JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free JPY Forecast

Most Read: GBP/USD Hovers at Key Inflection Point Ahead of Inflation and GDP Data

The Japanese Yen has continued its struggles this week losing ground to both the Greenback and the British Pound. This comes despite the recent policy tweak from the BoJ as the summary of opinions failed to excite Japanese Yen bulls.

Given the surprise sprung by the Bank of Japan in tweaking Yield Curve Control policy despite repeated comments that such a move is not needed, I wouldn’t rule out further surprises from the BoJ. At this stage comments from the BoJ are best taken with a pinch of salt as the shadow of FX intervention remains a possibility.

On another note, Japanese PM Kishida fielded question on a potential Cabinet reshuffle. The PM confirmed nothing has been decided yet, however the chance of a change to the finance portfolio or a potential removal of Masato Kanda seems unlikely as the BoJ looks to normalize policy over the medium-to-longer term. At this stage one would venture a guess that stability is important, but it is worth keeping an eye on.

Recommended by Zain Vawda

How to Trade USD/JPY

EXTERNAL FACTORS CONTINUE TO DRIVE YEN PAIRS

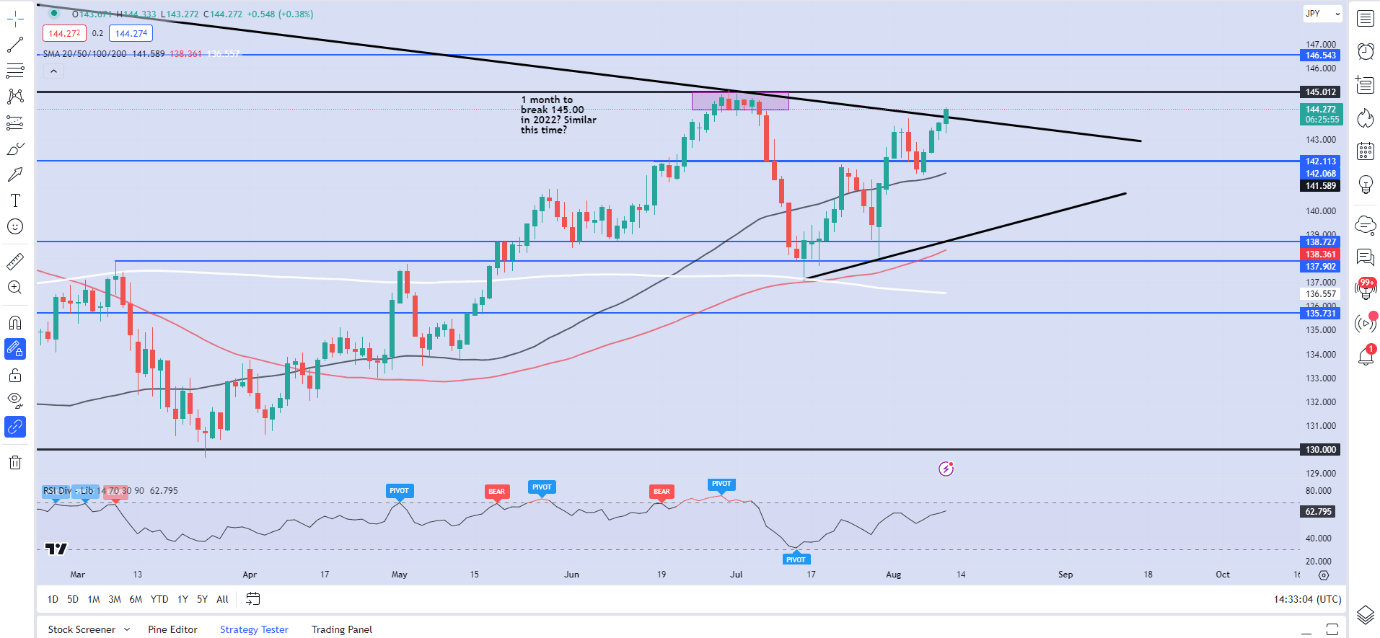

US CPI earlier this afternoon saw the Dollar gain against the Yen just as it appeared to be running out of steam. The rally in USDJPY now sees the pair within a whisker of the 145.00 psychological level. Now I have continued to mention this relentlessly over the past few weeks that FX intervention remains on the cards with the BoJ stating that they will intervene if we see excessive moves. I for one think the BoJ may only act should the Yen lose around 2% or more to the US Dollar in a 24-hour period. However, as seen with the YCC tweak the Central Bank could just as easily spring a surprise when markets least expect. Later in the day we also have policymakers of the Federal Reserve speaking which could have an

