Moving Average Stack:

MA Stack single timeframe, multi-timeframe and multi-currency versions for MT4 (Metatrader 4)

Very useful for finding current and higher timeframe trends. Best suited for long term trend based trading.

For quick scalping use fewer moving averages. And not suitable during low volatility. Only use during high volatility and steady trending markets.

Use this to enhance your existing Trend based strategies to find best trends. Instead of using as a standalone indicator.

You can get any of these variations depending on your needs:

MA Stack for Individual Charts:

Video Tutorial:

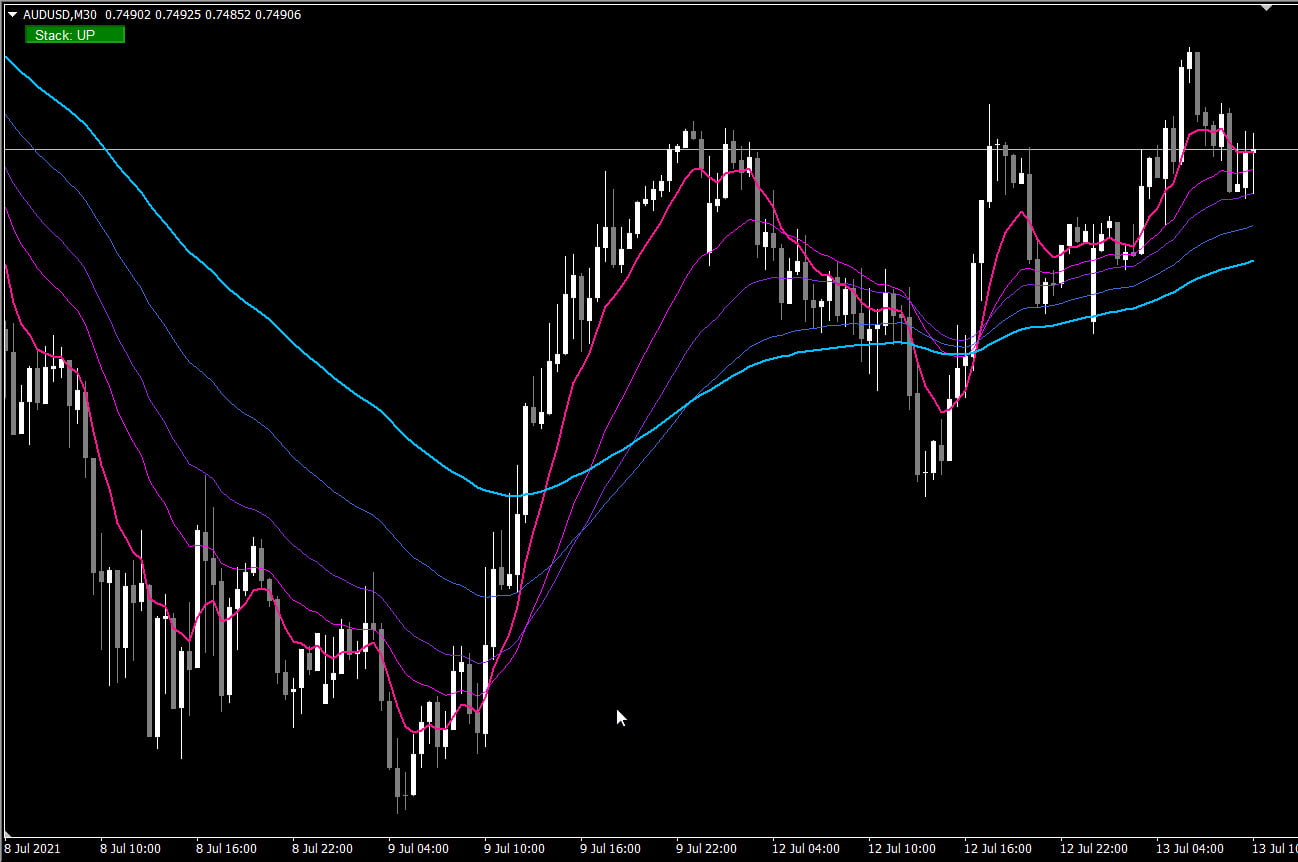

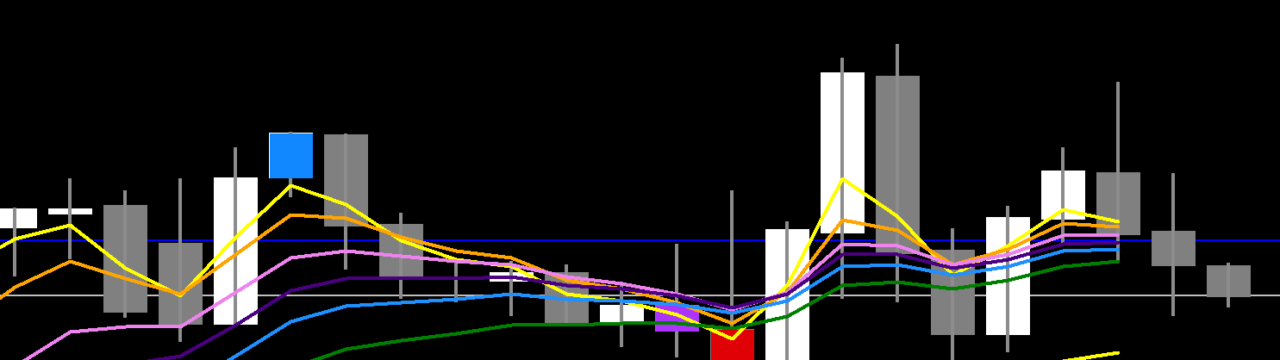

Basic MA Stack Indicator:

This is a single timeframe & single currency indicator. It looks at MAs and show 3 possible states on chart:

- When all MA Align Upwards: Stack Up

- When all MA Align Downwards: Stack Down

- If MAs not aligned: Stack None

You can position the small block on your chart. And get current status of the Stack:

You can use this template to get the above chart.

It is simplistic and very eash to use and can guide you to find good trends in your strategies.

Buy Stack:

When fastest above, medium MA in middle and slowest below. So the stack should look like screenshot above: 8 (above) > 21 > 34 > 55 > 89 (lowest)

Sell Stack:

