This article is a summary of the manual trading system

I use and publish in our very popular Morning Briefing channel.

Please subscribe if you like to get daily updates of our trading activities.

We recommend reading the entire article.

So let’s get started now.

The tools you need are FX Volume and FX Power NG

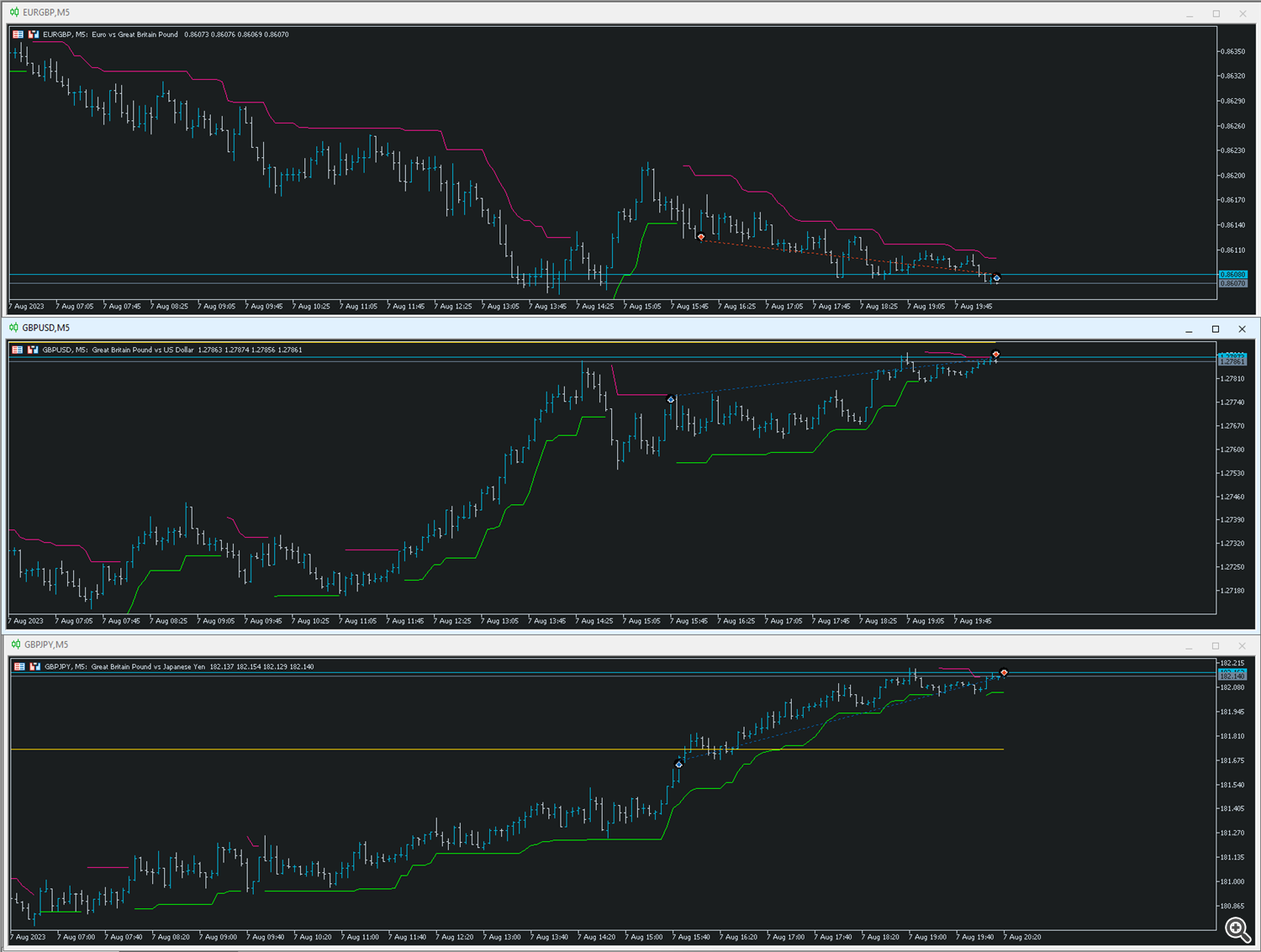

Chart setup

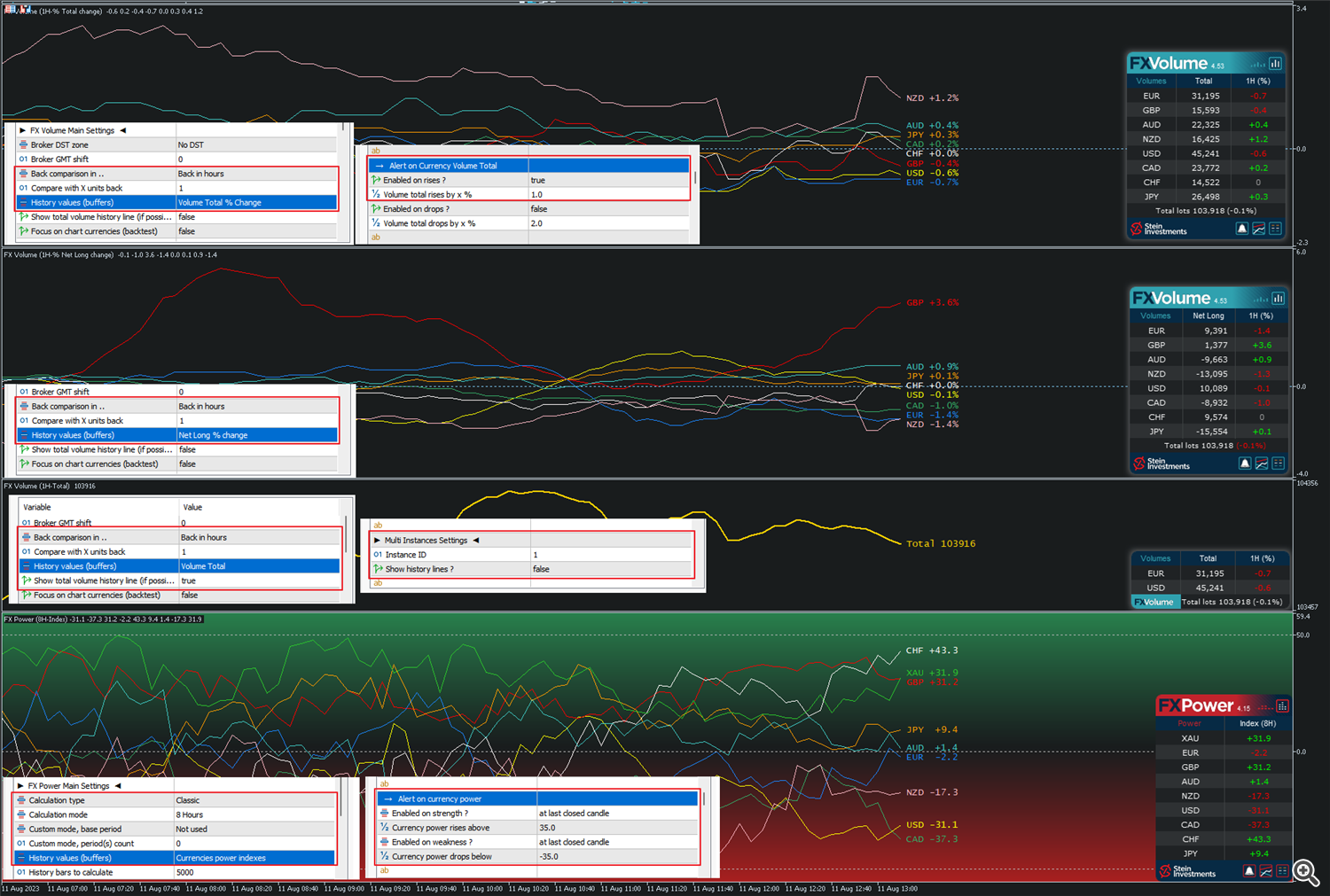

With these tools, we create a research chart, that alerts us in case things become interesting.

