Microsoft’s Q4 Earnings Preview: Growth Momentum on Watch

When does Microsoft Corp report earnings?

Microsoft Corp is set to release its quarter four (Q4) financial results on 30 July 2024 (Tuesday), after the US market closes.

Microsoft’s earnings – what to expect

Market expectations are for Microsoft’s upcoming 4Q 2024 revenue to grow 14.5% year-on-year to US$64.4 billion, up from US$56.2 billion in 4Q 2023. This may mark a slowdown in year-on-year growth from the 17.0% delivered in 3Q 2024.

Earnings per share (EPS) is expected to increase 9% from a year ago to US$2.931, up from US$2.69 in 4Q 2023. Likewise, this may mark a softer read than the 20% year-on-year growth delivered in 3Q 2023.

Cloud segment remains on watch to drive earnings beat

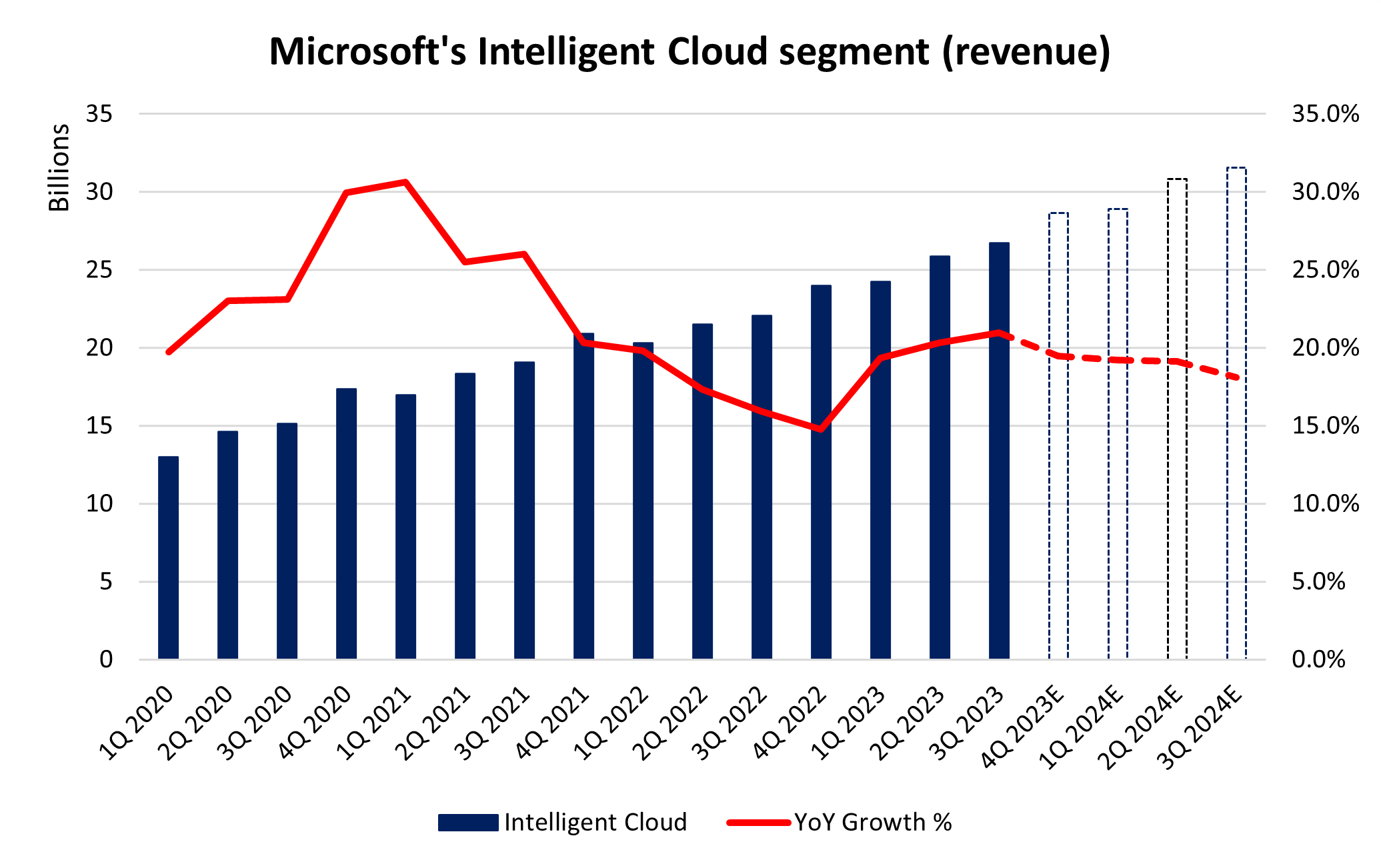

Microsoft’s Intelligent Cloud business remains as Microsoft’s highest-growth segment and accounts for 43% of its total revenue. For 4Q 2024, expectations are for the segment to grow 19.5% year-on-year to US$28.7 billion.

Previously, stronger-than-expected growth in this segment was one of the key reasons for the surge in Microsoft’s share price. During the quarter, Microsoft managed to improve its market share in the worldwide cloud infrastructure market to an all-time high of 25%, trailing just behind Amazon’s AWS at 31%.

That leaves little room for error ahead, given that a series of comments from Microsoft’s management team also seems to anchor expectations for the strong momentum in the adoption of Azure AI services to continue.

The management previously highlighted that the number of Azure AI customers continues to grow, average spend continues to increase and there is an “acceleration of revenue from migrations to Azure”. More famously, Chief Financial Officer Amy Hood said then that “near-term AI demand is a bit higher than available capacity”.

Source: Refinitiv

Product differentiators firing on all fronts previously. Growth momentum on watch.

Continued growth in several product offerings will remain on the lookout. Azure Arc, which allows its customers to run Azure services anywhere (across on-premises and multi-cloud platforms), has been up two-fold in the previous quarter to 33,000 customers.

New AI features have boosted LinkedIn premium growth, with revenue up 29% year over year previously. GitHub revenue has accelerated to over 45% year-over-year as well, fuelled by a surge in GitHub Copilot adoption. Microsoft Fabric, which is its next-generation analytics platform, has over 11,000 paid customers. Copilot in Windows is also available on nearly 225 million Windows 10 and Windows 11 PCs, up two times quarter-on-quarter.

Mass adoption of these features are likely to persist, with investors to keep a lookout on the growth progress ahead.

Cost pressures in focus amid cloud and AI infrastructure investments

In the previous quarter, Microsoft stated that it expects capital expenditures to increase “materially on a sequential basis” as a result of increased cloud and AI infrastructure investments. However, markets took comfort with the company’s guidance that despite the significant investments, FY 2024 operating margins will still up over 2 points year-on-year while FY 2025 operating margins will only be down only about 1 point year-over-year.

Any resilience in the company’s margins will be cheered. Market participants will also want to be assured that the huge investment cost outlay will be able to scale into profitable features quickly, rather than a long-term kind of a move. One may recall how Meta’s share price tumbled as much as 19% in its previous earnings release as investors did not buy into the company’s “long-term” investments in AI and the metaverse.

Other key segments may stabilize at double-digit growth

Microsoft’s “personal computing” segment has surprised on the upside in 3Q 2024, driven by a better-than-expected performance in gaming and Windows OEM. Year-on-year growth may stabilise at 11.2% in 4Q 2024, with expectations for recovery to continue ahead in the low double-digit growth.

Likewise, the “productivity and business processes” segment may offer a stable growth of 10% year-on-year in 4Q 2024, further underpinned by average revenue per user (ARPU) growth from continued E5 momentum and early Copilot for Microsoft 365 progress.

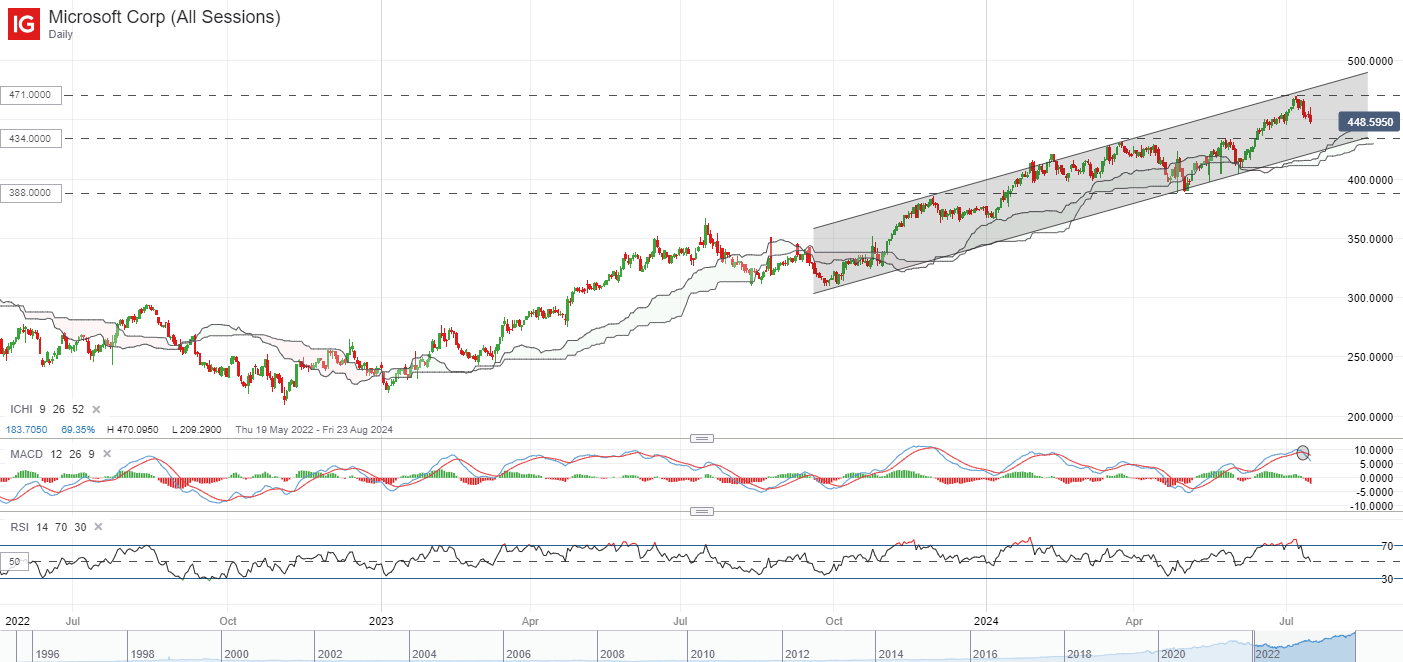

Technical analysis – Microsoft’s share price trading within a rising channel

On the technical front, Microsoft’s share price has been trading within an upward trend, with a display of higher highs and higher lows since October 2023. A rising channel pattern seems to be in place, with recent interaction with the upper channel trendline at the US$471.00 level finding some near-term resistance. A bearish crossover was also presented in its daily moving average convergence/divergence (MACD), which may raise the odds of a near-term breather.

Any deeper retracement may leave the US$434.00 level on watch as a key support confluence to hold. That said, it will probably have to take much more to signal a wider trend change, potentially with a breakdown of the rising channel as an initial indication. Until that happens, the broader upward trend prevails, with immediate resistance to overcome at the US$471.00 level.

Source: IG Charts