When fastest below, medium MA in middle and slowest above. 8 < 21 < 34 < 55 < 89

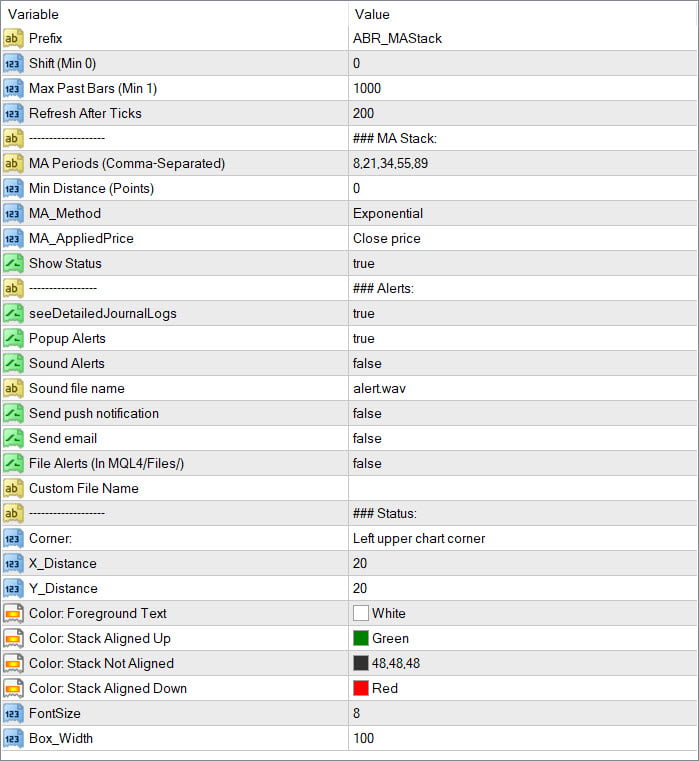

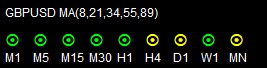

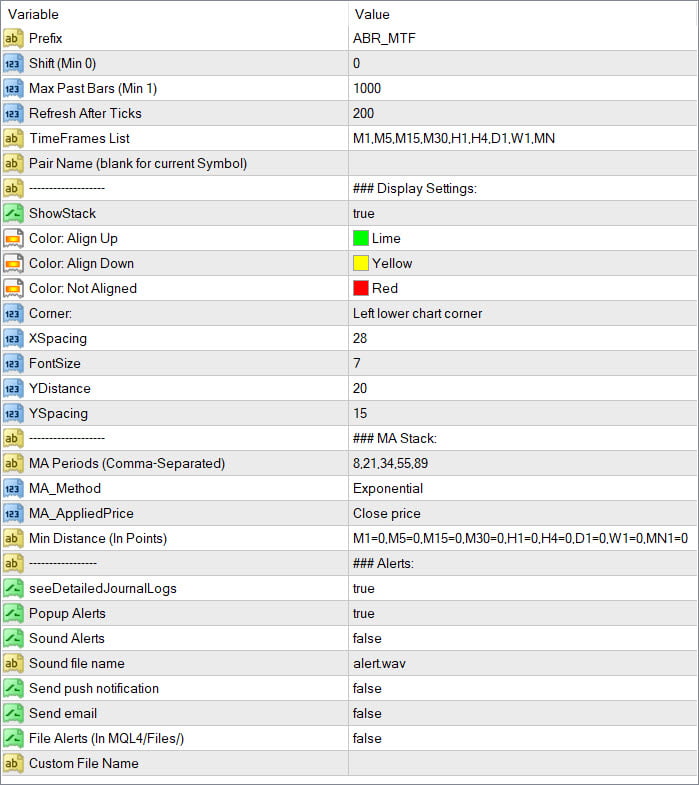

MA Stack MTF:

This is a Multi-timeframe and Single Currency Scanner. You can specify the Pair name and timeframes list (comma-separated).

It is very useful when trading strategies which depend on different timeframe trends. If you need to place multiple MTF indicators on chart, be sure to use a unique prefix for all.

And change the YDistance. And also YSpacing if you need it to be more compact.

Min Distance can be defined separately for each timeframe. It is a minimum distance in points.

It is checked for the distance between all MA individually.

Suppose M5=10,M15=20

Then for M5, it will check that all MAs are aligned.

And the 1st and 2nd MA are at least 10 points away from each other, 2nd and 3rd also, 3rd and 4th.. and so on. Same for M15 but with 20 points.

Min Distance will avoid signals like this. When MAs are aligned, but still too close together and price is obviously still ranging:

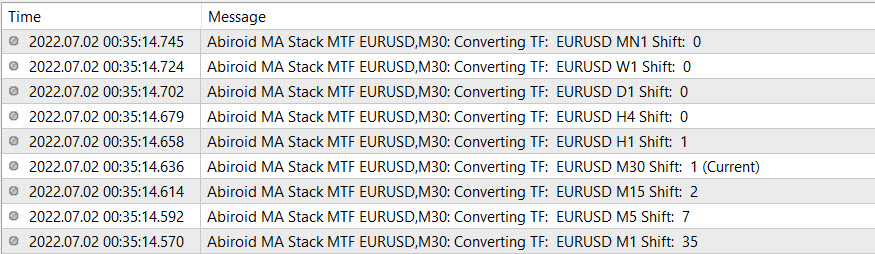

If false use same “Shift” for all timeframes. Or else convert bar’s time based on current timeframe.

You can see in Experts log which bar is used for which timeframe after conversion:

Suppose our current timeframe is M30 and Shift is 1. That shift bar’s timings will actually reflect different bar’s on different timeframes.

Bar 1 on M30 is still ongoing as bar 0 on higher timeframes. And it has already happened on lower timeframes several bar’s back.

But if you need Shift as 1 on all timeframes, keep “Convert Timeframes” to false.

