Next week (Wednesday) the next meeting of the Bank of Canada will take place, and economists fear that in the context of accelerated inflation, the leaders of the Canadian Central Bank will be forced to go for a new increase in interest rates, even despite the risks of plunging the national economy into recession.

All this, oddly enough, has a negative impact on the Canadian dollar (usually, when the interest rate is expected to rise, the quotes of the national currency strengthen).

Probably, here an important role in the dynamics of the Canadian dollar, as well as other major commodity currencies, is played by macro statistics coming from China, indicating a slowdown in business activity, industrial production and a drop in retail sales.

Market participants also continue to evaluate the results of the Fed Chairman Powell’s speech at a symposium in Jackson Hole, and the DXY dollar index broke through 104.00 at the end of last week and updated a 5-month high at 104.38.

Powell noted the stability of the US economy and a strong national labor market, confirming the readiness of the Fed leaders to further tighten monetary policy. This contributes to the growth of market expectations for another interest rate hike towards the end of the year, although they have not changed in relation to the September meeting of the Fed.

Will the Bank of Canada be able to raise the interest rate again in the face of accelerated inflation, but a slowdown in the national economy?

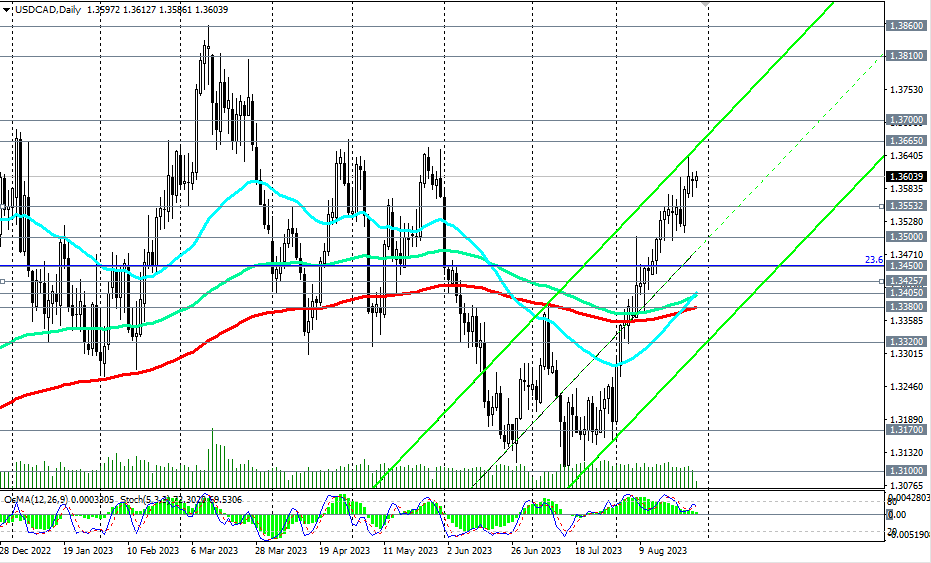

Given the hawkish rhetoric of the Fed leaders regarding the prospects for the monetary policy of the US Central Bank, we should probably expect further growth in the USD/CAD pair.

The nearest targets are located at local resistance levels 1.3665, 1.3700, distant ones – at local resistance levels 1.3810, 1.3860.

In an alternative scenario, USD/CAD will resume its decline. The first sell signal is a breakdown of the support level at 1.3592 and today’s low at 1.3586, and the confirming signal is a breakdown of the important short-term support level at 1.3553.

Support levels: 1.3593, 1.3586, 1.3553, 1.3500, 1.3450, 1.3425, 1.3405, 1.3380, 1.3320, 1.3300, 1.3200, 1.3170, 1.3100

Resistance levels: 1.3640, 1.3665, 1.3700, 1.3810, 1.3860, 1.3900, 1.3970, 1.4000

*) see also

· “Technical Analysis and Trading scenarios” -> Telegram – https://t.me/traderfxcrypto

· chanel FXCryptoTrader – https://www.mql5.com/en/channels/fxcryptotrader

· https://www.instaforex.com/forex_analysis/353041?x=PKEZZ

· signal Insta7 – https://www.mql5.com/en/signals/2035208?source=Site+Signals+My