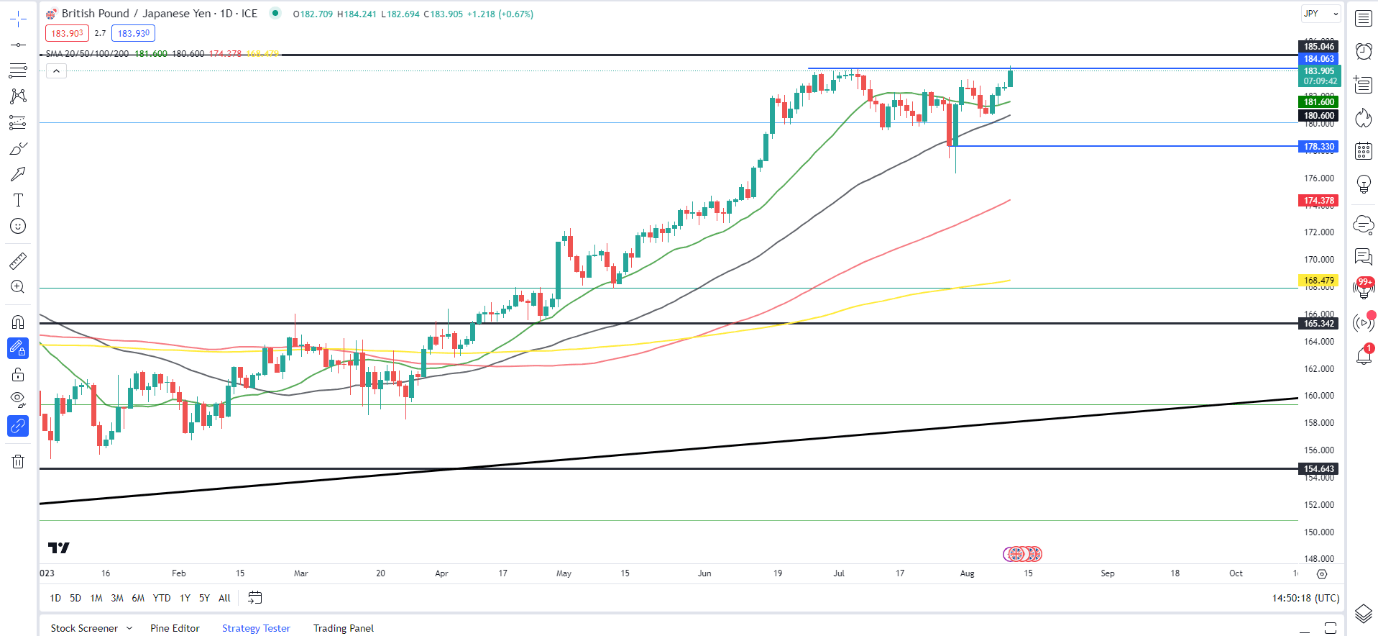

Looking at the Pound which has also rallied higher against the Yen testing the YTD highs today. Tomorrow brings UK GDP data, and this could have an impact on the Pounds outlook with UK inflation due next week which should paint a clearer picture of the Bank of England’s (BoE) monetary policy stance.

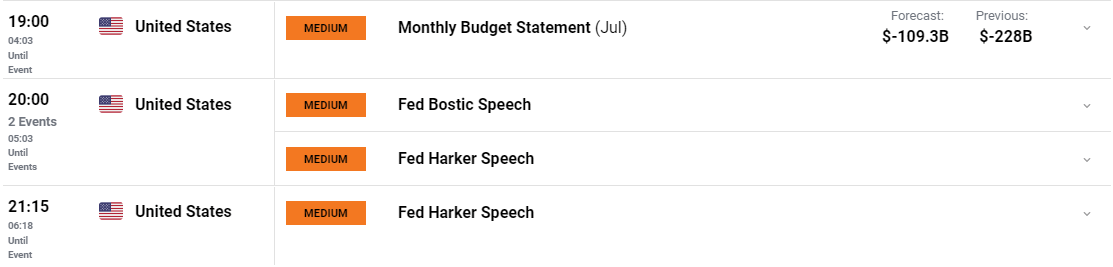

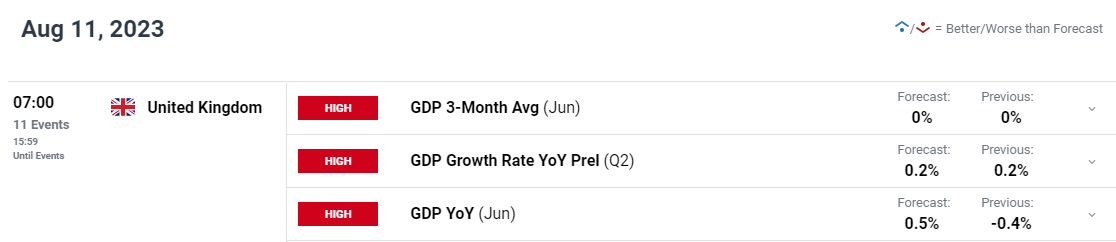

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

GBPJPY

GBPJPY has been on a tear in 2023 printing a fresh high this afternoon just above the 184.00 handle. Last week’s steep drop-off came about following the tweak in YCC policy with the Yen unable to hold onto gains. A push higher from here faces stiff resistance in the form of the psychological 185.00 handle which could prove problematic at present. UK GDP tomorrow and inflation next week could be just the impetus the GBP needs to resume its bullish price action.

Alternatively, any attempt at a deeper retracement could find the going tough as the 20 and 50-day MAs rest at 181.60 and 180.60 respectively. Structure on the daily timeframe remains bullish and dictates that a daily candle close below the swing low around 1.8060 for a change in structure to take place.

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 78% net-short with the ratio of traders short to long at 3.54 to 1.

For a more in-depth look at GBP/USD sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -8% | 3% | 0% |

| Weekly | -5% | 15% | 10% |

GBPJPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 185.00 (psychological level)

- 187.50

USDJPY

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY is on its way to the 145.00 handle and eyeing a fourth successive day of losses. The hurdle at 145.00 remains key if price is heading toward the 2022 highs above the 150.00 mark (intervention occurred when price breached this level previously).

Today’s daily candle is also breaking out of the long-term descending triangle (2022 high). A daily candle close above the descending trendline could open up a run toward the 2022 highs. Of course, there is still some key resistance levels ahead but without any intervention from the BoJ its looking more like when rather than if.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

- 143.40

- 141.58 (50-day MA)

- 140.00

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda