The risk to reward ratio—commonly known as the risk/return ratio—reflects the expected yield an investor may earn for each dollar they put at stake in an investment. Many investors use the risk to reward ratio chart to evaluate the potential returns of an investment in relation to the level of risk they must undertake to achieve those returns. A lower risk to reward ratio is typically more appealing, as it indicates less risk for a similar potential gain .In summary, the risk to reward ratio chart helps investors make informed decisions by comparing potential returns against the associated risks.

For instance: Imagine an investment opportunity with a risk-reward ratio of 1:5. This means that an investor is prepared to risk $1, with the potential to gain $5 in return .On the other hand, consider an investment with a risk-reward ratio of 1:2. In this case, the investor anticipates putting in $1, aiming for a possible return of $2 on their investment. This illustrates how different ratios can indicate varying levels of risk and potential reward associated with an investment.

Traders often adopt a savvy strategy to choose their trades wisely. This powerful ratio emerges from the calculation of what they stand to lose if an asset’s price takes an unexpected turn (the risk) compared to the potential profit they aim to pocket when they close the deal (the reward).

Did you know that successful traders often use this ratio to transform their mindset about risk-taking? By turning their attention toward potential rewards, they can better manage their fear of losses! By harnessing this insightful approach, traders can navigate the tumultuous waters of the market with confidence. They can effectively balance the scales of risk and reward, maximizing their chances of striking it rich! Plus, many seasoned investors recommend setting a target risk-reward ratio before entering a trade—kind of like having a treasure map guiding them to profits! Understanding this crucial ratio equips them to sharpen their strategies and seize lucrative opportunities as they arise. After all, in the world of trading, knowledge and preparation can mean the difference between merely surviving and thriving!

Utilizing risk/reward ratios

Utilizing risk/reward ratios effectively necessitates understanding what constitutes a favorable risk/reward ratio. A 1:1 ratio indicates that you are risking the same amount of capital if you are incorrect about a trade as you would potentially earn if you are correct. This parallels the same risk/reward ratio found in casino games such as roulette, making it essentially a gamble. The majority of seasoned traders aim for a risk/reward ratio of 1:3 or more.

The Dynamics of the Risk/Reward Ratio

In many instances, market analysts conclude that the ideal risk to reward ratio chart for investments is roughly1:3. This indicates that for every one unit of additional risk undertaken, there is an expectation of three units of return.Investors can effectively manage their risk to reward ratio chart by employing stop-loss orders and financial instruments such as put options. This approach aids them in achieving their financial goals while minimizing unnecessary risks.By carefully analyzing the risk to reward ratio chart, investors can gain insight into potential outcomes and make informed decisions. Overall, focusing on the risk to reward ratio chart empowers investors to navigate the market while enhancing their potential for success.

Shadows of Opportunity

In the ever-evolving landscape of trading, grasping the interplay between risk and reward is crucial for achieving success. Investors continuously seek effective strategies that align with their financial aspirations. Among the various metrics utilized in stock trading, the risk to reward ratio chart emerges as a vital instrument. This ratio enables traders to evaluate potential returns in relation to their risk appetite, guiding their decision-making processes across various trading styles. By delving into the intricacies of this essential metric, traders can refine their strategies, reduce losses, and enhance their investment journeys, all while leveraging insights from the risk to reward ratio chart.

Risk Dynamics

The risk/reward ratio is frequently utilized as a benchmark when trading individual stocks.

Varying Strategies

The optimal risk/reward ratio varies significantly depending on different trading strategies.

Personal Discoveries

Many investors often have a pre-established risk/reward ratio for their investments, and some rely on trial-and-error methods to find the best ratio for their specific trading strategies.

Components of the Ratio

A ratio is a relationship or comparison between two numbers or comparable quantities, typically expressed as a fraction.###

Components of a Ratio

1. Antecedent: This is the first term of the ratio. In fraction form, the antecedent is the top number or numerator.

For example, in the ratio (3:4), the number (3) is the antecedent.

2. Consequen: This is the second term of the ratio.

– In fraction form, the consequent is the bottom number or denominator. – In the example (3:4), the number (4) is the consequent.

Example:

If we consider the ratio of apples to oranges as (2:3): This means that for every (2) apples, there are (3) oranges.

Types of Ratios:

– Simple Ratios: Ratios that can be simplified.

– Complex Ratios: Ratios that involve various scenarios, such as the ratio of area to perimeter.

Concept of Risk and Reward Trade-off

Based on the principle of risk-return tradeoff, if an investor is prepared to tolerate a greater chance of losses, their invested capital has the potential to yield greater returns. To assess investment risk, investors utilize metrics such as alpha, beta, and Sharpe ratios.

Calculating Risk-Return

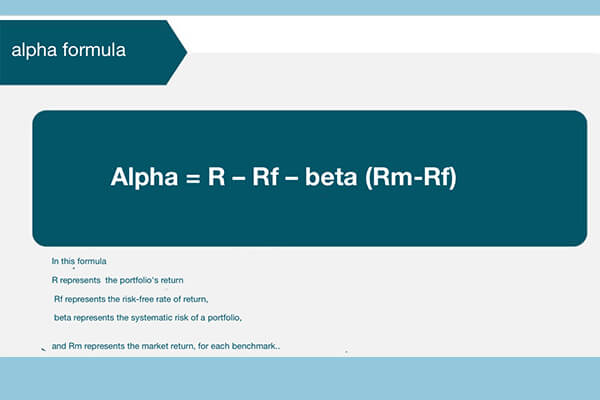

Alpha Ratio

– The alpha ratio is a measure used to assess the excess return of an investment compared to a benchmark index.

– It indicates whether an investment has effectively capitalized on its risk to achieve returns above what the market would predict.

– A positive alpha value signifies outperformance relative to the benchmark, while a negative value indicates underperformance.

Beta Ratio

– The beta ratio reflects the volatility of a stock relative to the overall market, commonly measured against the S&P500 index.

– To calculate beta, you divide the variance (which measures the market’s fluctuations relative to its average) by the covariance (which indicates the correlation between the stock’s return and the market’s return).

– A beta value greater than 1 indicates higher volatility compared to the market, while a value less than 1 signifies lower volatility. This ratio can help investors adjust their investment strategies accordingly.

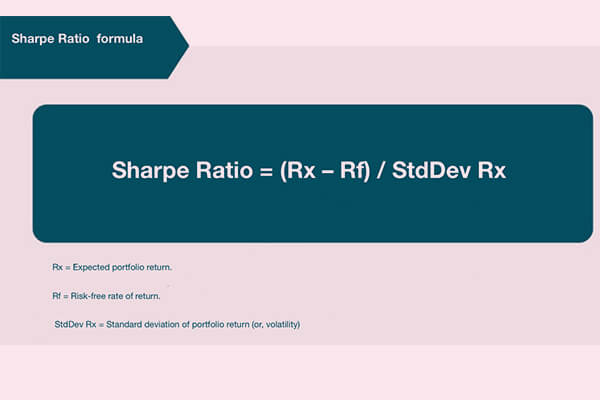

Sharpe Ratio

– The Sharpe ratio is used to evaluate the efficiency of an investment by considering its risk.

– This ratio examines whether the return generated from an investment is justified compared to the risk associated with it.

– The formula for calculating the Sharpe ratio is: (Actual Return – Risk-Free Return) / Standard Deviation.- A higher Sharpe ratio indicates that an investor has experienced higher returns relative to the risk taken, making it appear more attractive.If you have any further questions or if you need more detailed explanations, feel free to ask!

Factors Influencing the Risk to Reward Ratio

Several elements affect the risk to reward ratio chart forex. These factors include broad economic conditions like government policies, interest rates, and various social and economic circumstances that could adversely influence market prices.Additionally, unsystematic risk refers to the possibility of loss occurring at a more localized economic level, which is also reflected in the risk to reward ratio chart forex. Understanding these influences is vital for investors aiming to make informed decisions based on the risk to reward ratio chart forex. In summary, both macroeconomic and localized factors play a significant role in shaping the risk to reward ratio.

The Premium Trend Sniper Pro Indicator is an advanced tool for trading success, built on the Trend Sniper foundation. It utilizes modern algorithms to analyze price movements and features like multi-timeframe analysis, volatility indicators, and customizable alerts. This indicator helps traders make quick and informed decisions, suitable for both beginners and experienced traders. With the Premium Trend Sniper Pro, you can transform your approach to analysis and profit generation in financial markets!