GBP/USD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Download Your Free GBP Q3 Forecast Now

Read More: Dollar Index (DXY) Eyes Deeper Recovery with USD/CHF at 12-Year Lows

Cable saw Wednesdays drop extend into Thursday on the back of a stronger dollar as market participants position ahead of next weeks FOMC meeting. The US Dollar is facing some stern resistance while positive UK retail sales data this morning could keep cable moving higher in the short term.

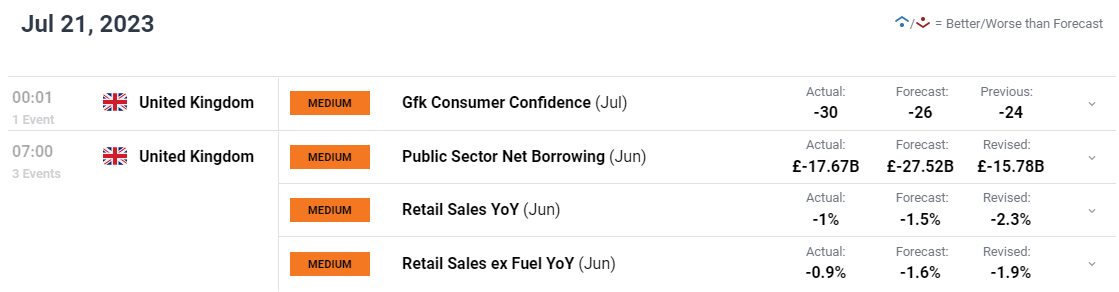

UK RETAIL SALES DATA AND US LABOR MARKETS

UK retail sales surprised to the upside this morning in what will likely serve as a positive indicator for the Bank of England (BoE) as it looks to hike rates at the September meeting. A positive retail sales print will reinforce the idea that UK consumers could handle higher rates as the fight against inflation continues. There were positive signs this week regarding UK inflation, but a lot still needs to be done with UK Chancellor Hunt stating that the UK will start to see results if they stick to their plan to halve inflation. The British Retail Consortium measured retail spending in June at 4.9% higher YoY with Barbeque food and garden furniture in high demand as the UK much like Europe grappled with one of the hottest months on record.

*Figure 1 shows the continued divergence between the quantity bought (volume) and amount spent (value) in retail sales over time because of price increases.

Source: Monthly Business Survey, Retail Sales Inquiry from the Office for National Statistics

US labor data remained robust yesterday adding a stamp of approval on a 25bps hike next week from the US Federal Reserve. The question on everyone’s lips however, is where will the Fed rates top out? At the moment the consensus seems to be for a 25bps hike next week before another pause. I for one had harbored hope that the Fed might spring a real big surprise and do something they haven’t done before and opt for a smaller rate hike of 10-15bps. However, the Fed have historically opted to hike rates in increments of 25-50bps which would make such a move even more controversial.

A dovish rhetoric and a 25bps hike next week could leave the US Dollar vulnerable to further losses and could work in favor of further upside for cable.

For all market-moving economic releases and events, see the DailyFX Calendar

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

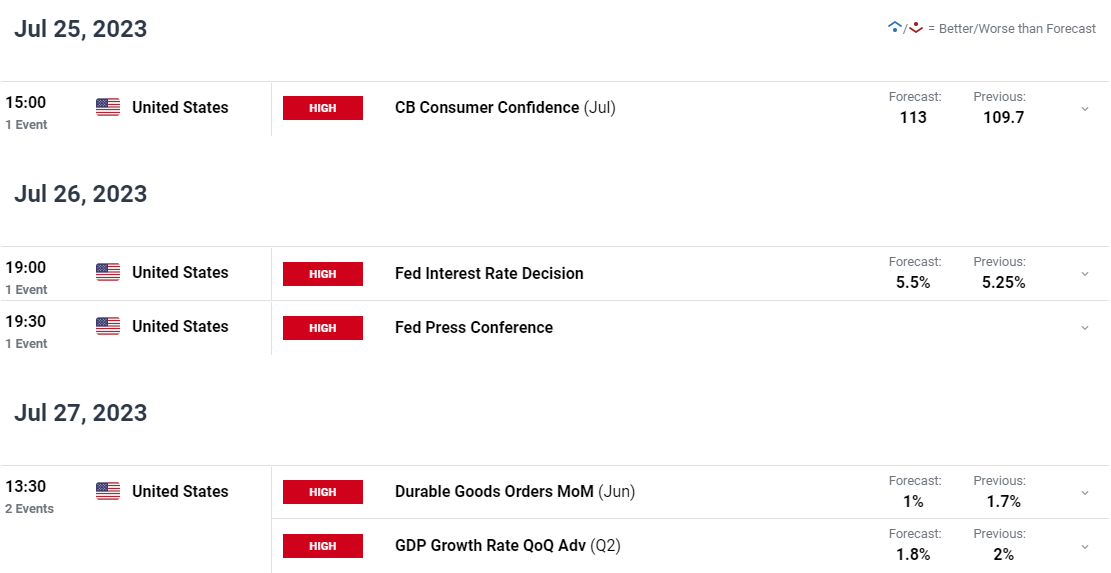

TECHNICAL OUTLOOK AND FINAL THOUGHTS

GBPUSD has been ticking lower since refreshing its YTD high on July 13. This morning’s bounce will be a welcome one as cable looks to snap a 5-day losing streak. Cable has found support at the June 16 swing high around the 1.2850 handle with the ascending trendline resting below and could provide dynamic support should we see further downside.

Looking at the overarching macro picture and we could be in for further downside heading into the FOMC meeting next and ahead of the Bank of England (BoE) in early August. As market participants price in a pause from the Fed following next weeks meeting and the BoE looking poised to deliver 2 more hikes at least the medium-term outlook for cable looks promising. Any attempted pullback toward the ascending trendline should excite potential given the lineup of different confluences. The 50-day MA provides further support currently hovering around the 1.2658 mark with a daily candle close below the 1.26000 mark invalidating the bullish trend.

Key Levels to Keep an Eye On:

Support levels:

- 1.2850

- 1.2700

- 1.2658 (50-day MA)

Resistance levels:

- 1.2900

- 1.3000 (psychological level)

- 1.3150 (YTD High)

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently SHORT on GBPUSD, with 54% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that GBPUSD may enjoy a short pullback before continuing to head higher toward the 1.3000 psychological level.

Recommended by Zain Vawda

Improve your trading with IG Client Sentiment Data

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda