Simplistic and easy to use Halftrend scanner.

https://www.mql5.com/en/market/product/69230

Please note, that this is not a full trading system. It will help you get initial Halftrend signals. And it’s to be used with your existing Halftrend strategies.

Get free Demo:

Demo version only allows 3 pairs. But contains all functionality of the actual dashboard.

So you can try it before buying 🙂

Use the attached Halftrend Indicator for your Chart template.

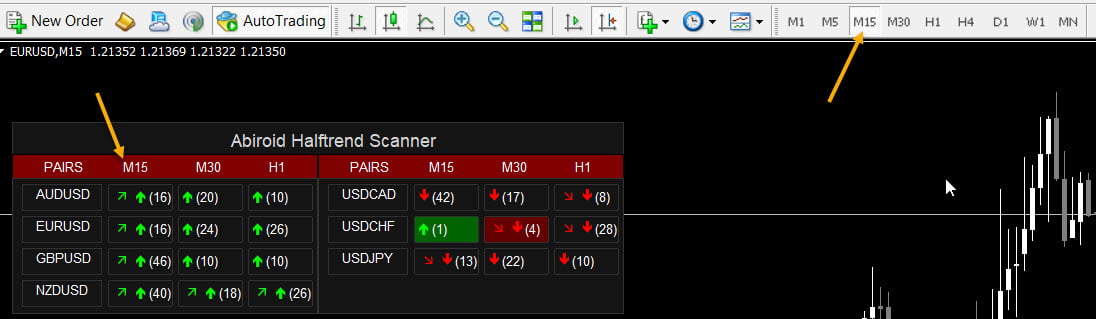

Dashboard refreshes every new bar. So set the MT4 base chart to the lowest timeframe in your dashboard:

Video Tutorial:

Halftrend is very good with finding trends:

Features:

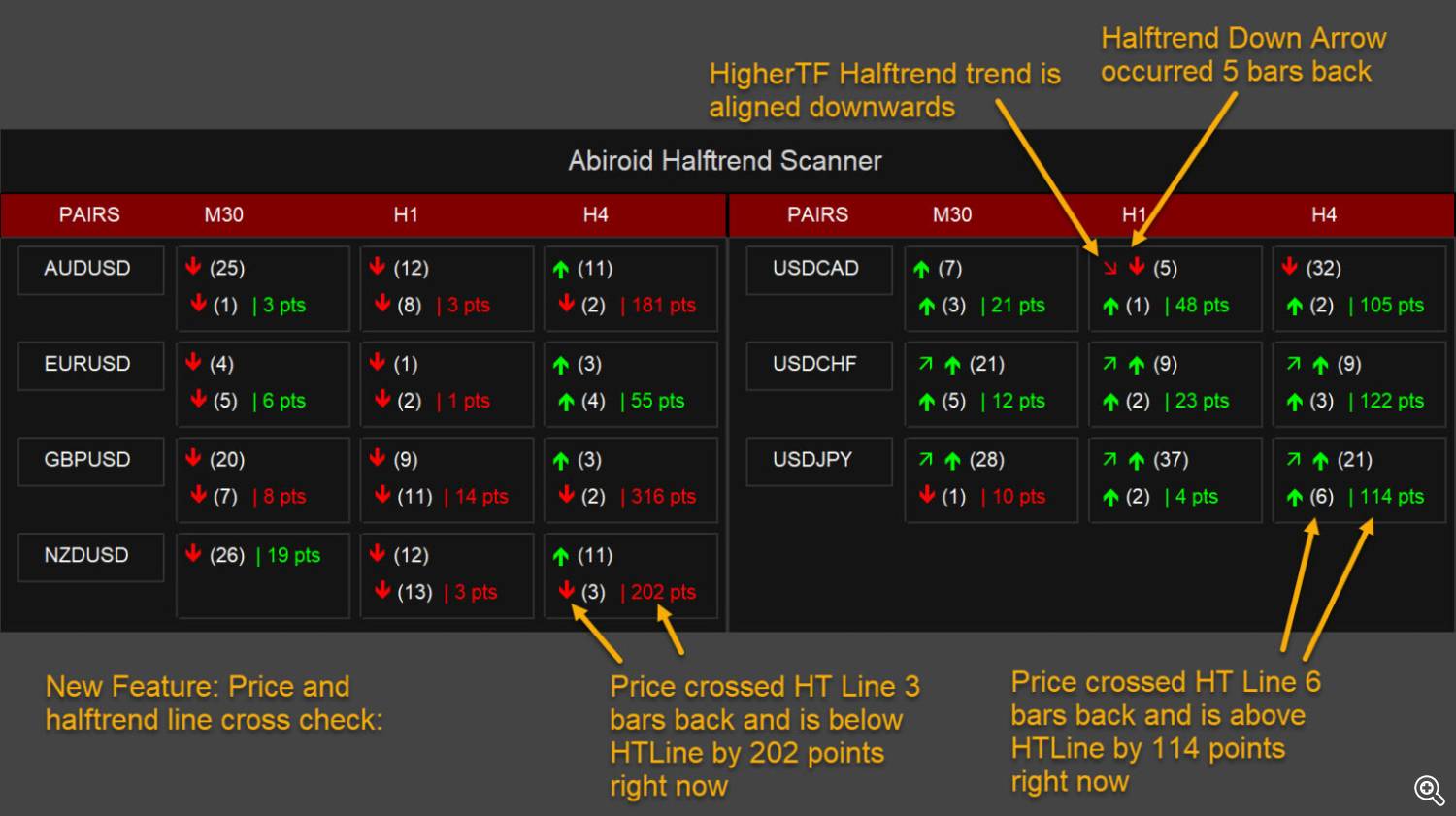

- Halftrend Arrow Scan:

- Scan Max Past Bars for Halftrend arrows. Show how many bars back the arrow occurred in a bracket

- Past Bars Back Alerts: Num of bars back for which scanner will send alerts

- Halftrend HTF Align:

- Scan Higher timeframes for Trend Direction of Halftrend Indicator and if trends align show a slanting Green/Red Arrow for Up/Down trend

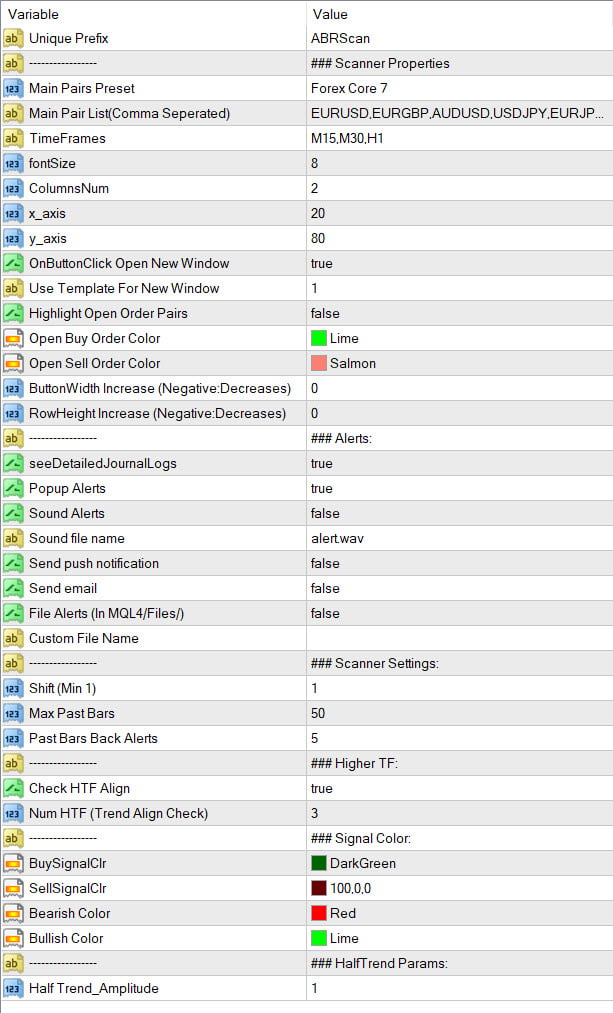

Settings:

See Scanner common settings:

https://abiroid.com/indicators/abiroid-scanner-dashboard-common-settings

Shift: Start scanning for halftrend from “Shift” bar to “Max Past Bars“. Shift is 1 by default. But if you are not interested in new signals 1 bar back, then keep Shift to higher value.

Don’t use 0, since halftrend might repaint while forming on current bar. Min possible value is 1.

Past Bars Back Alerts: Number of bars for which previous alerts are also sent. Suppose it is 5. And when you load scanner, it will also give alerts if Halftrend arrow had occurred 5 bars back.

Also Blocks will light up Red/Green if a signal was there within past 5 bars.

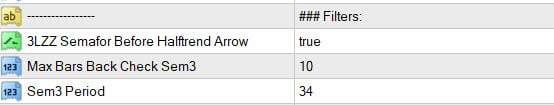

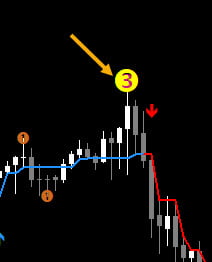

Filter: 3LZZ Semafor Before Halftrend Arrow:

If true, it will check for a semafor 3 occurring right before halftrend arrow (within Max Bars).

Even if you set “Max Bars Back Check Sem3” to a higher value like 20, make sure that price is still near the Sem3 price, and is on it’s support/resistance.

By the time halftrend arrow occurs.

If price has gone too far, by the time halftrend signal is there, avoid the trade. Or be careful.

It will alert and highlight only if a Semafor 3 is there. It uses this indicator to calculate Semafor3

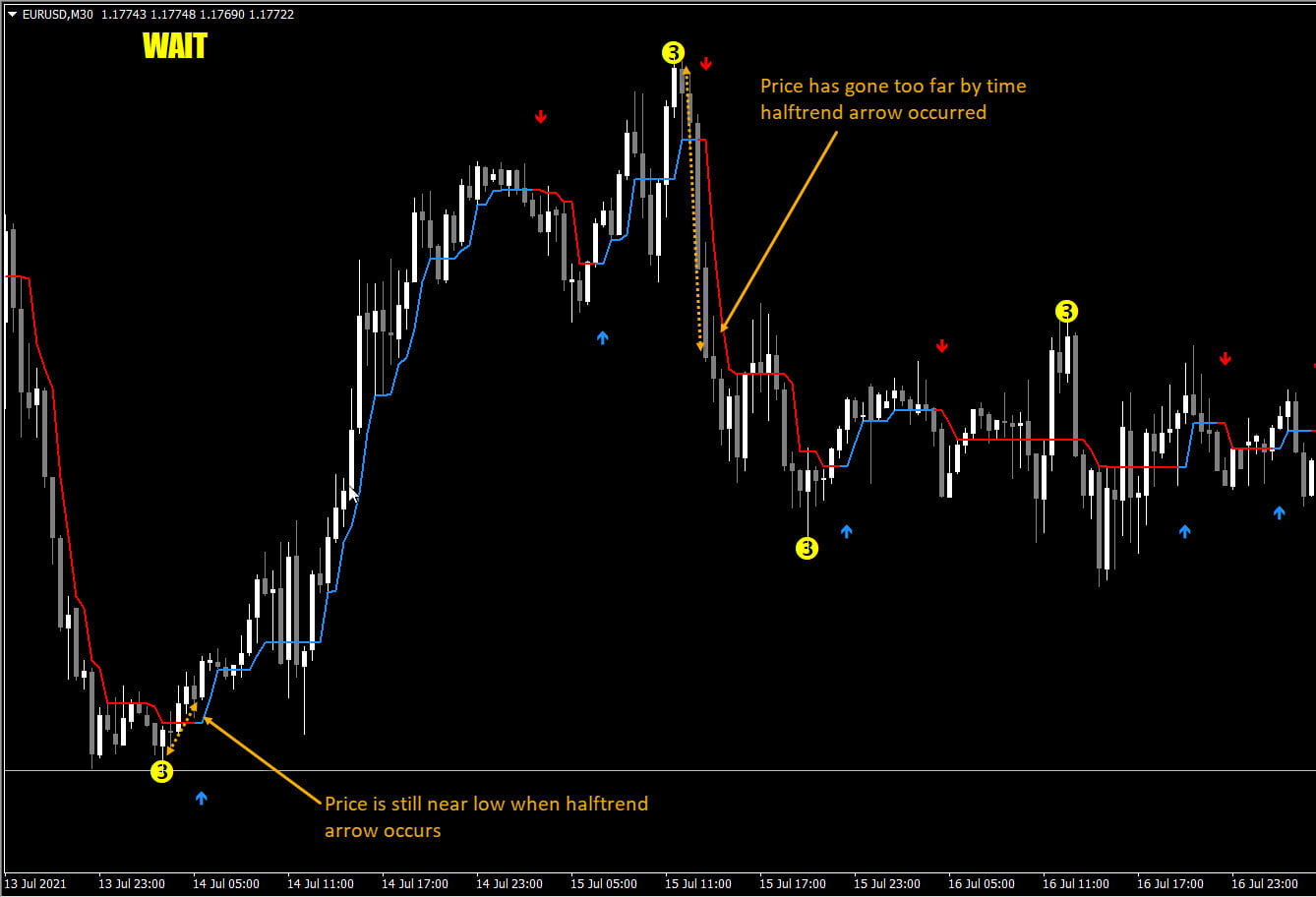

Halftrend and Price Cross Check:

If you need to know how long back did price cross Halftrend line (HT-Line).

Or if price is still in same direction as trend. And by how many points, then this check will be useful.

By default price crossing HT-Line alerts are off. You can also Show/Hide the Price and HT-Line Distance, Cross Arrows and bars in brackets.

Check HTF Align: Keep true, if you want to check Higher timeframe’s Halftrend direction

Alert only if HTF Align: If true show Halftrend Arrow alerts, only when all selected number of HTF are aligned in same direction

So, if up arrow occurs in current timeframe (say M15), and num of HTF check is 2. Then trend should be upwards in M30 and H1. Only then halftrend arrow alert will be shown.

Num HTF: Number of Higher timeframes to check for trend alignment with current timeframe.

Suppose current TF is M15 and “Num HTF” is 2. And current Halftrend direction is Bullish. It will check M30 and H1 for Bullish Trend as well. And show a slanting Up Green Arrow if Bullish.

Slanting Down Red arrow is for Bearish Alignment.

Halftrend Amplitude: Set to higher value to get halftrend arrows further apart and to get much longer trends.

How to read the symbols:

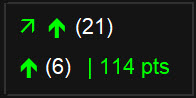

An up Halftrend Arrow had occurred 21 bars back. And selected number of Higher-timeframes are aligned in upwards halftrend Trend.

Price had gone below HT-Line and crossed back up HT-Line 6 bars back.

And price is now 114 points above the line.

Making Trades:

So, Halftrend can be used for trend based trading following a higher TF trend, or also for reversal based scalping.

When scalping, it is better to trade when market is going sideways. (quick: HT Amplitude 1, longer scalps: Amplitude 2)

And trend based is useful when market is in a consistent trend. (HT Amplitude 5)

Suppose price is moving in an UpTrend. But price crosses halftrend-line down and crosses it back up, then uptrend has held strong.

Also, the distance from halftrend-line will show how much price has progressed. Suppose price has already gone really far, then not good to get in trend now.

So, something like this will be good for a Trend based trade:

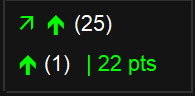

HT Arrow had happened 25 bars back. And Higher Timeframes HT-Trend is aligned upwards.

Also price has just crossed HT-line just 1 bar back, and is still near the HT-line by just 22 points.

And looking at chart, we see that price has been in a consistent up trend, but it does seem to be slowing.

I personally would not trade yet, until I see a strong volume breakout bar upwards, which breaks through the current resistance forming:

Point is, even in a trend, price makes smaller and smaller ranges. And then continues trend. When price starts to range, the price will cross HT-Line and back.

So, it will help detect those ranges, and trend continuation points. Especially with higher amplitude like 5.