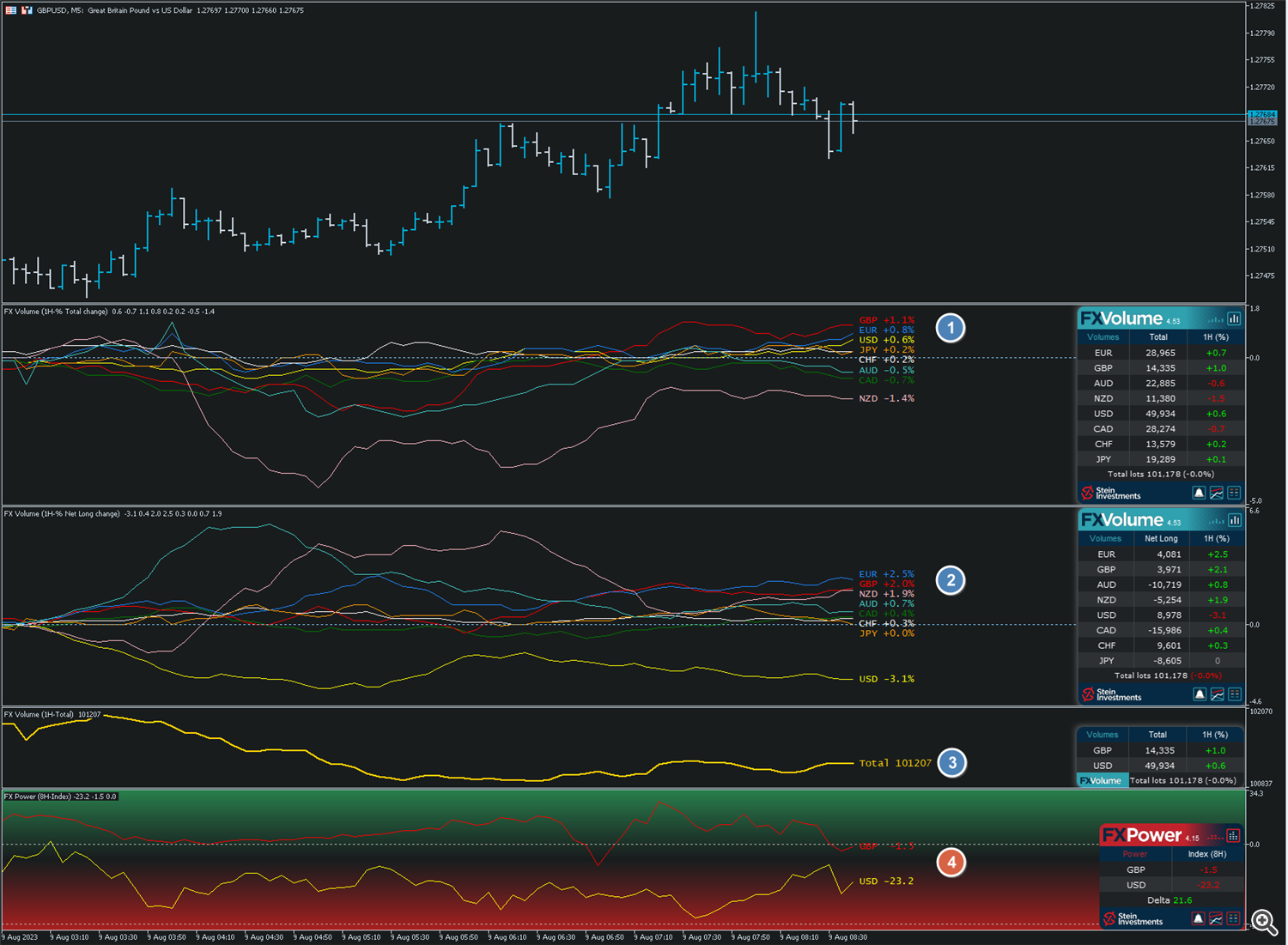

This is how it looks like, and below this screenshot we’ll explain which parameters we use in detail.

Crosshair is an optional tool that brings your price chart perfectly in-line with the indicators’ history lines. It’s also available for MT4 (here) and MT5 (here).

Indicator settings

And this is the same chart with the indicator settings displayed for every single sub-window.

I know ready-made set files would suit you the most, but I want to achieve that you get familiar our tools and its settings, and understand what kind of information they provide.

So, once this initial setup is done you can save it as a template yourself and we’ll move over to the trade setups we’re hunting for.

