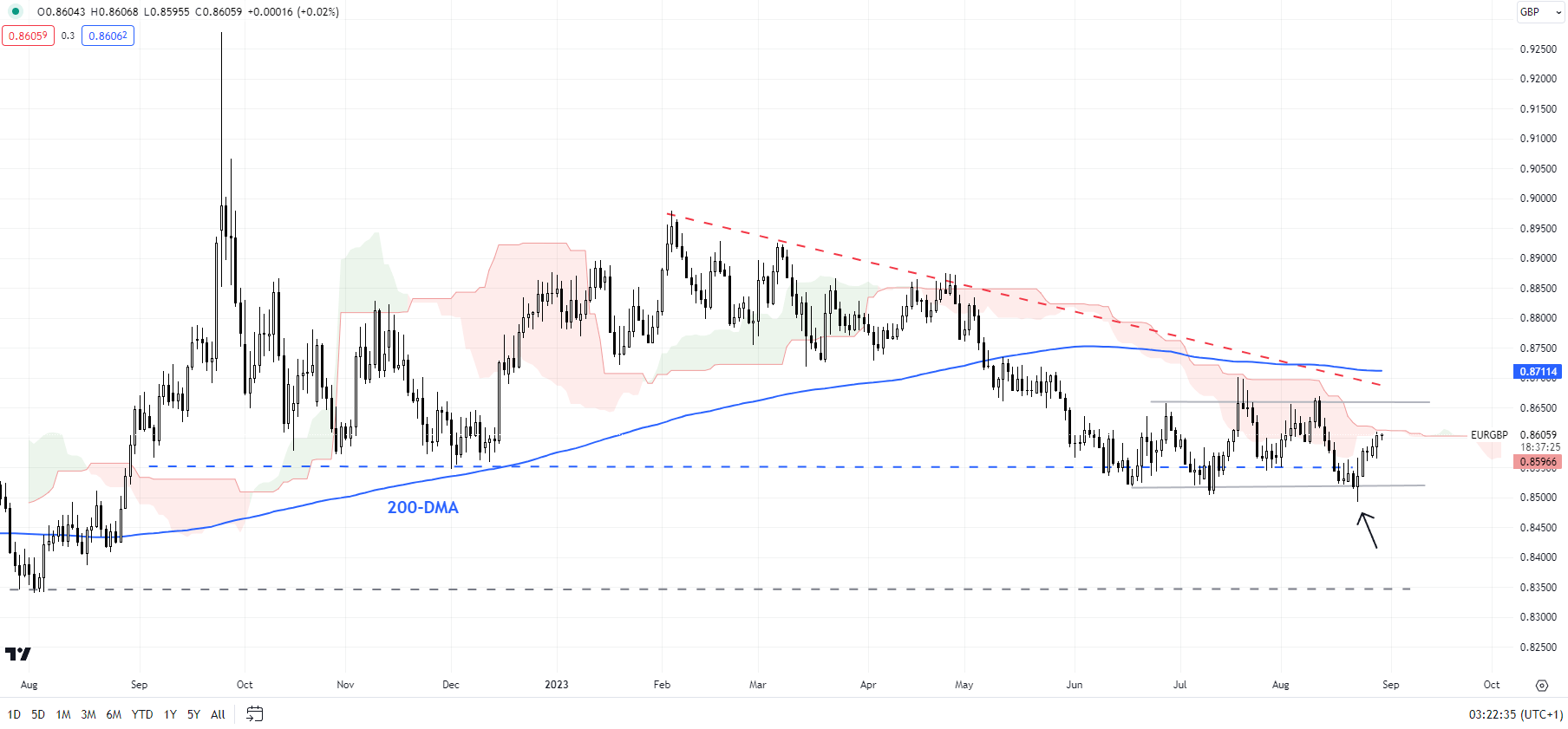

EUR/GBP Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/GBP: A test of patience for bears

EUR/GBP has once again rebounded from the major floor at 0.8550. Still, the rebound isn’t sufficient to suggest the broader bearish pressure is reversing. The cross would need to rise above a stiff converged hurdle, including the 200-day moving average, around the July high of 0.8700 for any rebound to be sustainable.

Recommended by Manish Jaradi

The Fundamentals of Trend Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish