GBP/USD Forecast: Pound Sterling poised for further downside

GBP/USD stays under modest bearish pressure in the European session on Tuesday and retreats toward 1.3100. The technical outlook suggests that sellers retain control as focus shifts to August ISM Manufacturing PMI data from the US. GBP/USD closed the first day of the week virtually unchanged as trading volumes remained thin amid the Labor Day holiday in the US.

With trading conditions starting to normalize on Tuesday, the US Dollar (USD) benefits from the souring risk mood, causing GBP/USD to stretch lower. At the time of press, US stock index futures were down between 0.5% and 0.8%, pointing to a bearish opening in Wall Street. Read more…

GBP/USD takes a negative turn

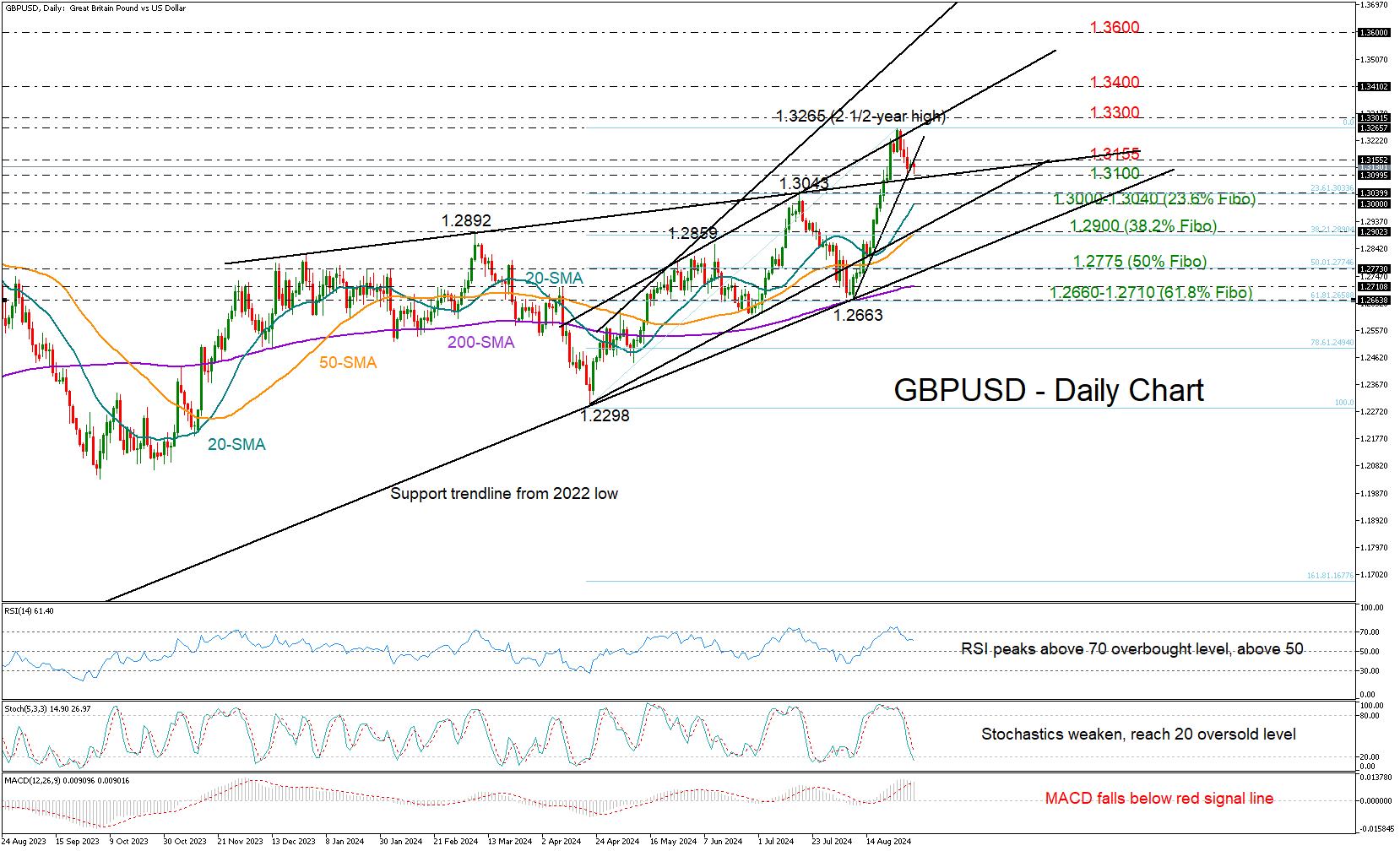

GBPUSD resumed its negative momentum during Tuesday’s early European trading hours, crossing below the steep support trendline, which had been curtailing the pullback from the two-and-a-half year high of 1.3265 over the past two trading days.

A decline below 1.3100 could motivate more selling towards the 23.6% Fibonacci retracement of the April-July upleg at 1.3040 and the 20-day simple moving average (SMA) at 1.3000. If the bears dominate there, the negative cycle could stretch towards the 38.2% Fibonacci mark of 1.2900 and the 50-day SMA. Another step lower could confirm a continuation towards the ascending trendline from 2022 seen around the 50% Fibonacci level and the 1.2775 level. Read more…