Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, S&P 500 Analysis and Charts

FTSE 100 approaches key resistance

The FTSE 100’s rally, triggered by weaker-than-expected UK inflation, is being boosted by June retail sales which came in at 0.7% versus an expected 0.2% and a downwardly revised 0.1% in May. The UK blue-chip index, which has so far risen by over 5% from its July low, is fast approaching its 7,679 to 7,688 resistance zone. It consists of the mid-May low and the mid-June high and as such may short-term cap. If not, the way would be open for the 7,806 mid-May high to be reached next.

Support is seen along the 200- and 55-day simple moving averages (SMA) at 7,599 and 7,573 as well as along the breached April-to-July downtrend line at 7,552.

FTSE 100 Daily Price Chart

Foundational Trading Knowledge

Macro Fundamentals

Recommended by IG

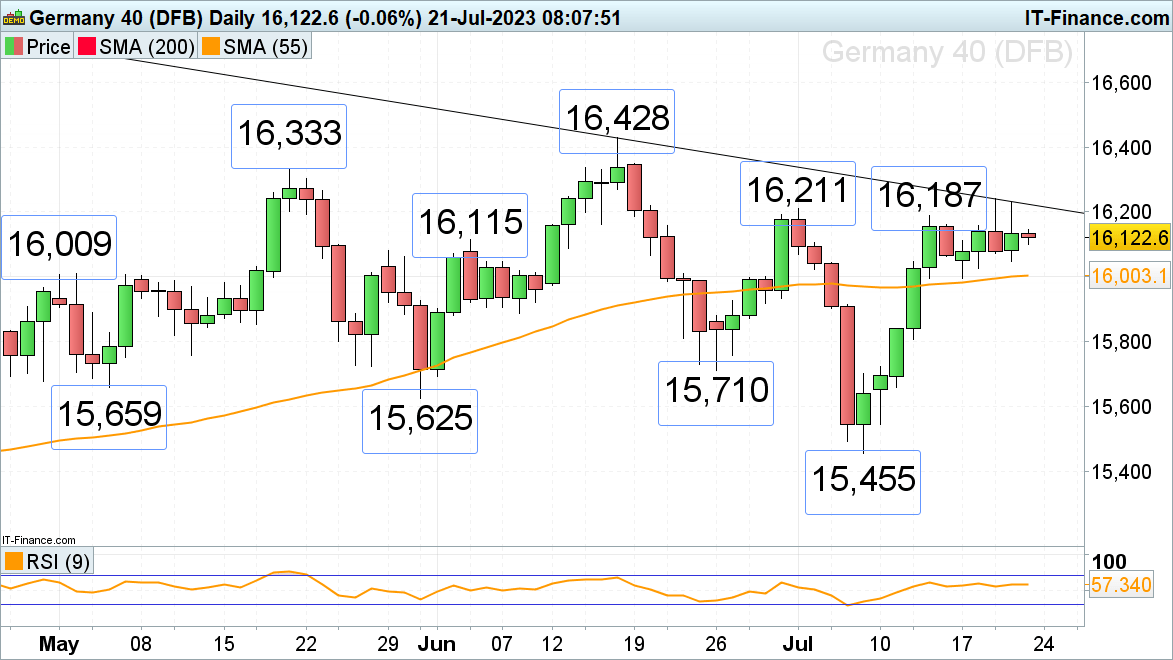

DAX 40 stays below key resistance area

The DAX 40 this week has only briefly managed to rise above its 16,187 to 16,221 previous July highs, to 16,240, before continuing to sideways trade amid mixed earnings.If this week’s high at 16,240 were to be bettered, however, the May peak at 16,333 would be next in line.

Immediate support can be spotted at Thursday’s 16,047 low and also between the 55-day simple moving average (SMA) and Monday’s low at 15,994.

DAX 40 Daily Price Chart

Recommended by IG

Traits of Successful Traders

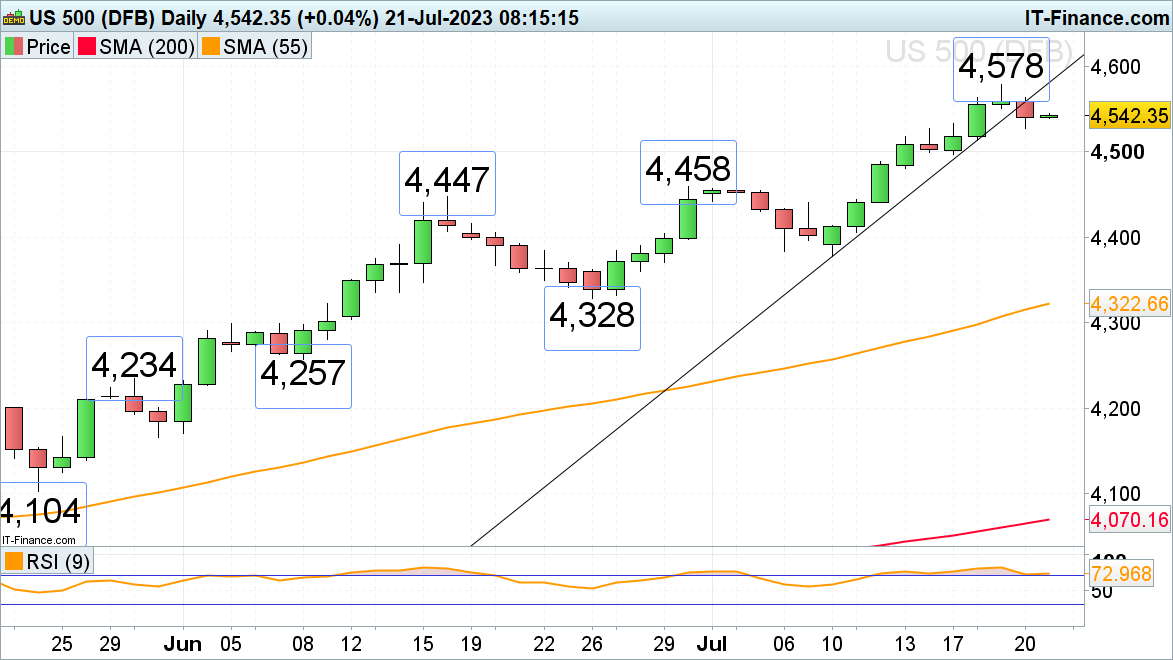

S&P 500 comes off its 16-month highs

Mixed corporate earnings provoked some profit-taking on the S&P 500 and have taken the index away from its 16-month high. Were this week’s high at 4,578 to be exceeded, however, the late January 2022 high at 4,595 and the March 2022 peak at 4,637 may be reached as well.

Minor support below Thursday’s low at 4,528 can be seen around Monday’s low at 4,498.