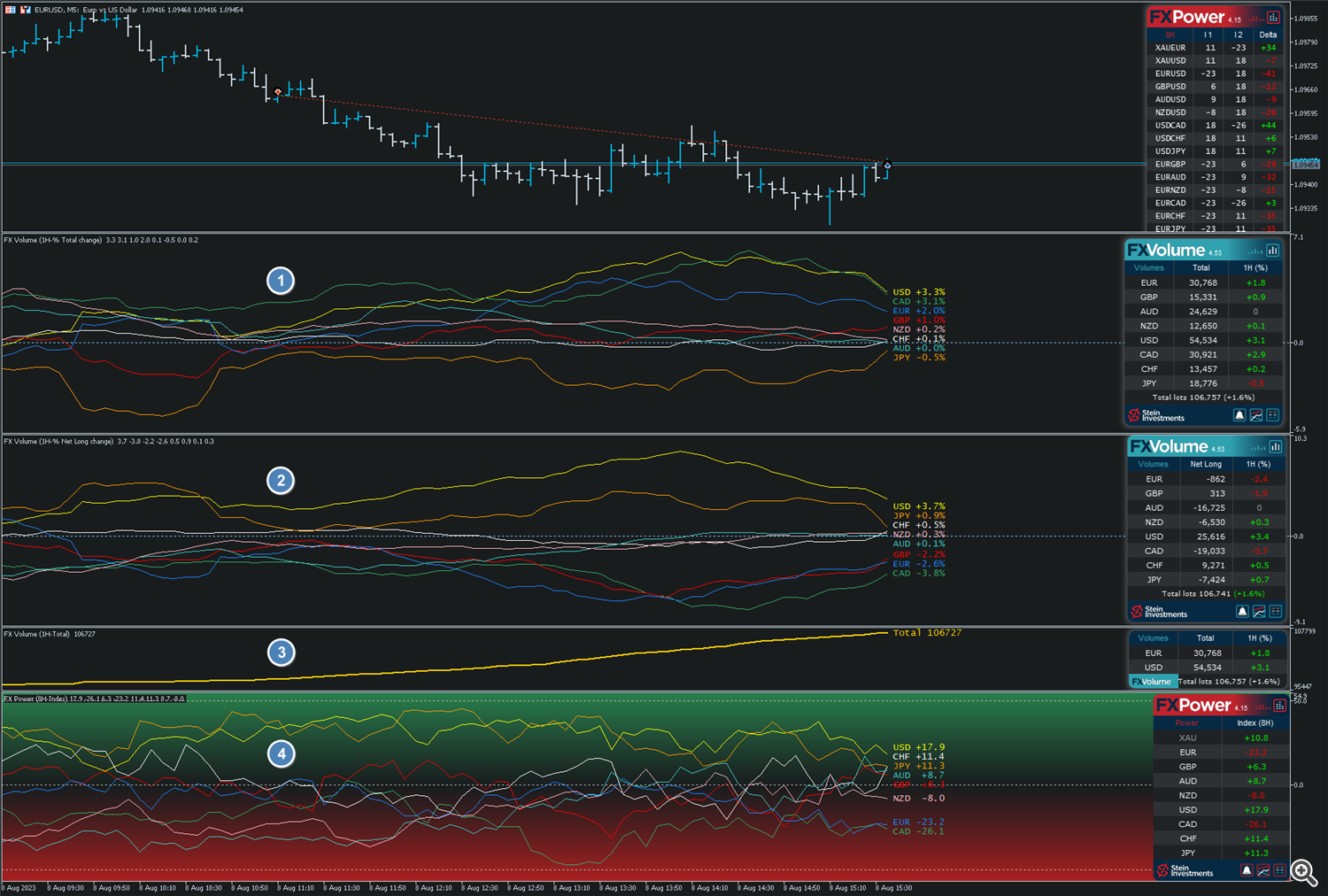

Trading setups

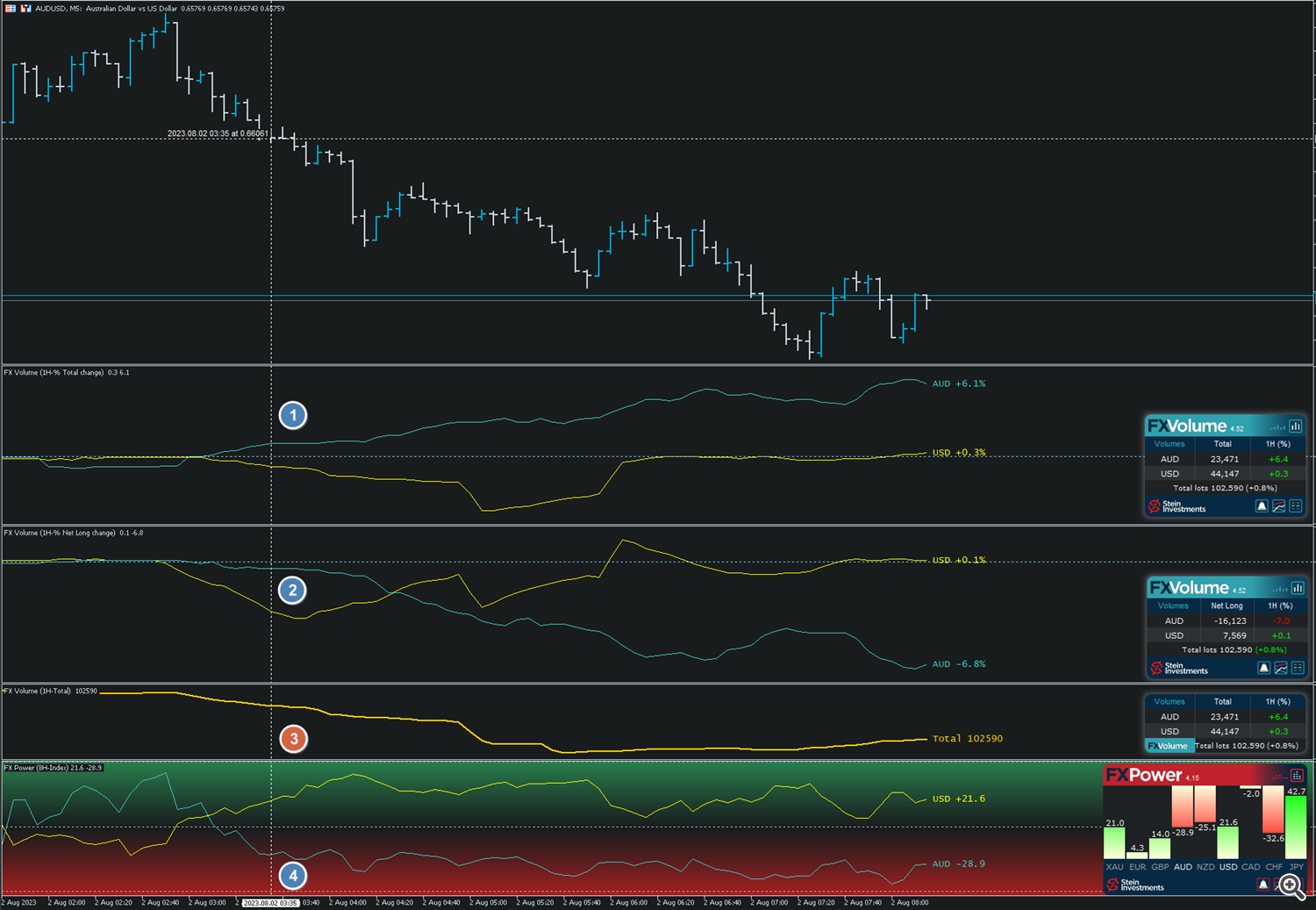

I’d like to point out what exactly we are looking for when trading with FX Volume and FX Power, and the AUD downtrend starting at 3:35 GMT+1 during this Asian session is a good example.

