Should I Stop Loss Manually or Wait For Expert Advisor?

One of the biggest advantages of expert advisors is that they operate without emotions. This is particularly true for retail traders who almost always think and trade with emotions until they consume all of their capital.

But markets are not like this. Markets operate with professional traders and professional trading algorithms. They never trade with emotions and they stop loss when they need to without a slightest hesitation.

There are certain times in financial markets, when the common thoughts of market participants are readable from the charts and therefore we can understand the expected direction of the price movement.

In such situations, if our expert advisor opens a counter trend position , we do not need to wait till martingale or loss grows and sweep our margins.

Today I want to talk about this simple method that can easily be defined from the charts. This is the ‘V’ shape price movement.

When the price reaches a certain level, it either accepts it or it strongly rejects it.

This picture here is taken from SP500 index futures. As you can see, after leaving the consolidation zone price moves to a certain level with a minimal pullback at the first stop which is the second box.

This shows a typical situation for an acceptance. Price then continues to advance. In this case, when our expert advisor places a short position around the second box region, the position could potentially create trouble for us. The odds for a bad trade is very high. In this situation you should consider a manual stop loss or exit as early as possible if buyers can clear the most recent top.

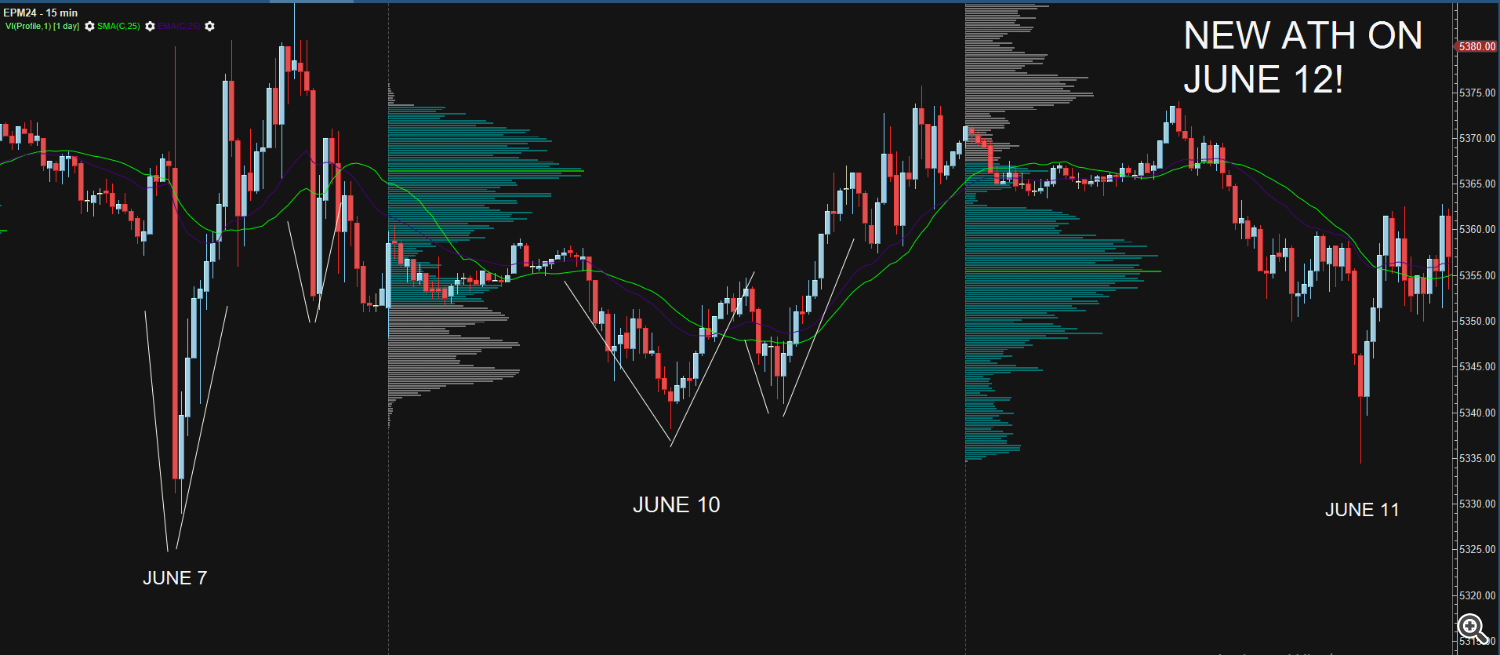

Now let’s give an example for the rejection scenario. In this example, between June 7 and June 11, we see 3 seller attacks but every attack has been defended and dips were strongly bought with “V” type price movements.

It is apparent that markets want to go up and we should not short in such situations. After 3 dip attempts, we see a new all time high on June 12. In such situations, if our expert places a short position around these dips, it could create big trouble for us. We should significantly consider stop loss or exit when possible.

In this short article, I have demonstrated a very simple yet powerful concept of trading. It is not magic or it is not a space science. It is just a simple rule of trading. Understanding this V shape price movements on M15 charts can save us from huge troubles.

Thank you for reading and I look forward to seeing you in my next article.

Best wishes,

Evren Çağlar