Introduction

There’s a vast marketplace of trading strategies available online, often showcasing impressive “backtest” results that suggest these methods will perform just as well in the future as they did in the past. While these strategies may appear attractive and promising, key questions arise: How much trust should we place in these backtested results, and how confident can we be in risking our capital based on them? Most importantly, why would someone reveal a highly profitable strategy so easily?

Having developed and analyzed numerous strategies myself, I’d like to share some insights into how to properly evaluate the performance of a trading strategy and explain why, in many cases, backtested results may not translate to success in real-world trading. This evaluation can be the difference between choosing a truly robust strategy and one that’s just “curve-fitted” to look profitable on past data.

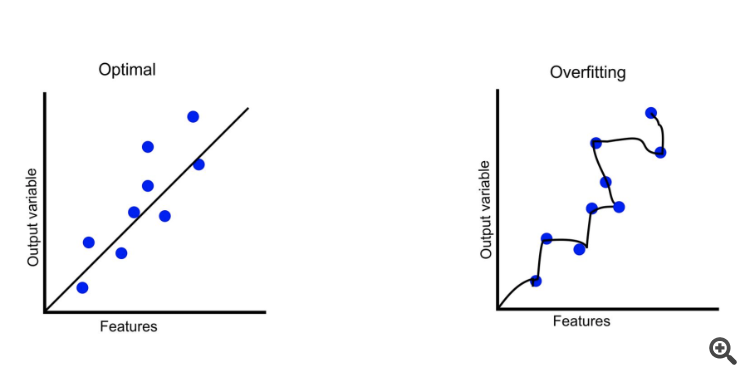

The Problem of Overfitting in Trading Strategies

One of the most common issues with unreliable strategies is overfitting. An overfitted strategy is one that appears highly optimized for past data, pinpointing the ideal buy and sell points in historical prices, but struggles to perform consistently in live market conditions. In essence, overfitting can create the illusion of a perfect backtest; in reality, it often leads to poor performance and financial losses when deployed in actual trading environments. Overfitting is especially dangerous because it capitalizes on random noise or patterns that may not be present in future data, rather than true, reproducible market behavior.

Examples of Overfitting

-

Example 1: The Perfect Trade that Never Happens Again

Consider this: Suppose I know that a stock price will move from 20 to 40 and then back down to 30. I could easily design a strategy to buy when the price exceeds 20 and sell as soon as it crosses 40, which would result in a flawless profit—on paper. However, such precise movements are highly unlikely to repeat in the future, rendering this strategy unreliable. The strategy works perfectly on the past data set, but its success hinges on a very specific pattern that is unlikely to recur.

-

Example 2: Fitting to Small Market Movements

Another example could be a strategy that looks for tiny price fluctuations within a certain range, like buying a stock when it dips by 0.5% and selling when it rises by 0.5%. A strategy like this might look amazing in historical backtests, especially in a highly volatile market where such fluctuations were common. However, when deployed in a less volatile environment, it might generate high transaction costs, poor liquidity, and frequent false signals. What looked like a profitable strategy is, in fact, too narrowly tailored to a specific historical period or market condition.

-

Example 3: Over-Optimized Indicator Combinations

Imagine combining multiple technical indicators like the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands, each with highly optimized parameters based on past price data. This may produce a strategy that appears to perfectly capture every profitable trend during a backtest. However, such fine-tuning often leads to overfitting because these indicator parameters are customized too precisely to the historical data, and they may not adapt well to different market conditions or new trends that emerge.

-

Example 4: Event-Driven Overfitting

Suppose a trader designs a strategy based on the idea that a stock tends to rise after a specific type of earnings report or news release. For instance, the strategy may be fine-tuned to profit from a 5% average rise after an earnings beat in a specific sector. The strategy performs well in backtesting during a period where that pattern occurred frequently, but when applied in live trading, it fails to replicate those gains. In reality, the market environment may have changed, or earnings reports may no longer follow the same predictable patterns, causing the strategy to underperform.

The illusion of success created by overfitting can be highly seductive for traders, particularly beginners who might take the backtest results at face value. It’s critical to identify overfitted strategies before using them in real-world trading. Below, we’ll discuss a few key factors to help distinguish genuinely robust strategies from those that are simply over-optimized for historical data.