1. The interest in AUD positions rises as we can see at the rising AUD total volume percentage change

2. The AUD Net Long volume declines, which means that the interest in AUD short positions rises.

3. The total market volume declines, which is NOT ideal, but the AUD trend worked anyway.

4. The FX Power strength analysis indicates the AUD falling out of the neutral zone to the weak zone.

Summarized, this is the perfect indication for an AUD SELL trend, and if you check the corresponding charts you’ll see that it worked on 6 out of 7 AUD pairs.

It also points out that the specific interest in one currency is enough to fuel a trend even thought the total market volume declines.

A rising total market volume would probably provide even more dynamic, but even without it, we would have been profitable with our setup.

Further opportunities and trade results…

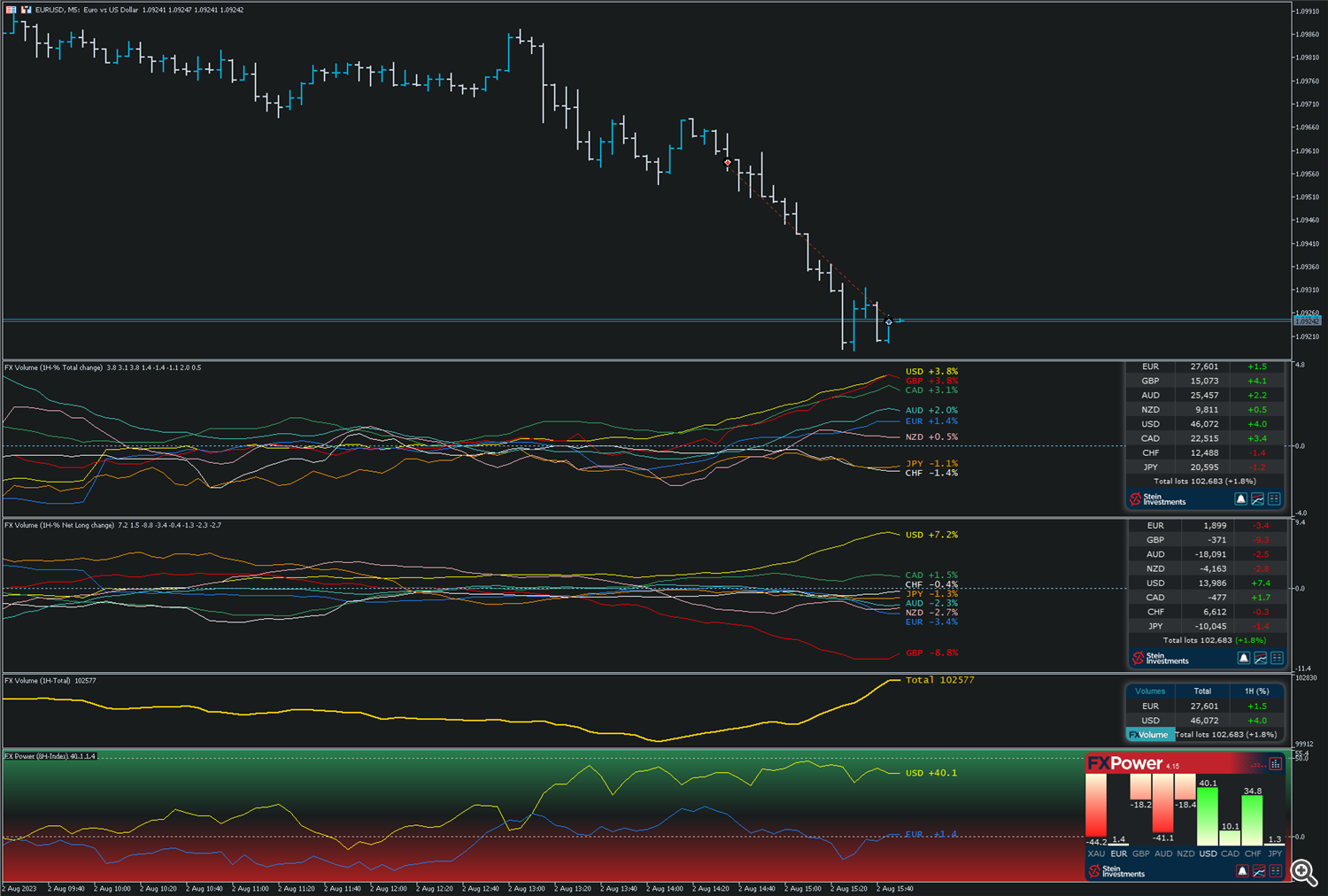

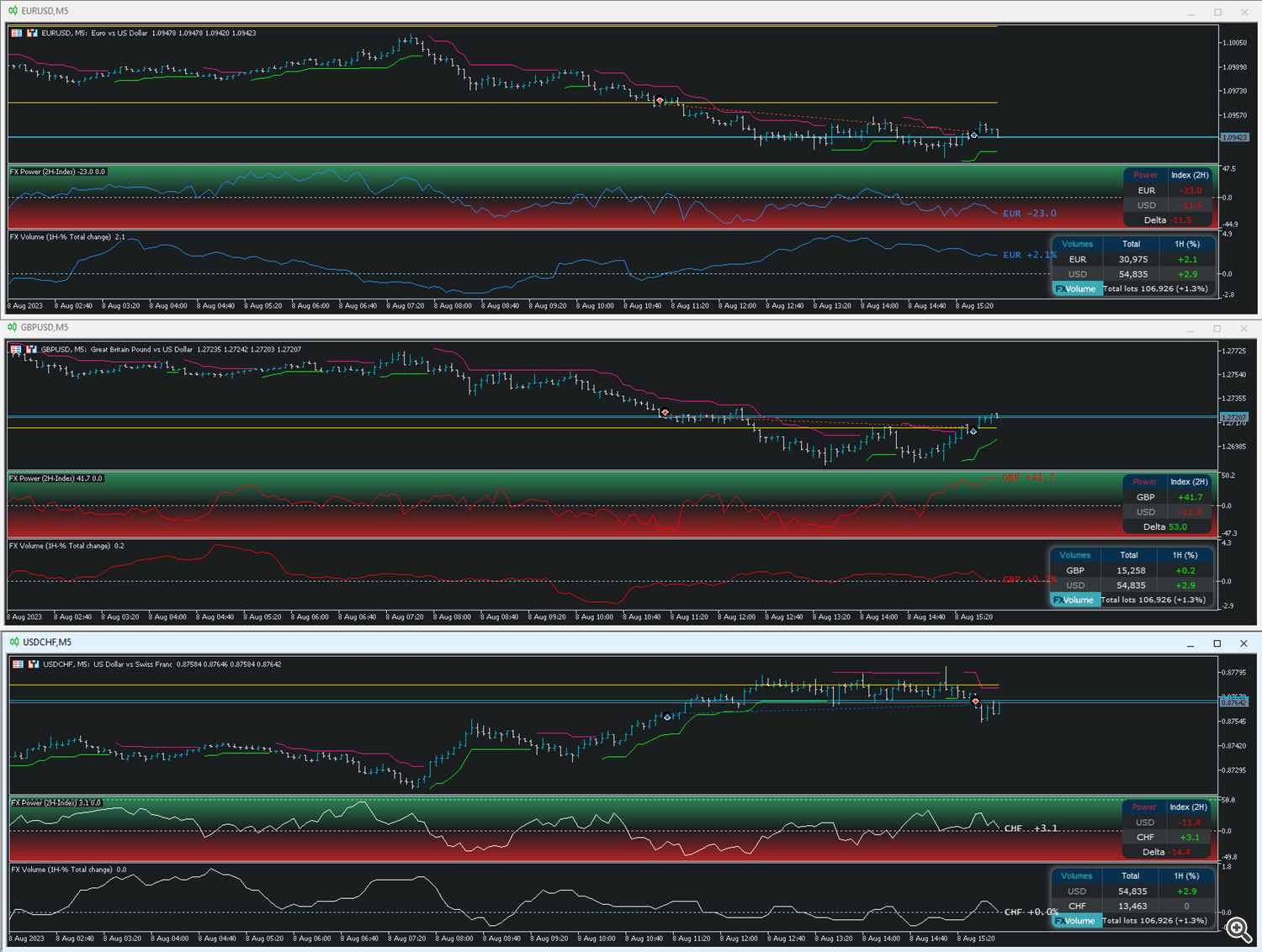

