Understanding Trend in Forex

What is a Trend?

Trends are essential in analyzing market patterns, as they can indicate potential future movements of a currency. Upward trends (bullish) suggest that the price is consistently rising, often driven by factors such as positive economic indicators or market sentiment. Downward trends (bearish) indicate a decline in prices, typically influenced by economic downturns or negative news related to the currency. Sideways trends (range-bound) occur when prices move within a specific range without a clear direction, often signaling indecision among traders. Understanding these trends is crucial for traders as it helps them make informed decisions based on historical price movements and market conditions. Identifying the trend and its strength can enhance trading strategies, allowing for better risk management and potential profit opportunities.To know the end of a trend in forex, traders often look for certain reversal patterns and indicators. Recognizing these signals can help in determining how to know the end of a trend in forex effectively. Additionally, tracking volume and price action can provide insights on how to know the end of a trend in forex. Using tools like moving averages can also assist in understanding how to know the end of a trend in forex. Would you like to know more about how to identify trends or any specific strategies?

Here’s an explanation of the types of trends:

Upward Trend:

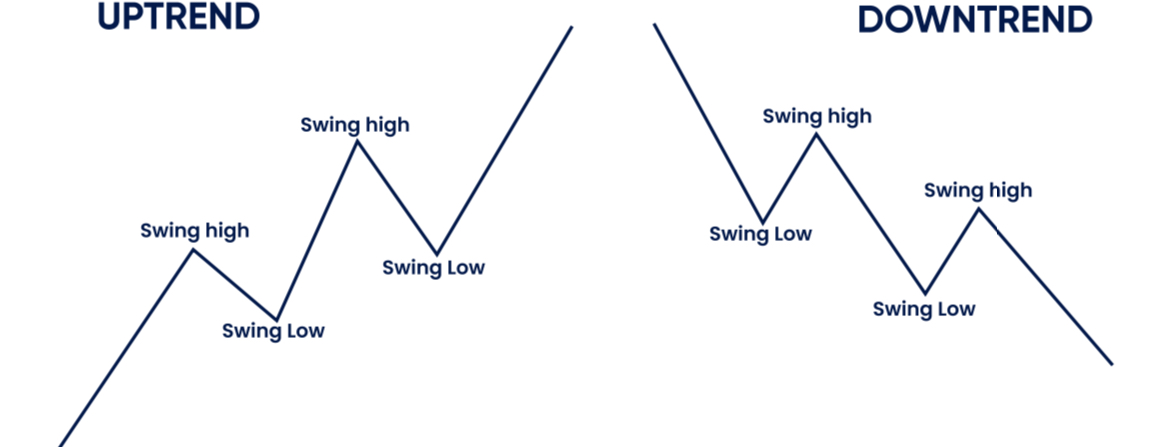

An upward trend, often referred to as a bullish trend, is characterized by a consistent increase in prices over a period of time. This trend indicates strong market demand, which drives prices higher. Investors often feel optimistic during this phase, as rising prices can lead to profits. A common indicator of an upward trend is the formation of higher highs and higher lows on a price chart. This trend may result from various factors, including increased consumer demand, positive news about a company or sector, or overall economic growth.

Downward Trend:

Conversely, a downward trend, known as a bearish trend, occurs when prices are consistently declining. This situation indicates a decrease in demand or an oversupply of goods in the market. During this trend, investors may experience anxiety and unease, as the decreasing prices can lead to losses. A downward trend is typically marked by the creation of lower highs and lower lows on a price chart. Factors contributing to a downward trend can include negative news, poor financial performance, or broader economic downturns.

Sideways Trend:

A sideways trend, often referred to as a range-bound market, occurs when prices oscillate horizontally over a period of time, showing little to no significant movement in either direction.This indicates a balance between buying and selling pressure, where the market is indecisive. During this trend, prices may fluctuate within a specific range, and traders often find it more challenging to make predictions. A sideways trend can be a signal of market consolidation, where buyers and sellers are assessing the market before making further moves. Each of these trends reflects different market conditions and investor sentiments, and understanding them is key to effective trading and investment strategies.

When Does A Trend End?!

Sure! Here’s a revised version of the text with the key phrase “When Does A Trend End” incorporated five times:—Below, you will find the current EUR/USD chart on the Daily timeframe, which presents a valuable learning opportunity as it indicates that ‘something’ is occurring here.The price was in a robust uptrend, but now we can observe a gradual shift. The inexperienced or unsuccessful trader will likely make the error of entering the market too soon, as they sense that a change is occurring. However, before they can determine when does a trend end, they need to wait for clear signals. The price has NOT yet signaled a move downward, and it is too early to act on the indication.This leads to an important question:

when does a trend end?

It’s crucial to understand the context of both trends and consolidations in trading.Many traders often wonder simply when does a trend end, which is more complex than it seems. With patience and practice, you’ll learn how to assess the market more effectively.In conclusion, let’s start from the beginning, and I will share a few essential principles that will enhance your understanding of trends and consolidations, particularly in answering when does a trend end.

Count of bearish versus bullish candles

When you notice an increase in bearish candles following an uptrend and the ratio between bullish and bearish candles shifts, it can serve as an initial crucial signal that a trend is losing momentum.

Ratio between wicks and bodies

During a trend, there tend to be smaller wicks and larger bodies as the price consistently moves in the direction of the trend. When candles begin to display longer wicks and smaller bodies, it indicates that something is happening and momentum might be diminishing.

Length of trend waves

As trend waves lose intensity, they become shorter. Before a market reverses, you can often observe that the final trend wave is significantly decreasing in length.

Support and resistance levels

Once the price starts to break the “higher high / higher low” or “lower high / lower low” pattern that characterizes healthy trends, you realize that something significant is taking place. In the case of the EUR/USD example, when the price breaches the previously highlighted blue level, it will register the first lower low for the first time in over four months. By integrating all these points, we can conclude that the trend is likely on the verge of reversing.

there are several intriguing ones in this context:

ATR – Average True Range

It illustrates how far the price has moved over a specific timeframe. As shown below, when the ATR is elevated, it typically signifies a turning point. During trending phases, the ATR usually remains lower. At those pivot points, volatility often increases, and the ATR can reflect this.

Historical Volatility (HV)

The same concept applies to HV, and we frequently observe a rise in volatility when a market approaches a critical juncture. Naturally, this won’t occur every time the market shifts direction, but it’s a good indication.

Bollinger Bands

they provide multiple signals simultaneously, whether it’s volatility, extremes, or exhaustion indicators. do not complicate matters; avoid layering on10 indicators and then attempting to decipher them. Instead, grasp the few essential principles that form our price charts, namely: volatility, momentum, velocity, and acceleration/deceleration.