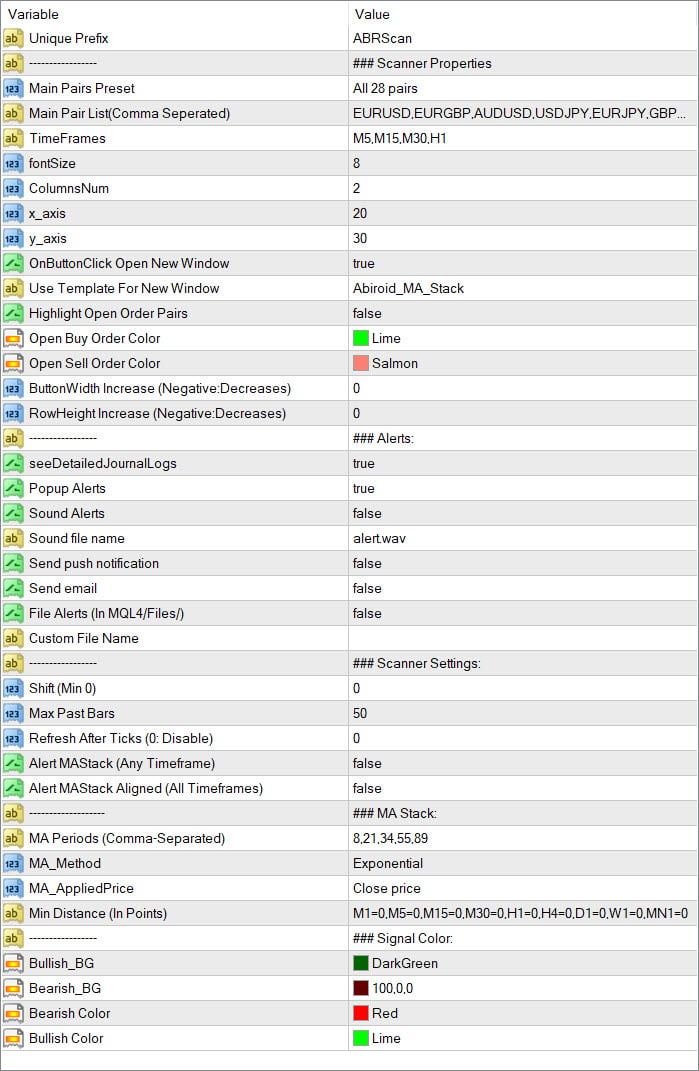

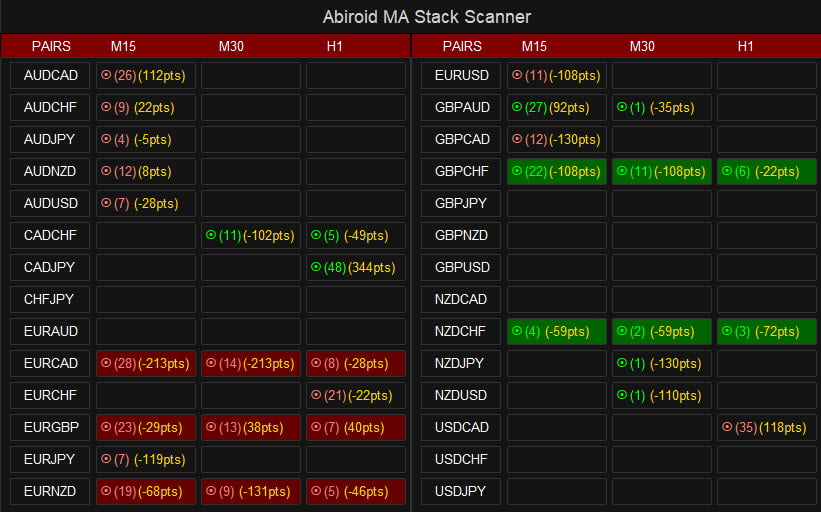

Full Scanner Dashboard:

Multi-Currency & Multi-Timeframe Full Scanner Dashboard.

This shows:

- MA Stack Up/Down

- And how many bars back the Stack happened (in brackets)

This is very useful to find which timeframes are currently in alignment.

If MA Stack aligned was more than MaxPastBars ago, then you will see (..)

Show Profit Points: true/false

If true, it will show how much Profit/Loss has happened in Points. Since the MAs were stacked.

This setting is useful, because even after MAs stacking happens, price can sometimes get stuck in a range. So, the points are helpful in knowing when the MA Stack happened and how far the price has come in how many bars.

Note that, if the stack happens, and if it stops even for a few bars, and then happens again. The Points will be calculated from the Candle Close of the most recent Stack’s starting bar to the current bar’s closing price.

Use this guide to see Common Scanner Settings:

https://www.mql5.com/en/blogs/post/747456