This USD BUY Setup provided us with 6 out 6 profit trades

1. The GBP total volume alerts has been triggered

2. The GBP Net Long weakened a bit but remained clearly positive

3. The total market volume declined – so no real power to expect

4. The GBP remained clearly strong

All in all, nothing fancy, but we’re happy with the profits. 😊

Another USD BUY setup with a high win rate of 6 out of 6

1. The USD Total Volume rose above +1%

2. The USD Net Long remained clearly positive

3. The Total Market volume was rising as well

4. The USD returned to the strong side of the FX Power scale

It was once more no explosive move, but we’re happy with the profits. 😊

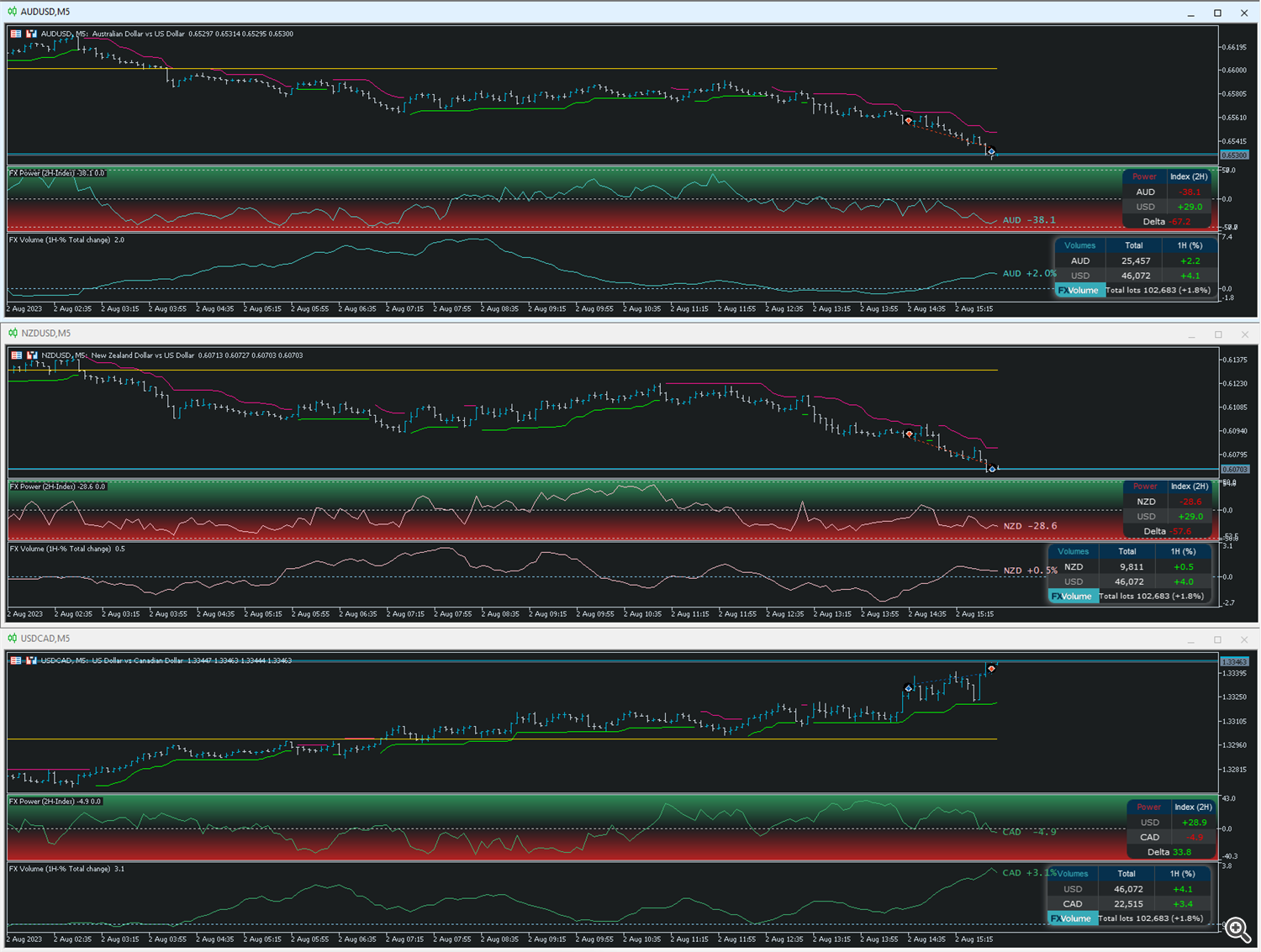

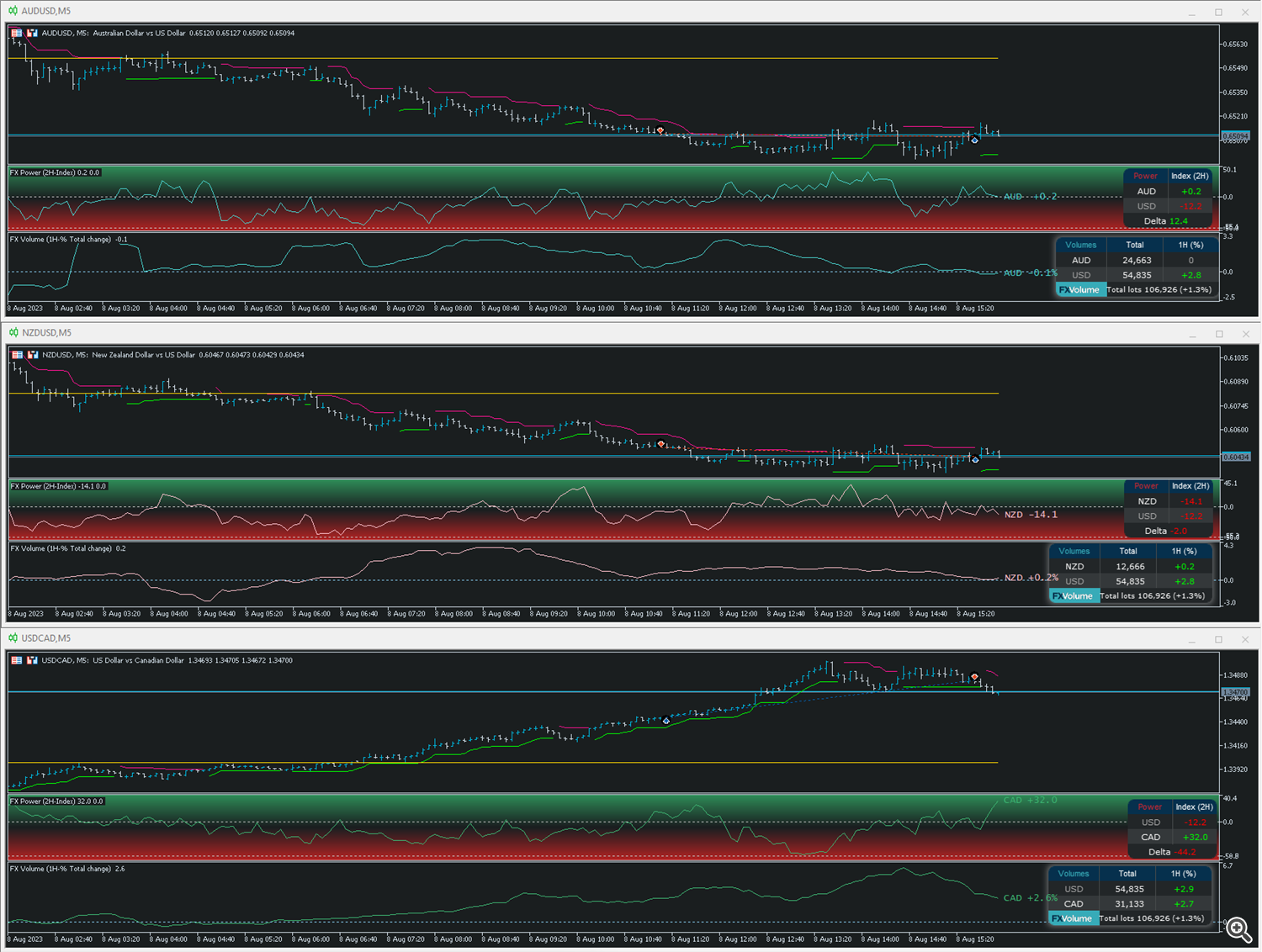

And another awesome trading opportunity on the EUR with a win rate of 5 out of 5

1. EUR total volume rose extremely

2. EUR Net Long Volume rose as well

3. The Total Market Volume rose, too