Development Methods: Idea-Driven vs. Data-Driven Approaches

The way a strategy is developed plays a crucial role in determining its robustness. There are two primary approaches to strategy development:

-

Idea-Driven Approach

Here, the strategy arises from a well-defined trading idea or hypothesis, often rooted in economic principles or behavioral patterns observed in the market. This approach can involve reading research papers or using insights from the trader’s own experiences to build a simple, intuitive model. -

Data-Driven Approach

This method uses algorithmic tools to generate strategies, typically by running thousands of simulations across different combinations of indicators and parameters. Platforms like StrategyQuantX allow traders to backtest countless variations, identifying combinations that performed well in the past and discarding others.

Generally, data-driven approaches are more susceptible to overfitting, as they often involve experimenting with various parameter settings to find the “optimal” combination. In contrast, strategies rooted in a solid trading idea tend to be more robust and less likely to overfit, as they aren’t simply tailored to historical data.

Key Characteristics of Reliable Strategies

1. Simplicity and Intuition Are Key

A good trading strategy should be simple and intuitive. While it may seem that strategies leveraging advanced technology and complex algorithms would outperform simpler ones, they’re often more prone to overfitting past patterns that may not hold up in the future.

Strategies with many parameters tend to “learn” the historical data too well, which increases the likelihood of failing under new conditions. On the other hand, a strategy with fewer parameters is less likely to overfit, and if it has performed well over time, it may be tapping into a more persistent market phenomenon.

2. Testing Over a Long Timeframe

For a strategy to be considered reliable, it should be tested on at least 10 years of historical data. A longer testing period reduces the likelihood of overfitting, as it’s far more challenging to fine-tune a strategy that performs well over an extended timeframe. Additionally, longer backtesting periods introduce a variety of market conditions, including bull and bear markets, periods of high and low volatility, and economic events, ensuring the strategy’s robustness across various scenarios.

3. Performance Across Multiple Markets

A robust strategy should work across different markets. For instance, a strategy that only shows profitability on a single asset, such as gold, may be highly optimized specifically for that market and unlikely to perform well elsewhere. Reliable strategies tend to capture underlying market dynamics that can be observed across various assets, indicating that they’re less likely to be overfitted to a specific market’s historical data.

Additional Tests for Strategy Validation

In addition to the core characteristics above, several tests can provide further insights into a strategy’s robustness:

-

Walk-Forward Testing: This method involves backtesting the strategy over rolling time windows and adjusting the model periodically to evaluate performance stability.

-

Out-of-Sample Testing: By setting aside a portion of historical data that the strategy was not trained on, traders can observe if the model can perform well on entirely unseen data.

-

Monte Carlo Simulations: This test involves running simulations on the strategy with randomized order execution, spreads, or market conditions to check if it remains profitable under variable scenarios.

Why Relying on Backtest Profit Curves Can Be Misleading

Even if a strategy meets the criteria outlined above, it doesn’t necessarily mean it will yield consistent returns in the live market. Many traders make the mistake of relying solely on the profit curve in a backtest report. Unfortunately, backtesting can sometimes create an overly optimistic view, as it doesn’t always account for real-world factors such as:

-

Latency and Execution Delays: Delays in order execution in live trading can affect entry and exit points, leading to different results than those shown in backtests.

-

Market Slippage: Large orders or trades executed during high volatility periods may incur slippage, where the actual price received differs from the expected price.

-

Changing Market Conditions: Backtests are based on historical data, which may not reflect future market behavior. Structural shifts in the economy, new regulations, and technological advancements can render even the most robust strategies obsolete.

Summary

To summarize, identifying a robust trading strategy that is not overfitted requires a keen eye and strict criteria. Here are the main points to keep in mind:

- Simplicity and Intuition: A good strategy should be straightforward and intuitive, avoiding excessive parameters.

- Sufficient Testing Period: Reliable strategies should be validated over at least 10 years of data to ensure consistency.

- Cross-Market Applicability: Strategies that perform well across multiple markets are generally more robust and less likely to be overfitted.

While following these rules doesn’t guarantee success, it does significantly reduce the likelihood of falling for overfitted strategies. If a strategy passes all these conditions, you have a better chance of finding a solid trading model.

But even then, does this mean you can completely trust the profit curve on the report? Unfortunately, the answer is still no. There are additional pitfalls in backtesting, particularly in platforms like MetaTrader, which I’ll discuss in my next article.

About Us

We are @lookatus, a dedicated team of traders and engineers committed to creating REAL profitable, systematic trading solutions. With a strong foundation in quantitative analysis and cutting-edge technology, our mission is to deliver reliable, data-driven trading systems that capitalize on market opportunities with precision and consistency. Beyond building advanced tools, we are passionate about empowering traders through practical education, equipping them with real, actionable insights to navigate markets intelligently and successfully.

Contact us at: haylookatus@gmail.com