Yesterday’s positive from strong US macro data was not enough for the dollar to be able to radically change the situation in its favor. Yesterday, the DXY dollar index rose to a 15-day high of 103.27, but then fell and is falling again today, dropping to 102.75 at the time of this article, in anticipation of the publication today (at 12:30 GMT) of the US Department of Labor report with data for June: forecasts suggest that the US economy was created +225.0 thousand new jobs outside the agricultural sector (after +339.0 thousand new jobs last month), and the unemployment rate fell by 0.1% to 3.6% .

If official data from the US Department of Labor expected today also turns out to be weak, then the likelihood of a pause in the Fed’s monetary tightening cycle will increase again.

Probably, it would be appropriate for investors to pay attention to gold again as a popular defensive asset in the face of uncertainty and high inflation.

As you know, gold quotes are very sensitive to changes in the monetary policy of the world’s largest central banks, primarily the Fed.

Next Wednesday will be published fresh data on inflation in the US. Earlier reports from the US Bureau of Labor Statistics pointed to a continuing slowdown in inflation. The May report once again pointed to this: in May, the annual CPI fell from 4.9% to 4.0% (forecasts assumed an increase of 4.1%). At the same time, the core CPI (food and energy excluded from this indicator for a more accurate estimate) slowed to 5.3% from 5.5% a month earlier.

If the July report also points to another slowdown in inflation in the US, it will leave little doubt that the Fed will once again take a break from its meeting in July (July 25-26).

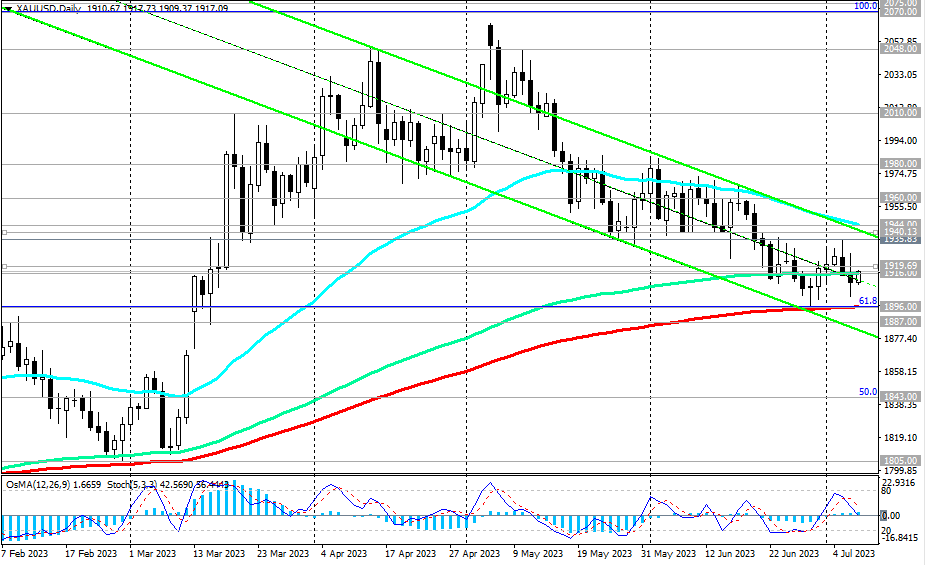

In turn, gold will then receive another argument in favor of the growth of its quotes, especially since now the XAU/USD pair is in the zone of key support levels of 1896.00, 1916.00, from which a rebound may occur and a new wave of growth may begin.

The very first signal for resuming purchases of XAU/USD is a breakdown of the important short-term resistance levels of 1920.00 and 1928.00 (yesterday’s high).

The fastest signal for the implementation of an alternative scenario may be a breakdown of the support levels of 1916.00, 1909.00 (today’s minimum).

A break of 1875.00 will open the way for a deeper decline towards the key long-term support levels at 1805.00, 1788.00, 1755.00, 1722.00, separating the long-term bullish trend of gold from the bearish one.

Support levels: 1916.00, 1909.00, 1900.00, 1896.00, 1887.00, 1843.00, 1805.00, 1788.00, 1755.00

Resistance levels: 1919.00, 1927.00, 1936.00, 1940.00, 1944.00, 1960.00, 1980.00, 2000.00, 2010.00, 2048.00, 2070.00

*) more details -> https://www.instaforex.com/forex_analysis/348157?x=PKEZZ