4. FX Power indicated a clear and stable strength for the EUR, and so I traded the EUR long against all the weak currencies like, USD, CAD, AUD, NZD, JPY.

5 out of 5 trades in profit is a pretty clear statement of how powerful this strategy and currency selection method is. 💪

NON TRADING SETUP

1. I received a total volume rise alert for GBP

2. The GBP Net Long Volume change is clearly positive

3. The total market volume is stable

Considering those 3 points, it is a perfect BUY scenario for the GBP.

4. The FX Power analysis tells us the GBP is currently neutral – and so we drop that trading idea (for now)

The volume conditions are almost perfect, but the strength, determined by FX Power, is clearly not given.

So, we’ll wait for the next alert, and opportunity where everything, volume and strength, fits perfectly.

Additional tips and tricks

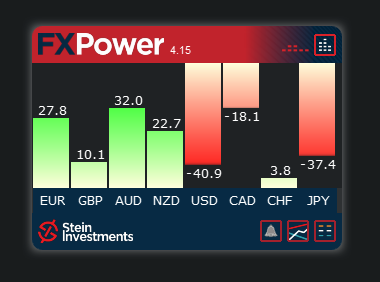

1. FX Power Equalizer

The FX Power Equalizer view shows you at a glance which currency is best to trade your chosen trend currency against.

In our example, we trade the weak JPY against the strong currencies, EUR, GBP, AUD, NZD and maybe the CHF.

USD and CAD are clearly to avoid because they are weak as well, and trading two weak currencies against each other will only lead to a sideways move with little chance of success.

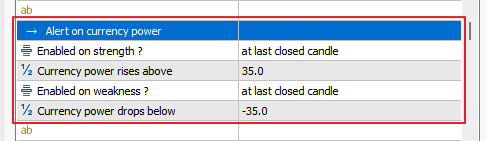

2. FX Power alerts

The FX Power strength weakness alerts notify you when a currency reaches the extreme areas of the scale.

I use them to look for an exit at the highest lowest point of the movement.

That’s it for the moment, but we’ll use this article as central point of our trading system.

If you like to get this entire article as PDF document you can download it here.

In case of questions, drop us a line in the comment section below.

All the best and have a great day, everyone

Daniel