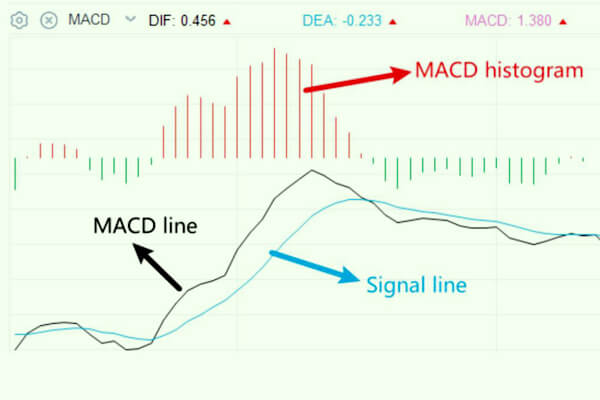

Breaking Down the Components of MACD

The MACD typically consists of three elements. The MACD line represents the 12-day Exponential Moving Average (EMA) subtracted from the 26-day EMA. The second element is the signal line, which is the 9-day EMA of the MACD. The final component is the MACD histogram, indicating the disparity between the MACD line and the signal line.

Nevertheless, the parameters of the MACD line can also modify based on the traders’ preference. To differentiate these elements clearly, DIF consistently denotes the MACD line, while DEA always signifies the signal line.

The fundamental concept of the MACD line is that the shorter-term EMA represents present price movement, while the longer-term one signifies past activity. Therefore, if there is a significant gap between these two EMAs, the market is either trending upward or downward. Additionally, the MACD histogram, which fluctuates around a zero line, denotes the vigor of the trend.

Analysis of MACD Signals

Crossovers

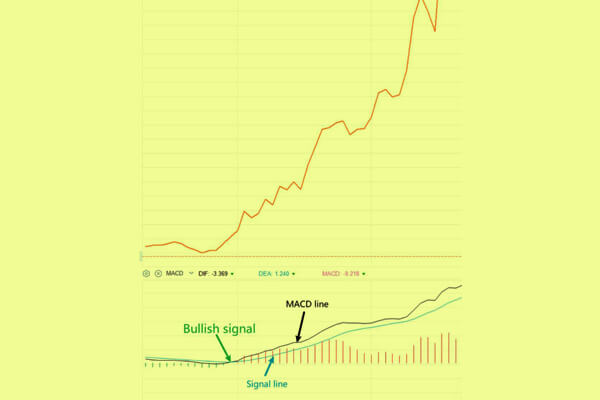

The intersections of the MACD line and the signal line can suggest a shift in price trend. Some illustrations are presented in the upcoming graphs.A positive signal is recognized when the MACD line moves from underneath to above its signal line.

A bullish signal occurs when the MACD line moves up and crosses above the signal line.

A bearish signal occurs when the MACD line moves downward, crossing below the signal line after being above it.

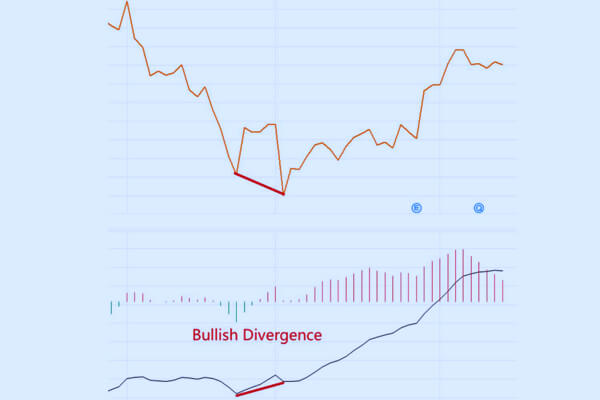

Divergence is displayed when the MACD line and the price exhibit contrasting trends. The divergence signal may suggest a potential shift in a trend. For instance, if the MACD line is moving upward while the price forms a lower low, a bullish divergence takes place, indicating that the price action may become positive.

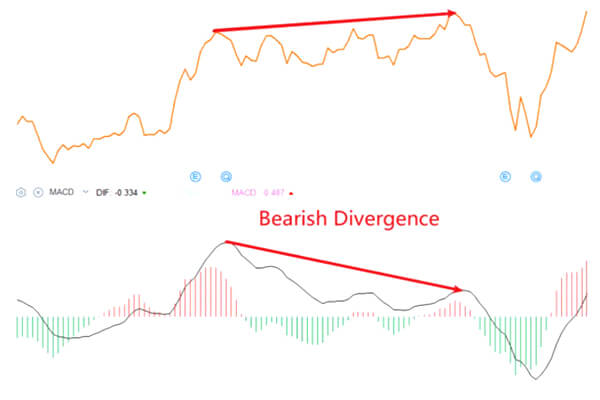

On the other hand, if the MACD line is moving downward while the price reaches a higher high, a bearish divergence emerges, suggesting that the price action may become negative.

Zero-Cross Strategy

When the MACD crosses from beneath to above the zero line, it is regarded as a bullish indication. Traders typically initiate long positions when this happens. Conversely, if it crosses from above to below the zero line, it is seen as a bearish signal by traders. In this case, traders enter short positions to capitalize on declining prices and rising downward momentum.

In both scenarios, the longer the histogram bars, the more potent the signal. When a strong signal is present, it is more probable—but not assured—that the price will persist in the trending direction.

Disadvantages of MACD

Like any oscillator or indicator, the MACD has limitations and hazards.

Reversal Signal

Ineffectiveness of MACD in lateral markets

MACD does not perform effectively in lateral markets. When prices predominantly oscillate sideways within a range defined by support and resistance, MACD often shifts toward the zero line due to the absence of an upward or downward trend—where the moving average is most effective.

Lagging Signals

Furthermore, the MACD zero-cross acts as a lagging indicator since the price typically remains above the prior low before the MACD crosses the line from beneath. This can result in entering a long position later than you potentially could have.